Table of Contents

Business Introduction:

DU DigitalTechnologies was founded in 2007 and is in the business of providing visa processing services to embassies from various nations. It serves as a human liaison between the visa applicant and the visa processing unit’s technical staff. The company performs administrative and non-judgmental functions for customers in connection with visa applications, digitization, document verification, and biometric data gathering.

DU Digital Global business segments:

- Accepts documents on the Ministry’s behalf,

- Services of attestation,

- Obtaining fingerprints, facial photographs, and retina scans, among other things.

Additionally, it offers a number of value-added services, including a premium lounge, a prime time application, mobile biometrics, SMS alerts, and courier services.

The company operates Visa Application Centers (VACs) in Delhi, Kolkata, Bangalore, and Mumbai, as well as a processing support center in Ahmedabad, Chandigarh, Chennai, Cochin, Jalandhar, Hyderabad, Pune, Gurgaon, Jaipur, and Goa in partnership with VFS Global Services Ltd.

DU Digital Global role in Visa Processing?

The company’s role is to perform administrative and nonjudgmental activities relating to visa applications, digitization, document verification, and the gathering of biometric data for its customers.

This allows the respective government entities to devote their full attention to the crucial task of assessment. DU Digital is not involved in the decision-making process for granting or denying visa permissions.

Currently, the company provides human interface services for visa processing in Greece, Malaysia, and India through various subcontracts provided to the company and its subsidiaries.

About founders:

Mr. Rajinder Rai is the promoter of the company.

Financial Information:

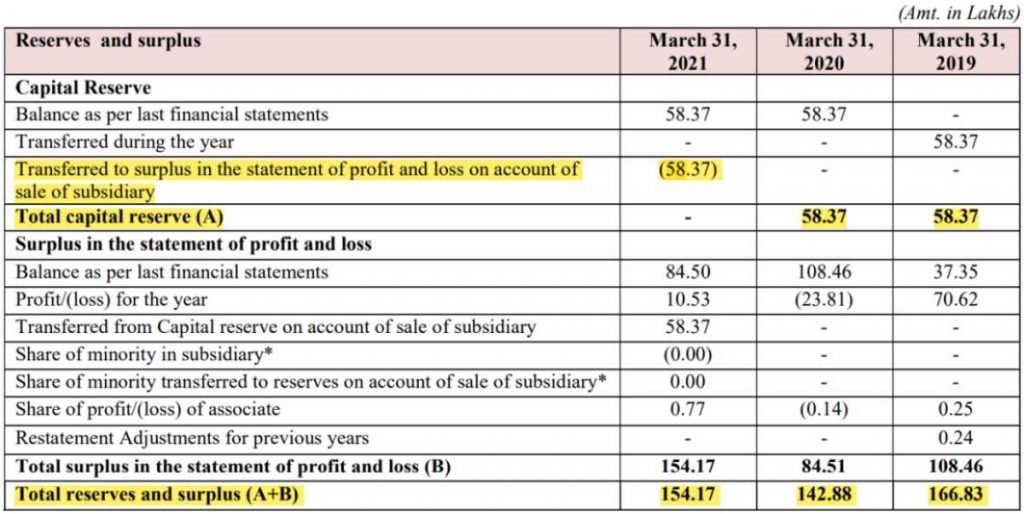

Reserves and Surplus:

