Table of Contents

Introduction:

In this article, we will explain the top 3 most favored sectors in the Indian market. Our investing view should be a long-term one. And thus, the companies we choose must be those that could give the most beneficial returns over time. Therefore, the first crucial thing to consider is the company’s product or service lifecycle.

At the very least, the items should be used for the next decade or two. We need to invest in businesses that can last for a long time, rather than ones where consumers stop using a product, causing the company to go bankrupt.

Also, to make money from stocks in the long run, make sure you invest in areas that are growing. Remember our “3M Strategy”? Watch this short video CLICK HERE!

In the past, many industries in India were successful because they grew at a reasonable rate. These industries include utilities, mining, and many more.

However, these industries will continue to shrink in the coming days or may not be able to expand their businesses as they used to. And we may have some new industries to become a giant!

A few sectors, such as technology, include machine learning, artificial intelligence, the Internet of Things (IoT), and many more. We may also see some revolutionary changes in renewable energy, and electric cars, which are already experiencing tremendous development.

In this piece, we’ll cover the three top long-term investment sectors in India, these sectors are already well established with a large market base, so one can expect consistent returns or the industries anticipated to expand the most in the next decade in India. Therefore, let us begin.

We have over 35 major sectors and many more sub-sectors in the Indian market. Some perform consistently well, some are cyclical and some have never shown any improvements in the past 2 decades.

In this article, I’m gonna talk about my top 3 sectors to invest in. These are what I call the pillars on which the Indian economy stands and even thrives.

Top 3 Sectors to Invest;

- Banking Financial Service & Insurance (BFSI) CLICK HERE! To Know More.

- Fast-moving consumer goods (FMCG) CLICK HERE! To Know More.

- Information Technology (IT) CLICK HERE! To Know More.

What are Sectors?

A sector is an economic area in which enterprises engage in the same industry or with other industries or businesses that are engaged in business, products, services, and such. Sectors are big groups of businesses that do the same thing for a living, like extracting natural resources or growing food.

Economic analysts can evaluate an economy’s economic activities more effectively by segmenting it into several sectors. As a consequence, sector analysis can indicate whether an economy is increasing or contracting.

In the Stock Market, companies will be grouped together based on their operations. Based on their business. Based on The goods and services they provide. Such categorization of companies over their purpose is known as sectors.

For example, We have Information Technology which provides IT services, and FMCG will provide Consumables, Banking, Insurance, and many more.

How to Know which Sector performs well?

This can be answered in two ways. First and foremost,

Cyclical Industries

A cyclical industry is one that is subject to the business cycle, with revenues usually increasing during periods of economic prosperity and expansion and decreasing during periods of economic recession and decline.

Businesses in cyclical industries can deal with this kind of instability by laying off and cutting back on employees to make up for bad times, and by giving bonuses and hiring a lot of new employees to make up for good times.

They do not give returns all the time. But when they do, they will astonish you.

For example, We have Graphite businesses such as “HEG” & “Graphite India” that went up like anything in the midst of 2017 up until the end of 2018. We made a lot of money during this uptrend.

Also, in recent times, when the pandemic broke out, almost everyone made money but, pharma really did well in the initial phase.

And now we have Sugar companies. Mainly Ethnol-based companies that are going up.

So, cyclical industries will make good money in a short duration. But, one needs to be in the right spot at the right time. For this, you should understand the market very well, and understand every move on a daily basis.

Growth Oriented

A growth industry is a segment of the economy that grows at a faster rate than the rest. Often, growth industries are new or pioneering sectors that did not exist previously.

Their expansion is a result of increased demand for new products or services supplied by field-related businesses. They can also be the companies with the most stable products and services, with the ability to dominate the market.

These are the sectors that have been with India and will take the Indian economy to the next phase. Sectors such as IT, BFSI, FMCG, and such.

3 Most Favoured Sectors to Invest in India:

Banking Financial Service & Insurance (BFSI)

Banking, financial services, and insurance (BFSI) is the industry’s name for firms that offer a variety of such financial goods and services. This category includes universal banks that offer a variety of financial services, as well as businesses that engage in various areas of the financial industry.

Commercial banks, insurance businesses, non-bank financial companies, investment management, cooperative societies, insurance businesses, pension funds, and mutual funds are all examples of BFSI.

Banking is a subset of BFSI and may comprise core banking, retail banking, private banking, corporate banking, investment banking, and cards. Financial services include stockbroking, payment gateways, and mutual funds, Insurance encompasses both life and general insurance to name a few.

India has some of the finest BFSI companies, mentioned as follows:

Fast-Moving Consumer Goods (FMCG)

Consumer items that sell rapidly and at a cheap cost are referred to as fast-moving consumer goods. These are also referred to as “consumer packaged products.”

FMCG firms in India sell packaged meals, toiletries, consumables, and personal care products.

Consumer packaged goods, or fast-moving consumer products, are the fourth largest sector of the Indian economy.

