Table of Contents

Business Introduction:

Founded in 1998 as a private limited company, DPWL manufactures steel wire and plastic products. Products such as LRPC strands, Induction Tempered Wire, geomembrane sheets, PE coated and greased strands, plastic film sheets, etc.

DP Wires manufacture and provide steel wires and plastic films that are used in a variety of sectors, including oil and gas, electricity, the environment, civil engineering, energy, automobiles, and infrastructure. All of the manufacturing divisions are headquartered in Ratlam.

The production facility of DPWL is located in Ratlam (Madhya Pradesh) and has an installed capacity of 50000 tonnes per year. DPWL also generates electricity with two wind farms in Jamnagar district, each with a minute capacity of just 0.80 MegaWatt.

As of March 2021, Promoters held over 70% of the Company.

DP Wires Business Segments:

DP Wires business is divided into four parts.

LRPC Strands

DP Wires is India’s third-largest manufacturer of LRPC Strands. Pre-Stressed Concrete Steel Strands are used to pre-stress concrete for a variety of construction applications. These strands are important to the building of a business because they give the structure strength and resilience.

LRPC strands or HT Strands are abbreviations for Low Relaxation Strands. Pre-Stressed Concrete Steel Strands are used to pre-stress concrete for a variety of construction applications. They are often used in concrete slabs that cover the roofs of commercial and residential buildings, bridges, tunnels, and aqueducts. These strands are critical in the building of a business institution since they provide the structure with strength and resilience.

Steel Wire

DP Wires’ section responsible for the fabrication of steel wires ensures that each unit created by us is free of flaws. Steel is essentially an alloy composed mostly of iron, recycled steel, and carbon. It is used to make cars, utensils, and ships, as well as conductors, meshes, clamps, and barbed wire.

Steel is essentially an alloy composed mostly of iron, recycled steel, and carbon. It is employed in the manufacture of automobiles, utensils, and ships, as well as conductors, meshes, clamps, and barbed wires. Steel, on the other hand, has become very important in the building business because it is durable and strong.

Induction Tempered Wire

Induction tempered wires are one of the most ubiquitous yet little-known components of our lives. An induction-tempered wire is created by heating a standard wire with electric energy or gas and quenching it with oil or water. These wires are used to strengthen their strength, ductility, sag resistance, and other mechanical qualities.

Geomembrane Sheet

Geomembranes have been around for some time, and the world has discovered several applications for this construction material. These sheets are also used as liners for waste conveyance canals, fish ponds, and agricultural enterprises. The right way to build them means that they are very energy efficient and resistant to wear and tear caused by the environment and physical forces.

DP Wires began manufacturing geomembrane sheets made of high-grade materials designed to resist the hardest tests of time.

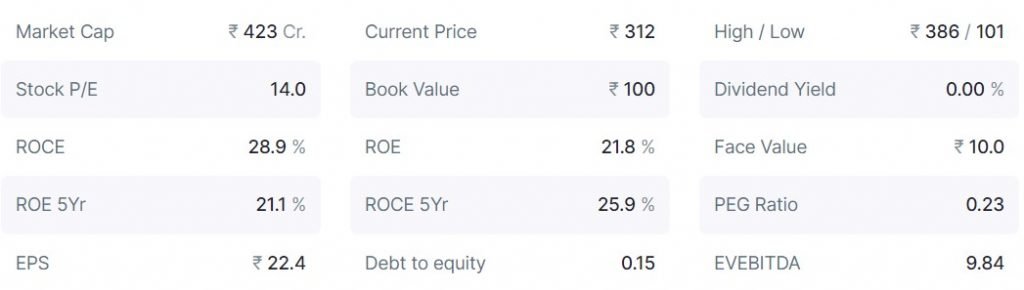

Fundamental Analysis:

Companies Revenue from Operations has been consistently rising and has given Sales CAGR of 24% for the past 5 years. With Profit growth of 62% CAGR during the same period.

D.P Wires Operating margin is Pretty low at just 6-7%. With the growth in business, considering the economics of scale. I believe the OPM will soon be in double digits.

The company has Debt capital which includes Borrowing & other financial liabilities worth over 7.5 crores. Comfortable debt range.

The major issue seen in D.P wire Ltd financial is that the company has huge trade receivables amounting to Rs. 85.57 crores! And the same is booked under Unsecured meaning no collateral.

Usually, small-cap companies find it difficult to receive their amount from sales. They run with a very thin cash reserve. This situation DP Wire is running with is often noted amongst many small & mid-size firms.

But, receiving the stuck amount shows the efficiency of the management. And, as of now, in this regard, the management has shown poor performance.

We can’t fully blame the management given the fact that cash crunch is a new norm due to the China-based Pandemic that’s going around.

DP Wires Reserves & Earnings Per Share has been continuously rising. A very good sign for efficiency.

As per my calculation of Fair Value at Rs. 145. The company is definitely overvalued. Obviously, the stock price has risen over 3 fold in under 1 year. So, that explains the high valuation.

