Table of Contents

Introduction:

I try to manage my portfolio just like any professional portfolio manager would. Have been doing it for over half a decade. And, throughout the journey, I have made all kinds of mistakes, and maybe this has made me a better investor than I was during 2014.

And, what I observed is that with proper diversification. I can minimize my risk extremely well and maybe, improve on returns too.

So, in this article, I’ll explain how you can diversify your Stock Portfolio.

Let’s get into today’s topic.

There’s a famous quote by a noble individual. It says –

If you are an Astrophysicist and you have known every inch of planet earth. Then, the “Concepts of Finance” is all there is in the observable universe and the Stock Market is just your Milkyway.”

So, what’s to learn is almost unlimited. What we know is what we see from our perspective, and may not be a complete truth.

There’s no one perfect strategy, no perfect method or way to approach Investing. In fact, it goes like this – “What works and makes the most amount of money and sustains through various market conditions is the best way to do it!”

How to diversify your Stock Portfolio?

Remember, your portfolio should have 2 important aspects.

- A Broader reach into the whole market via Index funds or ETFs (To know more about ETF Investing, click here).

- A concentrated portfolio that’s more towards your specification.

A broader reach

Investing in a broader market will help you balance your portfolio. It is investing in the entire market, thus, this type of investing will give strength and stability to your portfolio. Here, you must invest in ETFs, index funds. Basically, such instruments concentrate on the whole of “Nifty 50” or “Sensex”.

Concentrated portfolio

As much as it is important to have a wide varied investment. It is also important to own a concentrated portfolio. Here, you are investing in those companies or sectors that you are familiar with. It can be as follows;

- Investing in Large cap or Blue chip companies.

- Investing in Mid and Small cap companies.

- Investing in a particular sector such as FMCG, Banking etc. because you have a considerable advantage over the sector due to some insider knowledge, passion or interest or you are familiar with the sector.

Own a segregated portfolio:

It is to divide your portfolio into smaller chunks and try to balance it whilst managing the risk-return of your portfolio. I have noticed 3 important segregation that is a must in every portfolio. They are as follows;

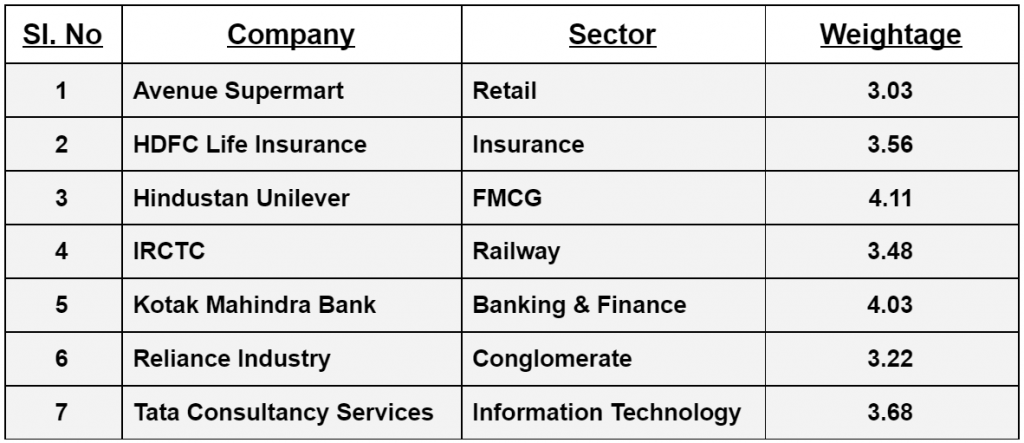

Growth Investing:

This is my “Core Portfolio”. These are those well-established, well-financed, and companies with monopolistic nature. They in some aspects define where the market is heading. These are large corporations that grow over and above India’s real GDP rate. And, they give an amazing strength & balance to your portfolio.

And, this is my core portfolio. Where I have allocated 35% of my entire portfolio.

