Table of Contents

Business Introduction:

Exide Industries Limited (EIL), founded in 1947, is India’s largest battery manufacturer. Associated Battery Makers (Eastern) Ltd. was founded in 1993 as a subsidiary of Chloride Overseas UK, which was acquired by the Rajan Raheja Group in 1993.

The company was renamed Exide Industries Limited in 1995. EIL acquired the battery business of Standard Batteries Limited (SBL), India’s second-largest battery producer at the time, as well as four of its manufacturing facilities and Standard Furukawa, which’s a well-known brand. EIL now has the greatest storage battery manufacturing capacity in India, with a geographically diverse manufacturing base and diverse industrial establishments.

Exide Industries Business Segments:

Exide Industries Ltd is primarily engaged in the manufacturing of storage batteries and allied products in India. The Company has identified two operating segments viz, Automotive and Industrial which is the “storage batteries and allied products”. And, the Group’s business has three operating segments based on different products and services: ‘Storage Batteries & allied products’, ‘Solar Lantern & Homelights’ and ‘Life Insurance business’. Storage batteries & allied products and life insurance business are the only reportable segments.

Note: Exide Industries “Life Insurance Business” is sold to “HDFC Life Insurance” for Rs.6,887 crores of which Rs. 725.98 crores in cash and the rest by issuing “HDFC Life Insurance” 87 million shares at Rs. 685 which accounts for 4.1% of the company.

About Founders & Promoters:

“Exide Industries” is currently owned by “Rajan Raheja Group”, which owns in total 45.99% of the company as “Promoter Holding”.

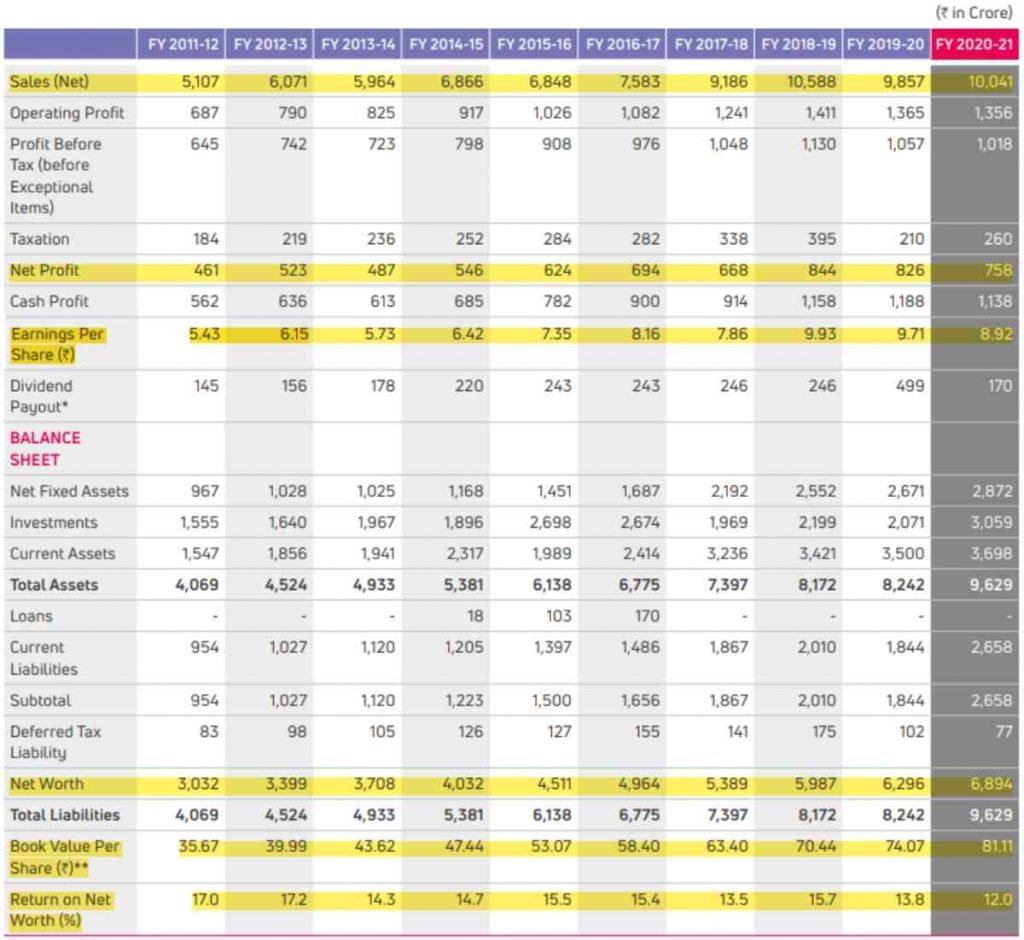

Financial Information:

Liquidity position:

Exide’s liquidity position is strong and consistent. With cash and bank balances of over Rs 1,000 crore, liquid investments of over Rs 1,000 crore, domestic bank lines of nearly Rs 300 crore (which have been used sparingly), and healthy business accruals, all of which should assist it in maintaining strong liquidity.