Due to strong consumer demand (e.g., soft drinks and confections) or due to their perishability (e.g., meat, dairy products, and baked goods). These commodities are often acquired, quickly eaten, affordably priced, and marketed in large quantities. Additionally, they have a high turnover rate while on the store’s shelf.

Consumer goods are items purchased by the ordinary consumer for personal consumption. They are classified as durable items, non-durable commodities, and services.

Durable products have a three-year or longer shelf life, whereas non-durable items have a shelf life of less than a year. Consumer items that move quickly are the greatest portion of the market. They are not long-lasting because they are eaten quickly and have a short shelf life.

These are India’s Top FMCG Companies, mentioned as follows:

Information Technology (IT)

As enterprises, governments, academics, and private individuals increasingly rely on information technology sector operations, the IT sector is critical to the nation’s security, economy, and public health and safety.

These virtual and dispersed functions design, develop, and provide hardware, software, and information technology systems and services, as well as the Internet, in partnership with the Communications Sector.

The sector is very complicated and quickly changing, which makes it hard to find threats and analyze vulnerabilities. Collaborative and creative approaches are needed for these tasks.

Information Technology Sector tasks are carried out by a variety of entities often network owners and operators, as well as their respective associations that maintain and reconstruct the networks, including the Internet.

While information technology infrastructure is inherently resilient, its interdependent and linked nature poses both problems and opportunities for integrating public and private sector readiness and protection efforts.

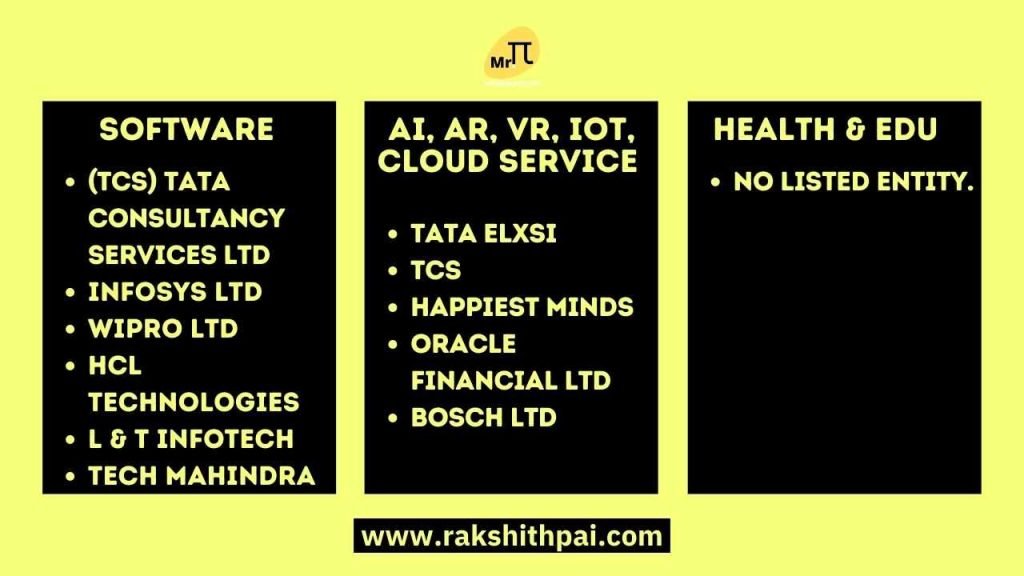

Information Technology includes Software Research & Building, Artificial intelligence, Cloud Computing, Data & Information, Health & Education IT, Electric Vehicle Software, Internet of Things (IoT), Cyber Security, Virtual & Augmented Reality, and many many more!

Following are some of the Best IT Companies in India:

Conclusion:

Long-term investing in stable businesses can assist you in accumulating significant wealth and securing your future. Numerous large-cap firms, such as Infosys, WIPRO, and HUL, have rewarded their long-term shareholders in extraordinary ways.

As a prudent investor, it makes perfect sense to invest in India’s rising sectors for long-term growth. Nonetheless, a key lesson to take away from this is that not every developing area will provide extraordinary profits. But, some sectors do make enormous wealth for investors, and some of the top three sectors are as mentioned above.

Thus, when it comes to picking the finest industries for long-term investment in India, diversification is the best strategy. Distribute funds throughout industries that you feel will expand-this reduces risk and ensures that you do not lose out on any flourishing sectors.

That concludes the topic on India’s long-term investment sectors (industries expected to grow in the next 10 years in India). While the economy has suffered as a result of the epidemic, the markets are on the mend.

For each investor with defined objectives and a working knowledge of sectors and sectoral funds, 2021 presents new chances. Along with conducting research on the finest sector funds and schemes to invest in, it’s a good idea to visit a financial professional and have your questions answered.

If you’re not sure about investing in pure equity funds, keep in mind that even when the market is unstable, buying these funds at a discount to their net asset value could be a great way to make a lot of money when the market improves.

FAQs:

For More Information, Watch YouTube Video:

Disclaimer: All the information on this website is published in good faith and for general information purposes only.