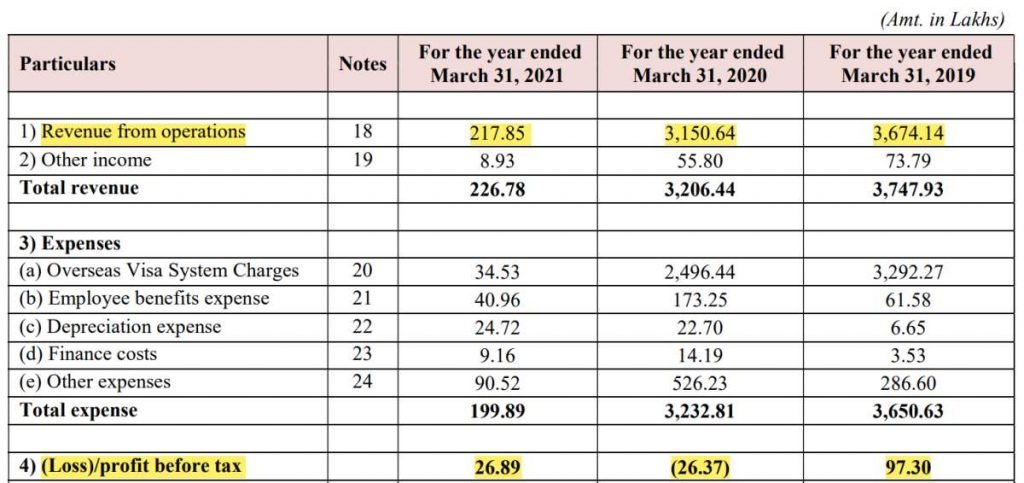

Revenue from Operation:

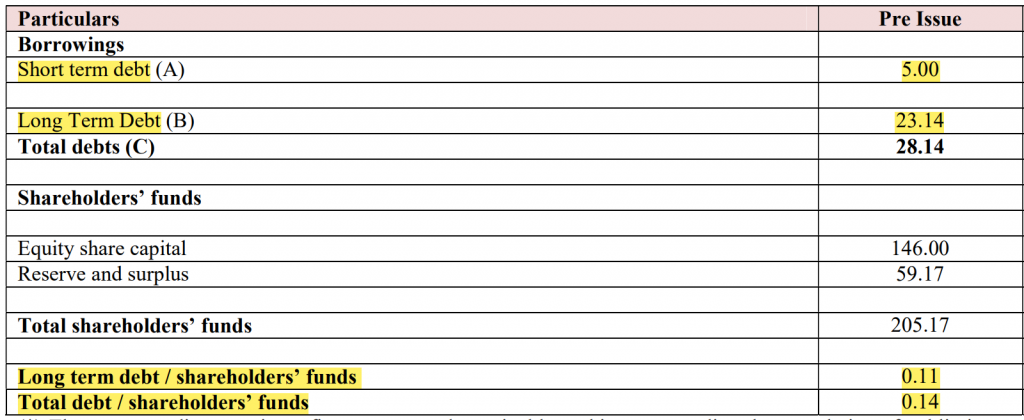

Capitalization Statement:

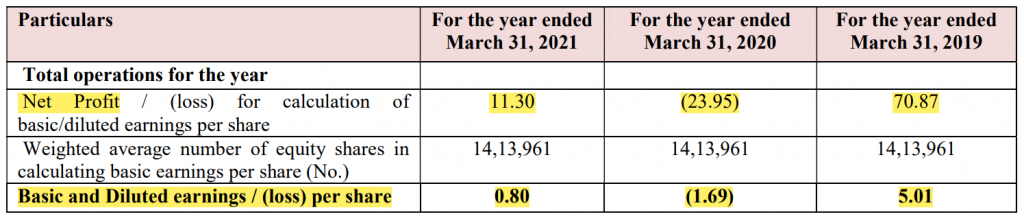

Per-Share Earnings:

Company Opportunity and strength:

- High Entry Barriers and a Niche Industry – Visa outsourcing industry is huge with very few players. So, the company can monetize its presence very well.

- Exclusive Service Agreements for visa processing – of Greece and Malaysian Visa in and for India.

- Providing efficient and secure services to clients and service providers – DU Digital Global aims at collecting, according to the demands of the Diplomatic Mission, applicants’ biometric data in the most secure electronic way and securely transmits them to the Consulate of jurisdiction, thus ensuring total protection of applicants’ confidential information and personal data.

- Qualified and experienced management team and personnel base strategy – Company has a well qualified employee base of around 29 employees as of March 2021.

Strategy:

- A greater emphasis on direct partnerships with governments worldwide.

- Increase the customer base through increase in foreign travel and tourism in India

- The company wants to expand its customer base by entering into more agreements with other companies that outsource visa processing services in India and Southeast Asia. And establish a “One stop Centre (OSC)” kind arrangement.

- Extending the scope of services through expansion into new locations and increasing public knowledge of immigration services.

Company Threats and Weakness:

- Weakening drivers of growth.

- Broad-based slowdown in potential growth the likes of which we are seeing now globally in the air industry.

