Table of Contents

What is a Stock Screener?

A stock screener is a tool that uses filters to choose a subset of firms from a pool of all publicly-traded companies on a stock exchange. Investors choose the filters, and the stock screener returns the appropriate results.

A good stock screener can filter through the thousands of stocks listed in the Indian Stock Market or the tens of thousands listed globally and discover those that satisfy your specified criteria and fit your investment plan in a matter of seconds. The more time you spend with a stock screener, the more adept you will get at restricting your options to the most promising investing prospects. We have listed the top 10 such screeners for you.

In general, the stock screener will help you find high-performing companies that meet your needs with just one click. The following is a list of the 10 finest Indian stock screeners that every Indian investor should be familiar with. Additionally, please read this piece through to the conclusion since the final portion will answer all your questions and doubts.

How to Use Stock Screeners?

Stock screeners are quite beneficial since they may save you a great deal of time. You do not need to sift through all of the listed firms in order to choose a few worthy candidates. You can just use the basic filter to come up with a list of a few good candidates for more research.

Watch this video to get a glimpse of how to use a stock screener. CLICK HERE!

What are available on Stock Screeners?

Basic View

Stock Screeners give a basic glimpse of what the company is, its main operation, and its purpose of business. And a primary view of the company fundamental position along with ratio analysis such as ‘Stock P/e’, ‘ROCE & ROE’, PEG ratio’, Debt to Equity and such many more important ratio figures.

Technical Indicators

Screeners give a chart view with varied technical indicators for the users. These technical indicators give information regarding the price, volume, bull & bearish view and show traders (intraday & swing traders) the movement of the company.

Pros & Cons of Business

Screeners will screen into summative forms the pros and cons of the company. They explain what’s good and wrong in a fundamental sense about the company. Investors can take note of such issues and act accordingly.

Peer Comparison

Screeners provide a list of competitions and their performances. Such a comparative list gives investors to choose from whether their wishlist company is performing better or worse than the competitors in the industry.

Financial Figures

Screeners will provide Quarterly, Semi-Annually, and even Annual Financial figures in a summarized and crisp manner. Instead of going through the entire report of over 200 odd pages (suggested to read the full report), an investor can take note of the company’s financial performance by going through the screen-provided consolidated figures.

These figures will be Quarterly & Annually for the past 10 years. Investors will know the companies performance for 10 odd years and thus judge the management accordingly.

Other Financial Reports

Screeners provide all four (4) Financial Reports which include Quarterly Reports, Profit & Loss Statements, Balance Sheets, and Cash Flow statements. This way Screener act as a one-stop-shop for all the financial reports.

Circulars and Announcements

Every company on the day’s end must inanimate the SEBI regarding all material happenings in the business. These pieces of information are crucial for investors. The sooner an investor knows such information, the better for his/her investments.

Screeners provide the said circulars and announcements as intimated to the SEBI. By adding the company to one’s watchlist, an investor can get all the information about the company in one spot.

How do Stock Screeners Work?

Stock screeners have access to a database of thousands of publicly traded firms. Different stock screeners employ a variety of different filtering criteria, but many regularly used indicators are included on major platforms.

When a trader or investor employs a stock screener, they select a collection of variables with predefined values. For instance, you may scan all firms and extract those with a market valuation of more than Rs. 1,000 crores or those with ROCE and ROE of over 25%, for instance. The screener looks through the database and comes up with a list of all the companies that have stocks that meet the criteria.

You may see charts and perform other data analyses on individual stocks and then begin trading them one at a time or even invest for the long term.

What to Look for in a Screener for Indian Stocks?

The Indian stock exchange market is home to about 7,500 companies. To begin trading online equities, consumers must first open a Demat account.

Put Zerodha link here!

While numerous screeners assist users in selecting the appropriate stock for investment, the screener that is perfect for you is determined by your budget, trading style and approach, technological needs, and much more. Several typical features to look for in Indian stock screeners or stock scanners include the following:

Platform

The User Interface (UI) of the Screener must be feasible and easy to use. It should give all the required details with ease and accessibility.