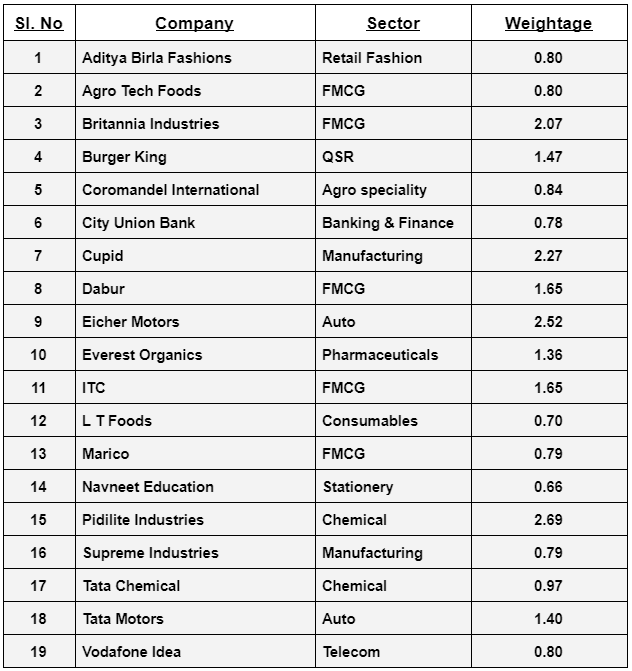

Value Investing:

This is your “Value-oriented Portfolio”. These are those companies that you find value for money. They are diversified and allocated based on their strengths and weaknesses.

These companies, if all goes fine, have the capabilities to become great wealth accumulators. And, the companies are not based on any certain set of market capitalization or are ranked based on any means whatsoever.

Remember, Valuation is a perspective. An idea of what the company could be worth in the future. Valuations are the story we Investors tell to ourselves based on the company’s past performance, present action, and future capabilities.

And, this is my value investing portfolio. Where I have allocated 35% of my entire portfolio.

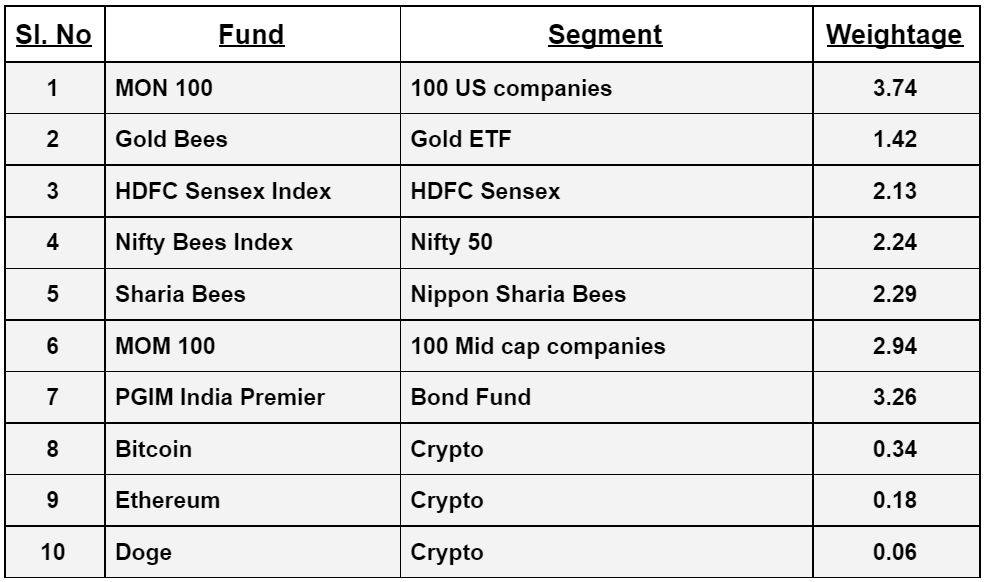

Broad Market Investing:

Broad Market Investing is important because they give a strong sense of balance to your portfolio. Imagine investing in Individual companies that you find value in and then invest a small chunk of your portfolio in the broader market. Because we don’t want to drift away from the market in its entirety. We must also have a share in the entire market. That’s what we are trying to achieve.

And, this is my Broad Market investing portfolio. Where I have allocated 25% of my entire portfolio.

Balance 5% (I.e, 35% + 35% + 25% = 95%) will be in “Cash position”. We must have at least 5% to 15% in cash and cash equivalents. This way, with a sudden mishap in the market, you can invest more into those that you find a bargain. Remember, “Cash is trash” for a Bull market. But, in the case of a Bear market, “Cash is King!”.

If you want to know more about my portfolio. Check out this link, I have attached a 30 page PDF where I have shared my current portfolio, weightage for each company, and return earned. Check the link in the description.

For more Information, Check this Video:

Disclaimer: All the information on this website is published in good faith and for general information purpose only.