With modest capital expenditure plans and the business likely to grow steadily in the medium term, EIL’s free cash flows are expected to remain healthy. However, unusually substantial dividend withdrawals and/or significant debt-financed expenditures may pressurize the company’s cash position, making it a critical monitorable.

Why low margin?

“Exide Industries” manufacture lead-acid batteries, which are also their primary products. Lead prices are more volatile the one thinks. By the end of “Covid first wave” the price of lead had bottomed out. But, has had a significate rise in price ever since.

Since the company has to rely on the raw material. The company’s bottom line will drastically affect if there is a major price change in “Lead”. As a result, the companies net profit margins have decreased.

This explains why we are seeing an increase in sales but not profits, as there has been constant inflation in lead prices, which appears to have slowed recently. As a result, an organization’s profit margins may improve in the future, and they may see profit growth in tandem with sales growth.

Also, now that we are foraying into the new age of “Electrification of Automotive industry”. The demand for a “Lithium-Ion battery” is growing more as days go by. This calls for already established players in the “Battery segment” to take up the stand and contribute. Hence, we saw the development of Exide Industries “Nexcharge”.

Research and Development:

The company conducts research and development on various aspects of lead-acid battery technology, including the development of new products for applications such as automotive, motorcycle, VRLA, telecommunications, UPS, railways, and defense, with the primary goal of increasing the product range’s international competitiveness.

Additionally, the R&D department is involved in initiatives involving process technology with the goal of enhancing product quality and consistency, as well as production efficiency and material use.

And, the R&D program involves the enhancement and indigenous production of materials such as metals, alloys, and polymers. The emphasis of research and development is on examining and enhancing the environmental aspects of the manufacturing process.

Company Opportunity & Strength:

Market leader:

EIL is the market leader in the domestic automobile battery industry, both in the OEM as well as in the replacement battery space. And, this Sector dominance in the vehicle battery market will support the company EV space in the future.

Diversified portfolio:

EIL sells its batteries to a large customer pool, spanning across the automobile and industrial battery segments. EIL has revenue streams from a variety of end-user sectors. Further, with the JV with Leclanche SA, EIL has diversified its presence by entering into the domestic lithium-ion battery segment as well.

Strong Financial statement:

The company has a steady increase in revenue and cash flows. The company’s liquidity position has remained strong, as reflected by its conservative capital structure as well as sizeable cash and liquid investments.

Lithium-Ion Battery:

Exide Industries is an early entrant of “Lithium-Ion Batteries” and the EV market being young and rapidly growing. The untapped market will flourish in the coming decade.

Company Threats & Weakness:

Intense competition:

EIL’s business margins have been under pressure because of intense competition in the industrial battery segment and the emergence of new players in the auto segment in recent years. Main competitors such as “Amara Raja Batteries Ltd – ARBL”.

Products of Hazardous nature:

Lead, a highly toxic and polluting material, is the primary raw material for manufacturing batteries. Hence, handling lead requires adherence to pollution control norms and EIL has to incur additional costs for managing the environmental impacts of the material.

Management Analysis:

The company is in existence for over 70 years and with rich management base. The Board of Directors has individuals with rich and varied experience in the field of Automotor and Battery allied businesses with over 3-4 decades of experience. Management has taken pro-active steps in accepting new change, boost Digital presence and easy accessibility such as follows;

Exide “Nexcharge” an entrance to EV world!

Nexcharge is a joint venture between two well-established organizations, Exide Industries of India and Leclanché of Switzerland. Nexcharge, founded in September 2018, aspires to be a market leader in customized energy storage solutions. “Nexcharge” is poised to become a leading “Lithium-ion-battery” manufacturer in India with an overall capacity of 1.5 GHz.

Exide Batmobile:

Exide Batmobile, the industry’s first-of-its-kind doorstep service, was introduced in 2000 and has subsequently expanded and scaled to improve consumer experiences.

Exide Batmobile support is accessible for all battery-related difficulties encountered by customers of passenger cars and will be expanded to include customers of inverter batteries and home UPS systems by August 2021. The Exide Batmobile service is available for all makes and models of automobile batteries.

The company strives to provide expert services to car consumers seeking roadside assistance within an hour of receiving the request through continuous technological advancements and the onboarding of experienced specialists.

Exide Industries “Digital foray”:

The “Exide Industries” website was totally redesigned this year (2021) to improve the digital experience for its valued customers. It was modified to provide more user-friendly elements that aided in the enhancement of client experiences.