Accuracy

All the details as provided by the Stock Screener platform will be picked up from the Financial Reports of the Company. So, it is crucial for us the investors to know that the details so provided are factual and real. Any misreporting and investment decisions based on such misinformed reports will be financially denting!

Fundamental Expertise

Financial reports such as Quarterly and Annual reports, Balance Sheet, Profit, and Loss Statement, and Cash Flow Statement along with Credit reports, Con calls, and such.

Technical Expertise

Technical aspects such as price moments, Volume chart, P/e and EPS growth, and other technical tools will be available on Stock screeners.

10 Best Stock Screeners for Indian Stocks in 2022

Screener.In

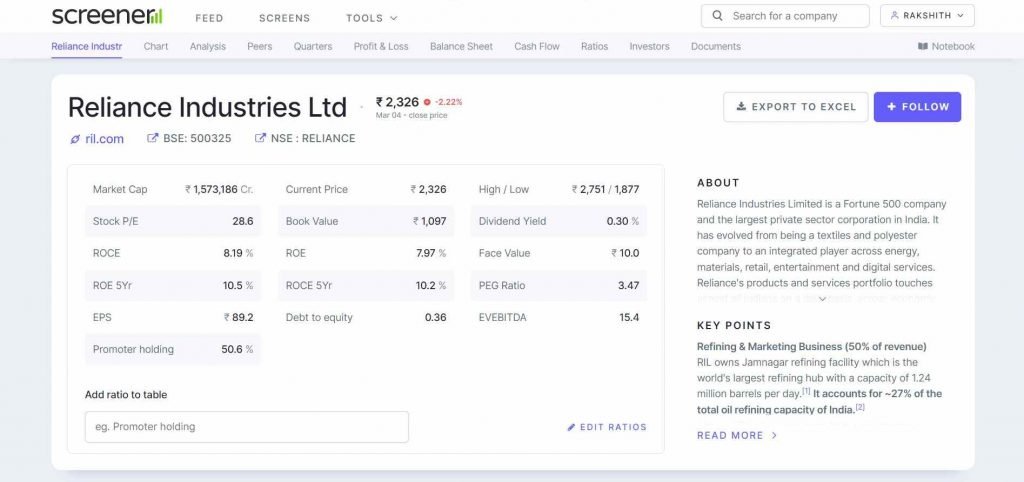

The screener is one of the best tools for screening stocks. Screener’s query builder enables users to use a variety of criteria to shortlist companies based on their PE ratio, market capitalization, book value, ROE, profit, and sales, among others. Screener also provides prebuilt screens based on various formulas for screening. You can also save the screen for future use.

The best part about Screener is that you can add companies to your watchlist and get all the updates on the home page. All material happenings in the company will be available for an investor to read on the ‘watchlist updates’ feeds.

‘Stock Screens’ on Screener allows an investor to screen stocks based on a predetermined formula such as ‘Company market cap > 1,000 crores’ will provide all the listed companies with a market capitalization of over 1,000 crores. This way, an investor can shortlist by their preference immediately.

Apart from creating your own stock screen, you can also export or import the data, search shareholders’ information, and up to date announcements if you subscribe to the Screener Premium.

Screener. in is a free and user-friendly website for performing fundamental stock research. It is capable of reading, analyzing, and filtering businesses based on a few indicators. It contains a sizable corporate database and can provide information on a firm’s performance over the last 10–12 years.

Users may examine information about the company’s industry, stock price-to-earnings ratio, market capitalization, and book value. In addition, the reports on this website are interactive, easy to read, and accessible to everyone, even people who have never used it before.

This website has a Query Builder tool, which streamlines the search process by extracting specified data from the website’s database. The results are completely customizable, and you may store the screen for future use.

