Table of Contents

What is Personal Finance?

Money management, savings and investments, tax preparation, and retirement preparation are all subsets of personal finance. Budgeting, mortgages, insurance, and other banking procedures are also included.

You might think of personal finance as the realm of goods and services that help you make educated decisions about your money so you can achieve your objectives.

Making money is easy, but getting the most out of it takes careful financial planning. In order to save for the future, deal with unexpected expenses, and grow your wealth, you need a solid financial strategy.

If you’ve ever heard the word “personal finances,” you know that it may refer to a wide variety of different things depending on who you ask. Read on to discover more about personal finance so you can handle your money wisely.

What Is an Emergency Fund?

An emergency fund is a sum of money set aside for use in the event of a sudden and unexpected expense.

An emergency fund is a savings account kept specifically for the purpose of covering small and large unexpected costs, including those associated with a medical emergency or substantial house repair.

Cash or other easily converted assets are typical of what you’d find in an emergency fund. In this way, you won’t have to resort to high-interest debt sources like credit cards or unsecured loans or jeopardize your financial future by withdrawing from retirement savings.

Importance of Budgeting in Personal Finance;

When talking about Personal finance, you might have heard of Budgeting, and more importantly, the word “Emergency fund”. As explained above.

It is said that 3 to 6 months of our expenses are sufficient to build an emergency fund. And, having an emergency fund is crucial at times of recession where the possibility of job loss, immediate expenses such as hospitalization, and other contingencies may occur.

Something like now, where the economy isn’t holding up well. And, hence it helps to have a rainy day fund.

But, what do emergency funds and their budgeting mean? What all is included?

Let’s get started on today’s topic.

Five (5) Financial Ratios To Help With Our Budgeting;

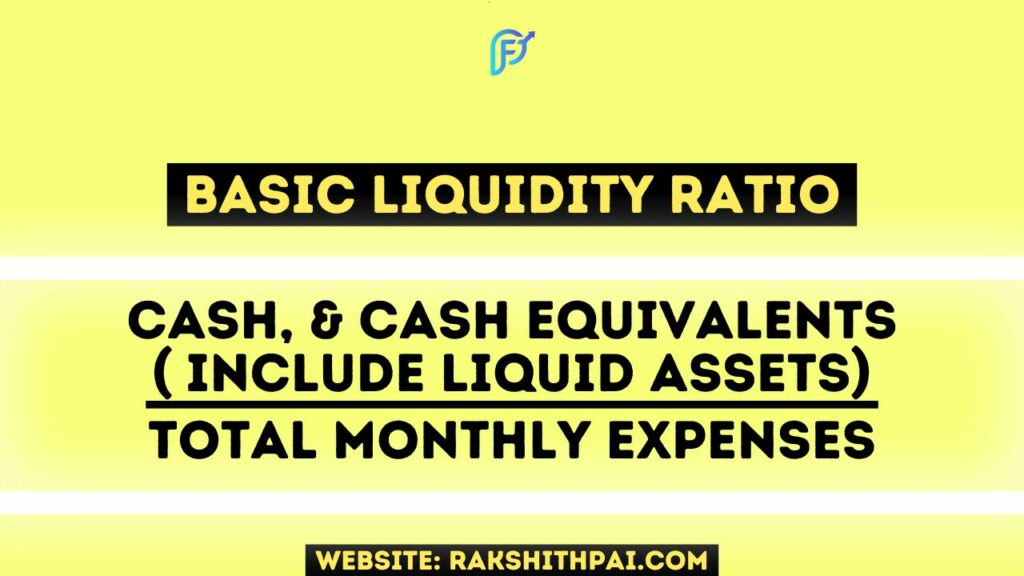

Basic Liquidity Ratio

Liquidity refers to the ability of an asset to be converted into cash and equivalents at any given point. For example, your cash and bank balance are already in cash. But, your stocks, bonds, and other instruments are listed on the stock market. If they can be converted into cash at a moment’s notice, they form part of your liquid assets.

As per the Basic Liquidity Ratio formula,

You must have liquid assets worth 3 to 6 months’ worth of your monthly expenses. So basic liquid asset = cash, and cash equivalents (which include liquid assets) / your total monthly expenses.

This ratio is also known as the current ratio or, as we call it more often, the “emergency fund.”

Liquid Asset to Net Worth

Cash is trash if we hold it as it is for a long period of time. For example, holding cash when inflation is over 6% means that close to half of the savings’ purchasing power will be lost within a decade.

But cash is also important in times of need. Right? As a result, we must keep cash and other liquid assets on hand in case of an emergency. But, how much should we hold?

To determine how much cash and cash equivalents you should have in relation to your net worth, we use this ratio.

Here, “liquid asset” stands for assets such as cash savings, bank deposits, stocks, bonds, and all other assets that are easily convertible into cash at a minute’s notice.

Divide liquid assets by your net worth. Net worth is nothing but your total assets (-) your total liabilities.