Management Analysis:

Chairman and Managing Director Mr. Rajinder Rai has a rich experience of around 40 years in the Travel and Tourism Industry and is the backbone of the Company.

The Board of Directors have individuals with rich and varied experience in the field of Travel and Tourism with over 2 decades of experience.

DU Digital Global IPO details:

| Sl. No | Particulars | Information |

|---|---|---|

| 1 | IPO Issue opens on | August 12, 2021 |

| 2 | IPO Issue closes on | August 16, 2021 |

| 3 | Issue Type | Fixed Price Issue IPO |

| 4 | Face Value | Rs. 10 per equity share |

| 5 | IPO Price | Rs. 65 per equity share |

| 6 | Minimum Order Quantity | 1 lot = 2,000 Shares, Amounting Rs. 1,30,000 |

| 7 | Maximum Order Quantity | 1 lot = 2,000 Shares, Amounting Rs. 1,30,000 |

| 8 | Listing At | NSE and SME |

| 9 | Issue Size | Amount aggregating up to Rs. 4.49 crore |

| 10 | Fresh Issue | Amount aggregating up to Rs. 4.49 crore |

| 11 | Offer for Sale | - |

| 12 | Allotment date | August 20, 2021 |

| 13 | Initiation of Refunds | August 23, 2021 |

| 14 | Credit of share to Demat Account | August 24, 2021 |

| 15 | IPO Listing date | August 25, 2021 |

Use of IPO proceeds:

- Maintain sufficient working capital.

- investment in DU digital Global LLC, a subsidiary company.

- To accomplish general corporate objectives.

- To cover the costs associated with the issue.

Risk Factors:

- The pandemic of COVID-19 has had, and is likely to continue to have, a major adverse effect on the travel industry, and thus on the business, financial condition, results of operations, and cash flows.

- DU Digital Global’s operations are contingent upon the Company obtaining service level agreements or subcontracts from third-party service providers. These agreements are typically effective for one to three years, and if they are not renewed on favourable terms, the companies’ operations may suffer.

- Despite precautions, the organisation may be subject to risks associated with the verification, processing, storage, use, and disclosure of client data.

- DU Digital Global relies on third-party service providers for a substantial share of its operational services, and the firm may suffer if they fail to meet standards or experience operational difficulties.

- The company is prone to information technology system failures (including cyber security system failures), which could have a negative impact on the business. Additionally, it is dependent on external information technology infrastructure to conduct business, and any failure of such infrastructure would have a negative impact on the organisation.

- The company’s revenue is derived from its visa processing services in the limited geographical areas of Greece and Malaysia (which are not ideal portfolio sites). Failure to extend its company in additional geographies for visa processing services could have a negative impact on its revenues, results of operations, and financial condition.

- Seasonality has an effect on operating results.

Industry Overview:

Following a collapse caused by the COVID-19 pandemic last year, worldwide economic output is predicted to expand by 4% in 2021 but will still be more than 5% below pre-pandemic estimates. Global growth is expected to slow to 3.8 percent in 2022, dragged down by the pandemic’s long-term impact on prospective growth.

The Indian economy suffered a setback in 2020-21 as a result of the extremely contagious coronavirus (Covid-19) sweeping across the country. In response to the pandemic, the government has taken several proactive preventive and mitigating measures, including progressive tightening of international travel restrictions, issuing public advisories, establishing quarantine facilities, tracing contacts of virus-infected individuals, and various social distancing measures.