Trade Brains

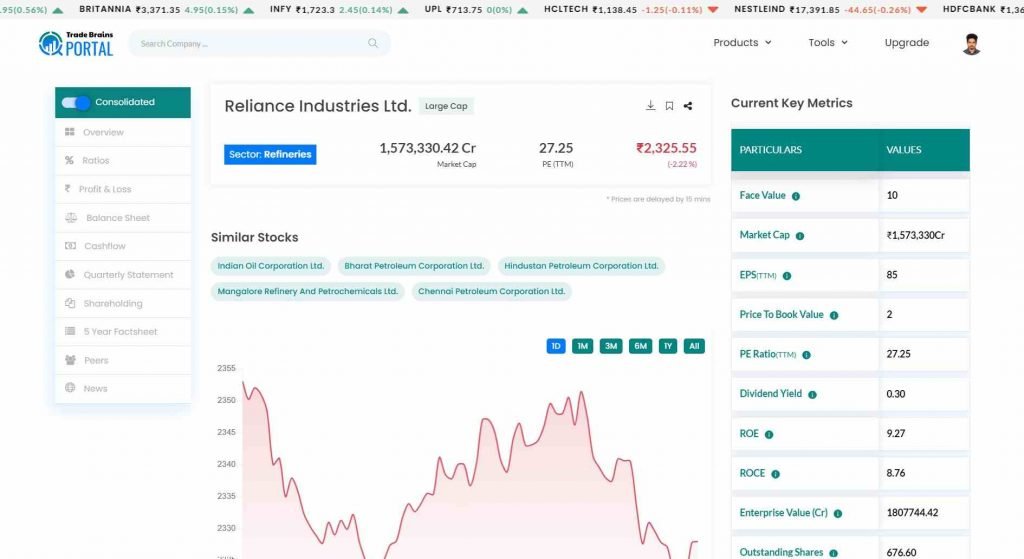

Through Trade Brains’ “Stock Screener,” you may search for and shortlist stocks that match your investment style by applying numerous factors. The Trade Brains Portal provides over sixty commonly used metrics for stock screening. This gateway enables you to screen for winning stocks using a variety of filters.

Utilize several criteria to narrow down the field of over 5,000 publicly traded firms in India. The primary benefit of this function is that, rather than going through each share and checking the set of parameters individually, you can just tweak them once and our screener will take care of the rest, using specially created filters.

Other than Stock Details, you get a basic screener and watchlist with compare option of up to 2 stocks and 1 backtesting option per day. ‘Trade Brains Portal’ Pro version has lots of features that are worth looking at. Features such as Custom screeners, advanced watchlist options, advanced screener, and even a free stock market investing course.

Investello

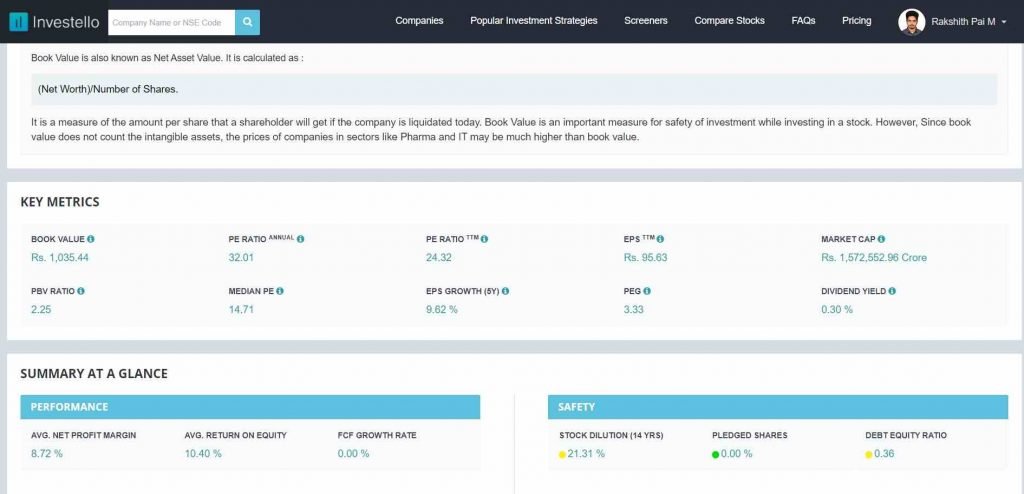

Investello provides a stock screener, Financial Charts & Performance summary for the past 10 years. Along with Stock price alert features and Quarterly results.