So, a healthy liquid asset to net worth ratio is when you have at least 15% of your entire net worth in liquid assets.

Savings Ratio

The savings rate, defined as the proportion of disposable income that is put aside each year, can be determined for a whole economy, any company, or in this case, an individual. A person’s disposable income is defined by the Income Tax Act as their total income minus their tax liability.

The savings rate is the fraction of after-tax income that an individual puts away in a savings account or invests for future use.

In economics, the savings rate is a measure of time preference since it represents the rate at which an individual or society is willing to sacrifice some current spending in favour of enhanced future consumption. The marginal inclination to save is connected to the savings rate as well.

So, now we know we must have 15% in liquid assets. But, how do I reach there? What should we do to build my savings?

To answer this question, we have the savings ratio.

As per this ratio, you must save at least 10% of your total income every year. Remember, your journey to financial freedom begins with saving.

The formula goes like this:

Savings ratio = Savings (which include short-term investments) / Your Total Income (that is your post-tax income)

Debt to Assets Ratio

Total debt to total assets is a measure of leverage that indicates how much debt you have in relation to your total assets. You may evaluate the strength of your leverage by using this statistic.

A person’s financial security may be inferred from such data. Higher ratios indicate a greater degree of leverage (DoL) and, by extension, a greater likelihood of insolvency.

Once your savings are set, you must first concentrate on your debt. Those who are in debt have a difficult time during recessionary periods.

As per this ratio, you must have debt that is equal to or less than half of your total assets. So, the formula goes like this,

Debt to asset ratio = Total debt / Total asset.

So, all your debt, such as a home loan, a vehicle loan, an education loan, and other payables, must be equal to or less than half of your total assets. If not, try to reduce your debt first before going any further. Why? Because of this next ratio.

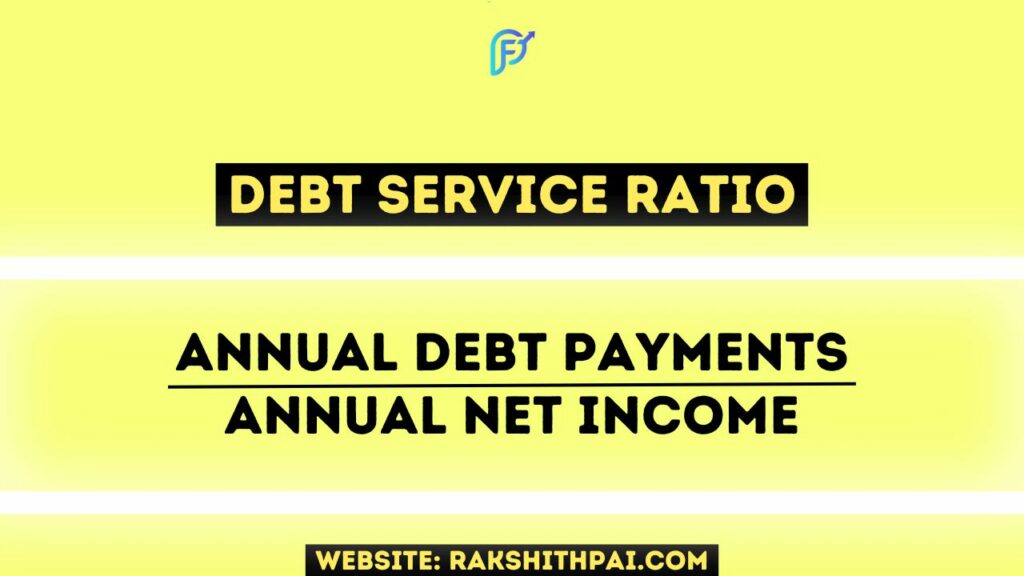

Debt Service Ratio

The debt service coverage ratio (DSCR) is an important indicator of your financial health and your capacity to take on additional loans and interest payments when they come due.

Along with the debt-to-equity ratio and the debt-to-total-assets ratio, it is one of three indicators used to evaluate a company’s ability to incur and service debt.

The debt service ratio is related to the debt-to-asset ratio. Here, we try to estimate our total debt liability, which includes both the principal and the interest cost. Now, this amount must be below 35% of our annual net income.

So, the formula goes like this,

Debt to Service ratio = Annual debt payments / Annual net income.

If your debt service cost is over 35%, then please consider reducing consumption and working on settling your debt.

Conclusion:

These ratios will undoubtedly assist you in making better financial decisions in the future. Remember, anything that’s related to finance (personal finance) has everything to do with how much you make, what part of it you set aside, and how much you expend.

And if you are rushing to achieve your materialistic financial goals through debt (not suggested), be sure to consider the metrics listed above before making a decision.

In line with the topic, I’ve written a book on “personal finance.” It’s called “A Personal Guide to Your Personal Finance.” It’s an ebook on the topic. Feel free to download it and let me know your opinion of the book.

For More Information, Check this Video:

Disclaimer: All the information on this website is published in good faith and for general information purposes only.