Additionally, the company used digital platforms such as WhatsApp to communicate directly with customers. It enables consumers to easily request products or services from the comfort of their homes, either using the website’s service request forms or by putting booking requests through the contact center.

Application such as “Exide Access” (for in-app dealers), “Exide DYNEX” (for in-app dealers), and “Exide SF” (application for retail users).

Risk Factors:

Dependency on Auto:

Automotor Battery is one of the major segments of “Exide Industries” and since the Auto sector is cyclical in nature and sensitive to global cues. It is apparent that those that depend on the Auto sector will feel the same heat. Hence, at times, a drop in sales and revenue can be expected. But, on a long-term basis, the sector and the business is as good as it can get. Also, the company has a well-diversified client base.

Disruptive market:

EV tech is bringing in a major disruption to the Automotor sector. And, only those with innovation can sustain the competition. Thus, excess spendings on R&D is noted.

Slow growth:

Every sector has a saturation point. And, the Lead-based battery segment had slow growth. Although, the sector is thought to increase rapidly due to the huge untapped market and new opportunities ahead in Lithium-Ion based EV segment. The decline of regular batteries is apparent.

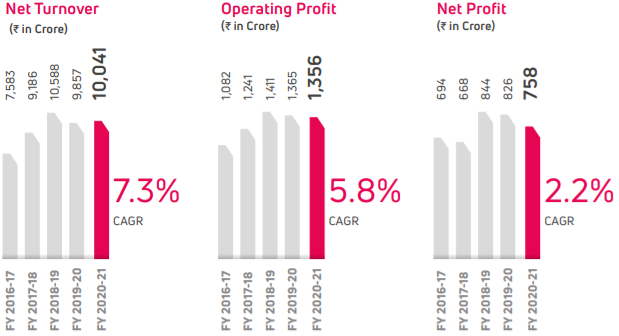

Low Margin:

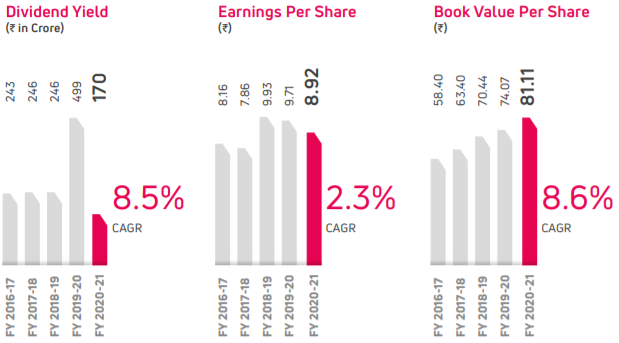

Exide Industries has had a very low Operating margin. The entire industry is such and the bottom line is in single-digit growth at 2.2% CAGR for 2020-21.

Industry Overview:

Lockdowns around the country and dwindling automobile sales wreaked havoc on the already fragile automotive sector.

Manufacturing was also significantly impacted by the pandemic. OEMs and car part makers are still attempting to reach their maximum manufacturing capacities. Massive supply chain disruptions, decreased demand, lagging sales, and continual delays in new product introductions all weighed on the sector.

But, the same is changing and we are staring at the largest bull run straight ahead. Especially, the case in regards to “Electric vehicle” and “Lithium-Ion Battery”.

This decade will pave way for the “New India”. And, companies such as “Exide Industries” will play a prominent role. EV segment is said to grow in double-digit for the next 10 years. And, established market leaders will be hugely benefitted.

Conclusion:

It is said that by 2030, India’s adoption of electric mobility is predicted to accelerate across all the vehicle categories, rising from roughly 6% of the on-road vehicle population in 2010 to about 33% in 2040. Even as India switches to electric mobility, demand for lead-acid batteries will continue to expand in tandem with the ICE vehicle.

Additionally, the growing popularity of electric vehicles (EVs) will boost lead-acid battery volumes. This is because it will be used in a novel way as an auxiliary battery in an electric vehicle.

With that said, “Exide Industries” is the market leader in the segment and is making efforts to become one in the “Lithium-Ion” battery segment. With the help of Government’s Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell battery.” The company EV division, “Nexcharge” is set to build an output capacity of 1.5 GWh.

Now that the Exide Insurance business is sold. The entire management can concentrate on “Exide Industries” with additional capital (from the sale of business & others” and concentrate on the operating revenue better. And, as the demand for EVs rises, the company expands its establishment.

And, being the largest battery producer it already is, in a 30k crore market which is supposed to grow (Lithium-Ion segment) to over a lakh crore in market cap by the end of the decade. I see no reason why one shouldn’t invest in “Exide Industries”.

Have allocated a considerable portion of my investment in the company and info for the same will be available on my website. Click here!

Disclaimer: All the information on this website is published in good faith and for general information purpose only.