Under Premium membership, users can access various valuation models, investment strategies, and a detailed screener with stock comparison options. These features will enable the users to make better investment decisions and would yield higher returns.

Investing.com

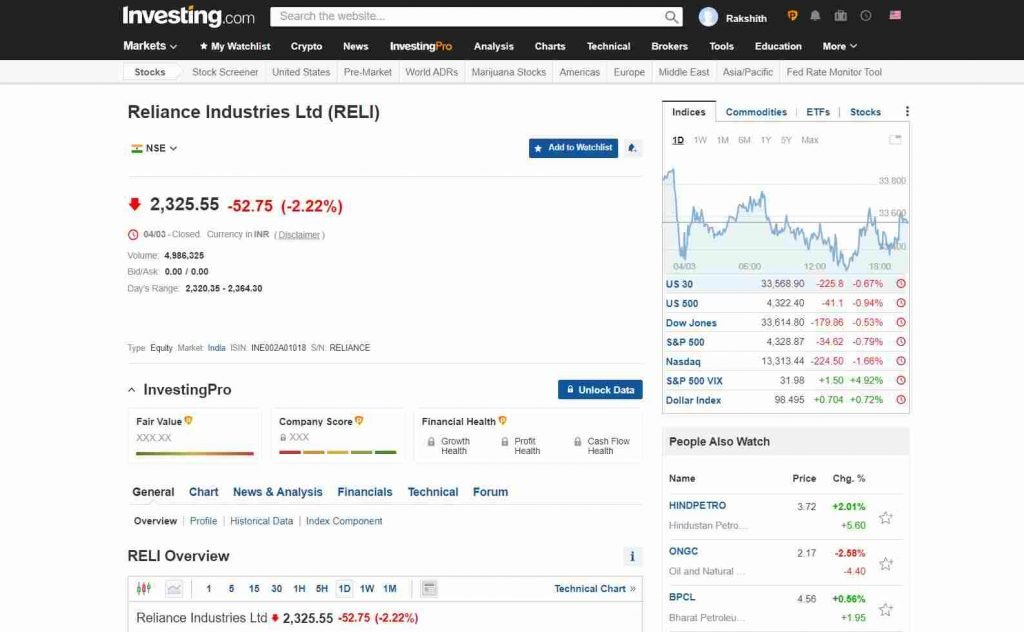

Investing.com is also an extremely strong stock screening website. The complete list of firms trading on the NSE and BSE may be seen here. INVESTING has a lot of different criteria for screening stocks, like ratios, price, volume, volatility, fundamentals, dividends, and technical indicators.

Additionally, it’s a really valuable resource if you take a top-down strategy. You may choose an industry to analyze and then use criteria such as PE, P/Book value, ROCE, and so on to narrow down the list of the top stocks in that sector.

Investing.com is not an India-specific screener. They provide stock screeners for global markets along with news updates regarding Geopolitical issues.

Investing.com is a top stock screener for Indian investors. It may be used for both basic and technological research. This platform is suitable for both novices and specialists. The complete list of firms trading on the NSE and BSE is available here.

Investing.com enables users to apply a range of filters, which can be beneficial when performing stock screening. Ratios, dividends, fundamentals, price, and volume are only a few of these criteria. Additionally, this site gives charts and quotations, as well as the latest corporate news, live stock market statistics, and a wealth of other important information for investors. It is one of the greatest attractions to visit if you like a top-down approach.

Investing also has a mobile application that gives up-to-date information on the go. Create your own Stock screener based on Technical and FUndamental analysis and download the same for future analysis.