In the stock market, unless we are in a sheer crash or a steep correction, the stock prices usually don’t quote their exact valuation. In such a case, we consider the risk rewards situation and try to quote a price that gives us a comfortable margin of safety whilst bringing in return what we prefer.

With that said, My margin of Safety per share comes at Rs. 292. So, im not gonna pay anything higher than Rs.300 per share based on the current valuation. But, the company is really good in regards to its financial performance.

Liquidity Position:

As seen by low bank line utilization, liquidity is ample, as seen by fund-based BLU averaged 34% for the 12 months ending October 2021, whereas non-fund-based BLU averaged 19% over the same period. Net cash accruals of Rs 27–32 crore are envisaged, which will be more than sufficient to cover repayments of Rs 0.10-0.20 crore over the medium term.

As of March 31, 2021, the cash and bank balance was Rs 3.51 crore. Liquidity is further aided by an unsecured loan of Rs 2.31 crore (as of March 31, 2021) from friends and family. As of March 31, 2021, the current ratio was 4.64 times. The company does not intend to pay big dividends in the near future.

Technical Analysis:

D P wires have reached their peak pricing in the last week of January. Post that, be it due to US Interest rates or Budget sessions, the stock price has seen a 12% drop. Since it’s a small-cap company with very few free float equity shares. There are not many technical indicators to rely on.

But, one fact is straight. The company is overvalued and the stock price is correcting. Whether the stock is correct to reach its true valuation is to be seen in the near future.

SWOT – Risk Analysis:

Opportunity & Strength

Infra Concentrated Budget

Budget 2020 was all about Infrastructure with spending of about 7.5 lakh crores. (Check the link, have made a video on Budget 2022 & Important sectors to watch out for post Budget). Basically, Huge capex directed towards the infra sector will benefit allied sectors such as Cement, Paint, and Chemicals, and other industries such as steel wires. For example D.P Wires.

Diversified Clientele

D.P Wires caters to a wide range of customers. A well-diversified customer base of around 150-200 diversified industries which include oil & power, automotive, construction, infrastructure, etc.

DPWL has a strong history of working with its customers and suppliers. It serves a client base of around 150–200 across a diverse range of end-user industries, including oil and power, automotive, construction, and infrastructure. A diverse end-user industry base enables it to overcome the danger of a specific sector slowing down and achieve better growth.

Additionally, LRPC/stranded wire is a highly specialized product with a limited market presence. Additionally, this has resulted in the establishment of a market position. DPWL’s moderate size enables it to operate with agility in a highly competitive business.

Strong Liquidity Position

Moderate working capital requirement with low dependence on creditors & bank loans. Cash & Bank balance is at 5 crores. DPWL has a modest working capital cycle, as seen by its 97-day GCAs as of March 31, 2021, fueled by 49-day receivables and 21-day inventories, respectively.

This is backed up by bank lines and creditors, both of which stood at four days as of March 31, 2021. Internal accruals help the working capital cycle, which means less reliance on creditors and bank lines.

Operating Profitablity

Healthy operating profitability with room for improvements in margins. And, placed well to grasp the market share given the importance government has shown towards infra spending.

DPWL has a low reliance on external debt, which results in a smaller debt level and hence a stronger capital structure. The company’s high net worth of Rs 122.66 crore as of March 31, 2021, is a result of solid revenue growth and profitable operations.

Weakness & Threat

Sensitive

The company is sensitive towards steel price as it is the company’s core raw material. So, Sales, Financial status, and profit margin will be affected by a drastic change in steel price.

The operating margin and realizations are subject to steel price fluctuations. Operating margins ranged from 7.1 percent to 8.2 percent over the four fiscal years ending in 2021. Though the impact of steel price changes is limited because the company has a wide range of products, the company’s profitability will still be affected by changes in steel prices.

Low Command over Price

Low entry barrier and the sector is filled with multiple organized and established players, also unorganized operators. Thus, D. P wires have very little room to command over its pricing.

High Competation

Steel wire manufacture is a highly fragmented business with a huge number of small, medium, and large firms. This is because entrance hurdles are low, such as cheap capital expenditure and technological needs. While the majority of unorganized sector businesses operate on a shoestring budget and do not adhere to high-quality requirements, they continue to serve tiny regional clients in price-sensitive marketplaces.

As a result, organized players such as DPWL are limited in their capacity to charge a premium for items. In addition, because the building and infrastructure industries make up the majority of demand, sales could be hit by a drop in demand from these industries.

Conclusion:

Small-cap investing always comes with a risk. More so than usual. And in the case of DP. Wires, although the financial performance has been satisfactory. The companies receivable is worrisome.

We are not sure if and when will the company be able to receive all of its unsecured receivables. Apart from that, I haven’t noticed any major issues to mention.

Companies financial is good. They are showing improvements, I will update my review on the company from time to time on this channel. If you haven’t subscribed. Please like and subscribe. Click on the bell icon to get notifications of my future uploads.

For now, I give a 7/10 rating for DP wires. And I have invested in the company with just 0.5 percent weightage.

For More Information, Check this Video:

Disclaimer: All the information on this website is published in good faith and for general information purposes only.