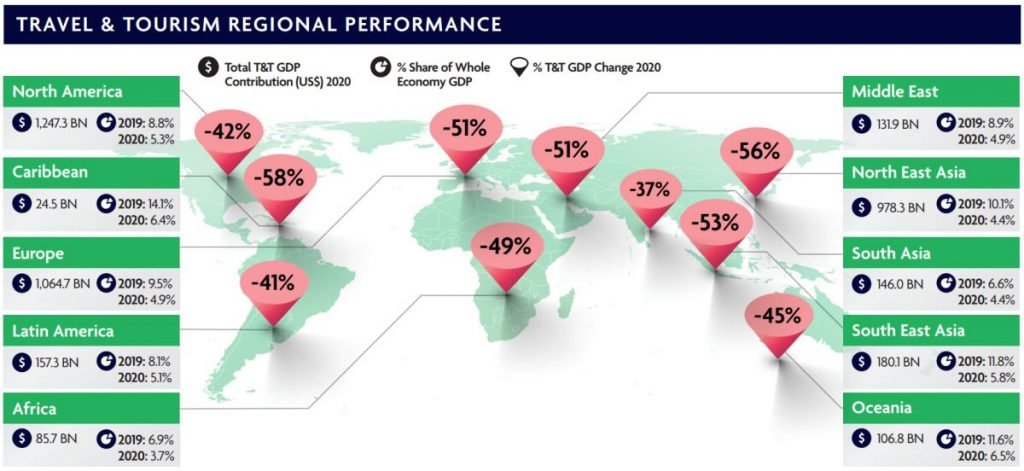

In 2019, the Travel & Tourism sector contributed 10.4 percent to global GDP; this contribution will fall to 5.5 percent in 2020 owing to further mobility constraints.

In 2020, 62 million jobs were lost, a loss of 18.5 percent, leaving the industry with a global workforce of just 272 million, down from 334 million in 2019. Job losses continue to be a worry, as many positions are currently supported by government retention programs and reduced hours, which might be lost if Travel & Tourism does not fully recover.

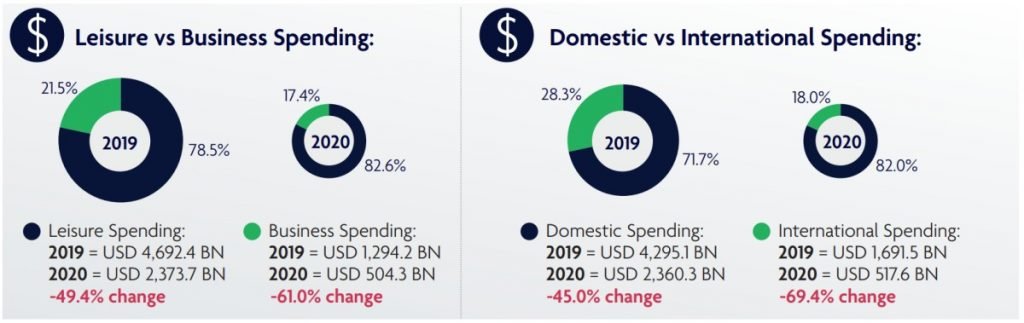

Domestic visitor expenditure fell by 45%, while overseas visitor spending fell by a record 69.4 percent.

Conclusion:

The business model seems feasible. Although there’s not much visible moat in the company’s business structure. The company seems well-positioned. But, I would be happier if the company had a well-diversified location as a market. With just Greece and Malaysia as major markets, I don’t see much growth in it.

But, the company has assured that it is venturing into different markets and that is a good sign.

Financials are reasonably well. Management seems experienced and we do notice a good entry barrier in the industry so, that is one noticeable plus point to DU Digital Global.

If one is planning to invest in this company. Please note that there’s not much to earn as in ‘IPO Gains’ here. So, go for it if you find it a worthy investment for Long-term.

Will I subscribe to this IPO?

No, I’ll have a pass on it. I do think the company can be a wealth creator if one holds on for a long period. That can be a possibility. But, At present, due to the ongoing situation. I’m not interested in this company and would like to invest elsewhere.

And, since the lot size is huge. I.e Rs. 1,30,000 per lot. I believe only serious investors who really find value in the company and would hold on for the long term should consider investing.

How to apply for DU Digital Global – IPO?

Steps to be followed to apply for “ DU Digital Global IPO – DU DIGITAL” via Zerodha console:

Step 1: Visit the Zerodha website and log in to Console.

Step 2: Go to Portfolio and click the IPOs link.

Step 3: Go to the “ DU DIGITAL ” row and click the ‘Bid’ button.

Step 4: Enter your UPI ID, Quantity (In lots), and Price.

Step 5: ‘Submit’ IPO application form.

Step 6: Visit the UPI App (net banking or BHIM) to approve the mandate.

Do not have a brokerage account? Apply for Zerodha – India’s top brokerage service.

Disclaimer: All the information on this website is published in good faith and for general information purpose only.