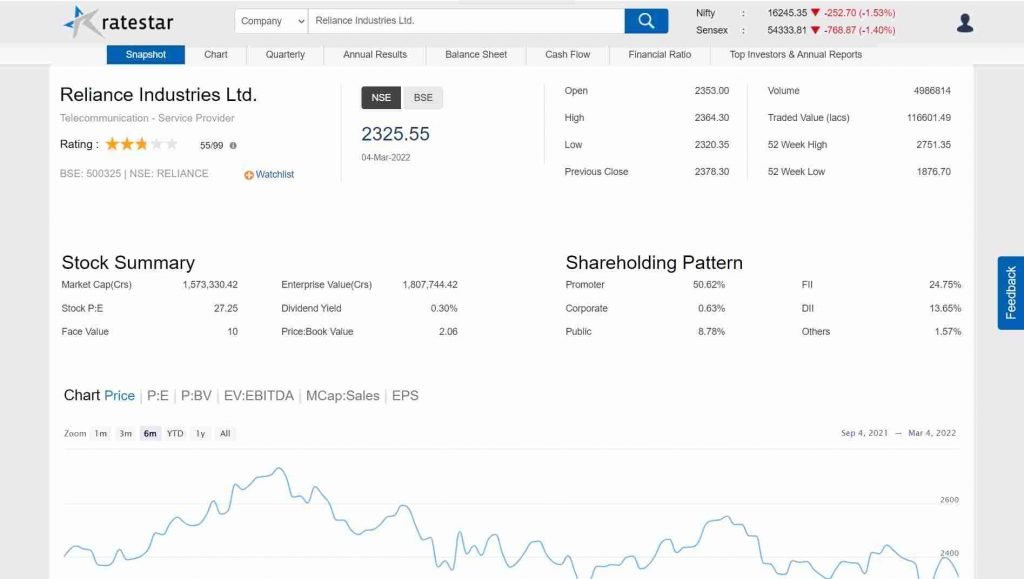

Ratestar

Rate star rates the company based on Fundamental and Technical Informations. Under Rate star, there is no need for another page. You get all that you need on 1 single page.

Apart from company-specific information, you can also search for your favorite investors and see what they are buying or selling. You can see where their interest is.

Ratestar offers no premium version. So, this is a basic tool for investors. It’s a free version that offers all the basic information about a company and investors need for one glance.

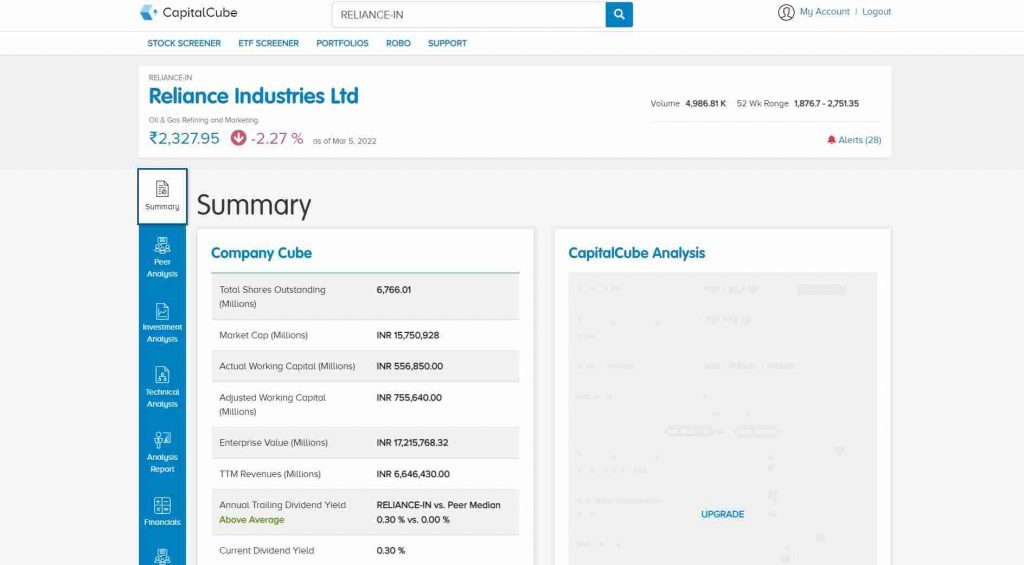

Capital Cube

Capital Cube is one of the most comprehensive stock screeners accessible. This platform was created by AnalytixInsights, an artificial intelligence startup that converts data to knowledge.

Capital Cube analyses companies and provides portfolio management, fundamental research, and screening tools for over 40,000 worldwide stocks. It helps investors make smart decisions by giving them a detailed look at a company’s history, profits and debt, dividend strength and equity, and how well it has done compared to its competitors.

The best feature of Capital Cube is that it enables users to search for and locate businesses using extremely natural search keywords. For instance, you may uncover debt-free businesses by simply entering “debt-free businesses”. In addition to stock research and screening, this platform offers ETF research and trading.

As a Global database provider, Capital Cube is equipped with details for over 40,000 listed companies in all major economies of the world. Thus providing indepth analysis and research reports for the users.

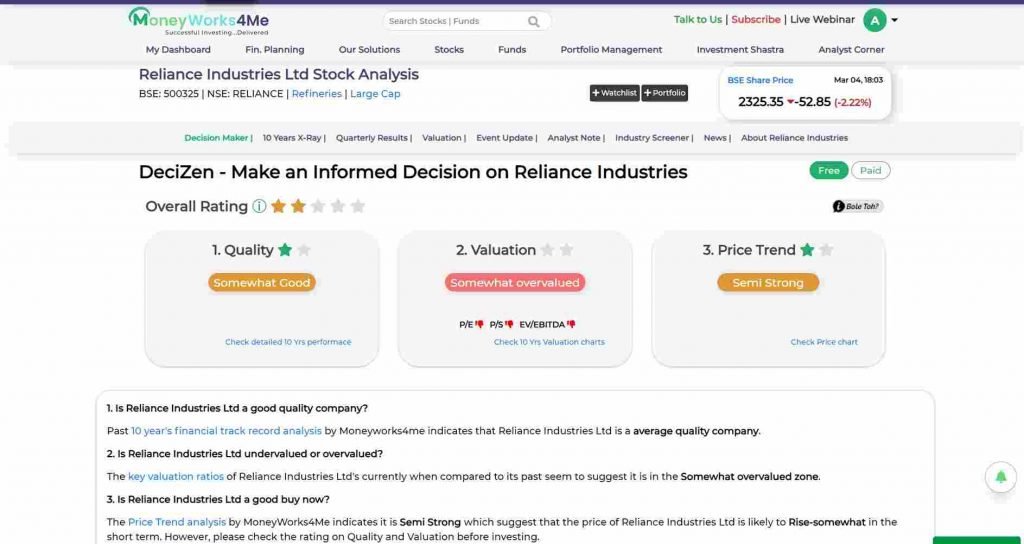

MoneyWorks4Me

MoneyWorks4Me is another robust stock screener that provides comprehensive business research. It is a subscription-based solution that includes value indicators, stake and price point screeners, and competitor filtering. The following are the findings, which are denoted by color codes.

The green hue denotes highly good stocks, yellow denotes average stocks, and red denotes stocks that are not worth your money. This platform offers customers a comprehensive history of the company’s performance, as well as access to all of the company’s financial information.

The website also provides paid tool for Stock picking. And detailed research reports regarding Stocks and Industry analysis. Other than Valuation reports and models, users can also access Mutual funds and portfolio manager analysis.

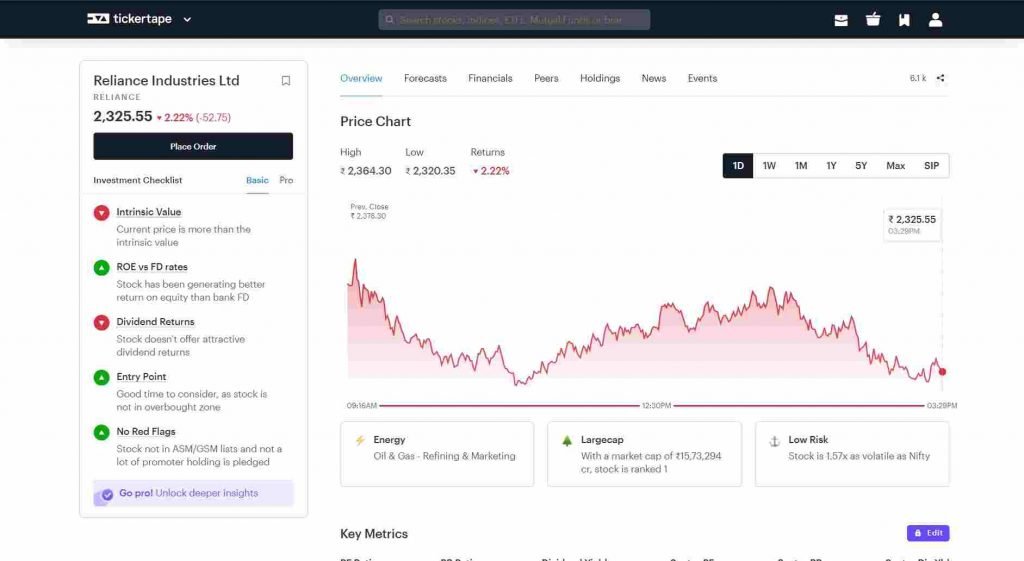

Ticker Tape

Ticker Tape is another simple and easy-to-use stock screener that significantly simplifies the stock screening process. What differentiates it from the competition is the fact that it includes over 120 filters for stock selection, including market capitalization, sector, and close price.

The User Interface of Ticker Tape is one of the best amongst all the screeners.

This website can be used by anyone, whether they are new to investing or seasoned traders. The website interface is extremely user-friendly, and unlike other screeners, all of these filters are accessible via a single tab. Additionally, the outcomes are very adjustable.

The easily accessible interface provides over 100 different and unique stock filters or stock screeners to the users.

Trendlyne

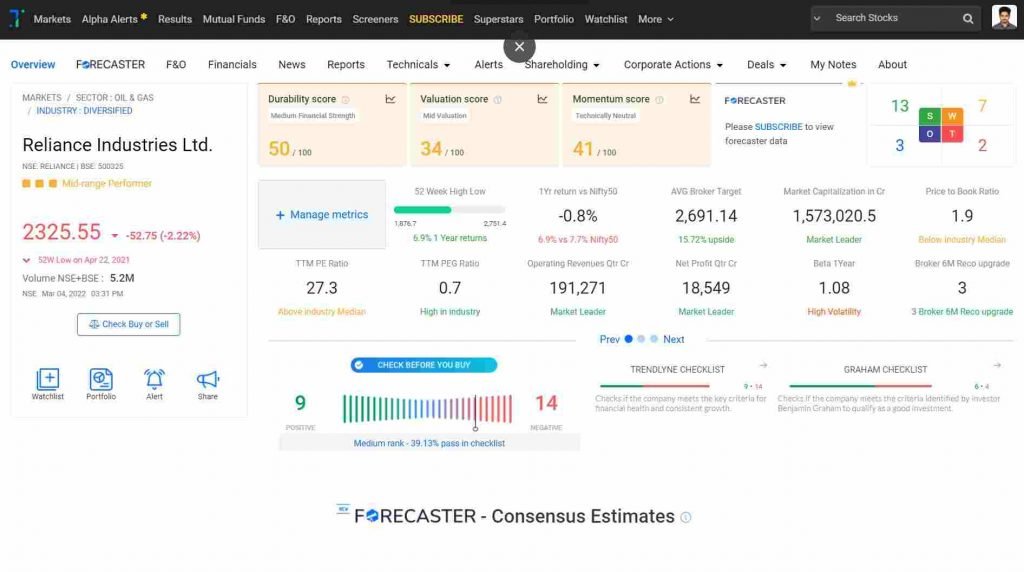

Another interesting website is Trendlyne, which offers stock market analysis, research reports, stock alerts, and trending business news. This website is suitable for fundamental as well as technical analysis. Before you can use the website, you must first register. It offers both free and paid services. Trendlyne is a query-based screener at its core.

Trendlyne provides a SWOT analysis of the stocks in a very interesting manner along with the bar representing buy and sell emotions in the market. This way, the User Interface is unique on its own.

Trendlyne Alpha Alert is a must-check page. Here, investors and traders can set technical alerts for the stock to breach. Such alert and notified and an investor or a trader can take action accordingly.

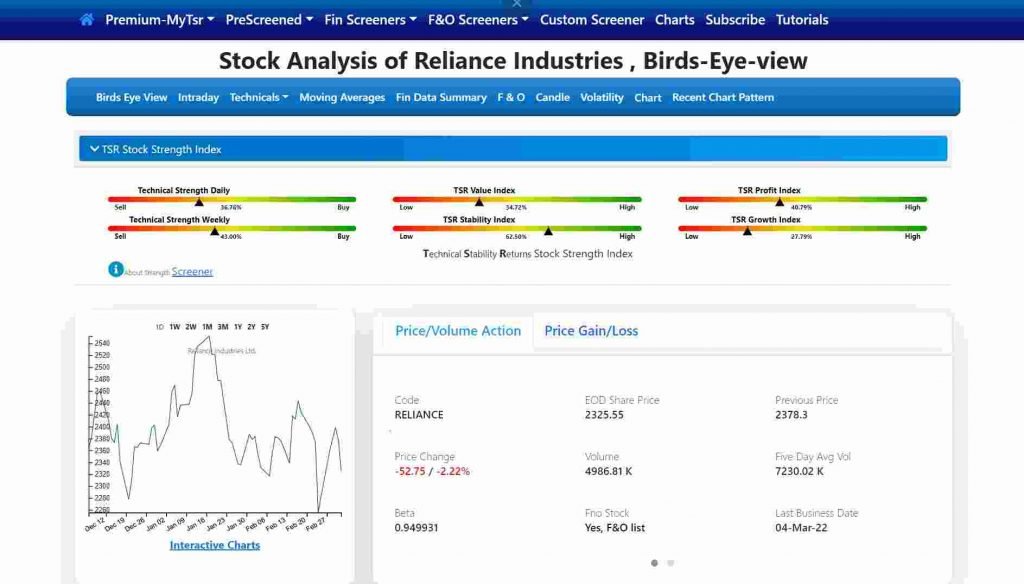

Top Stock Research

Topstockresearch is a highly effective stock screener that may be used for in-depth technical analysis. This platform is not very user-friendly since it needs a firm grasp of charts and patterns.

Topstockresearch, on the other hand, maybe extremely beneficial to seasoned investors and traders. This platform offers customers a complete study of a company’s historical performance and all financial data.

Topstockreasearch offers a comprehensive lesson to assist novices in comprehending the technical analysis of stocks. Registered users have the ability to store search results. A watchlist feature is also included with advanced technological screeners.

Top Sources for Research reports:

- Motilal Oswal Mutual Fund.

- Edge Reports.

- IDBI Capital.

- HDFC Securities.

- Credit Rating Agencies Reports.

Conclusion:

These are the Stock Screener I use while doing my research on Stocks to Invest or Trade, sometimes both. I hope you find this list of top Stock screeners useful in your journey of being the best Investor and Trader.

If you know any other worth looking stock screener, please let us know in the comment section.

FAQ:

Disclaimer: All the information on this website is published in good faith and for general information purposes only.