Table of Contents

Introduction

India is a developing country where the middle class has gotten financially stronger over the years and, as adults spending power has increased, even the young have become free spenders and heavy consumers in some instances.

With a strong economy, a large population of the young and vibrant generation who are fascinated with emerging clothing brands, unique tech gadgets, food, travel & tourism, have seen comfort in spending. I mean People spend well nowadays.

None to blame here. But, the current generation has quite good taste in terms of selective purchase but this has come at a cost.

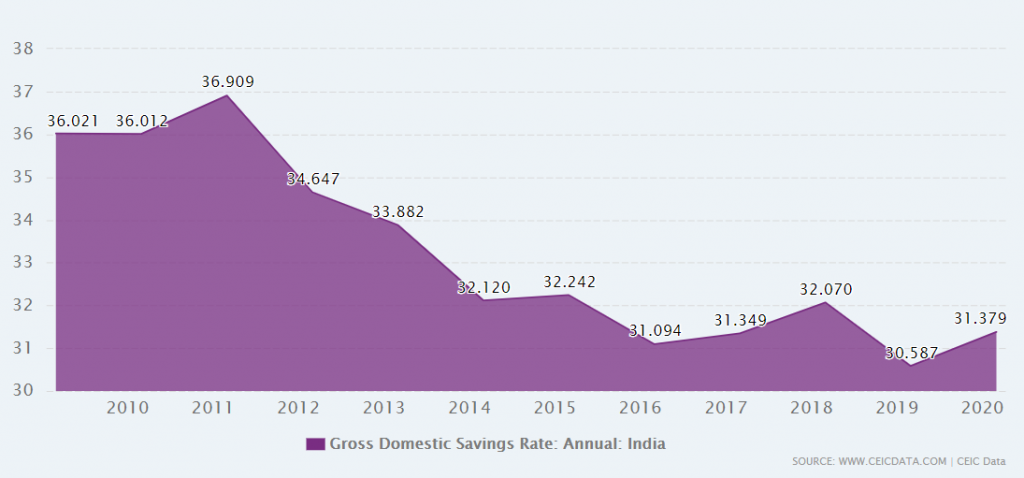

Look at the Gross savings rate;

Since 2010, the drop in savings rate is real!

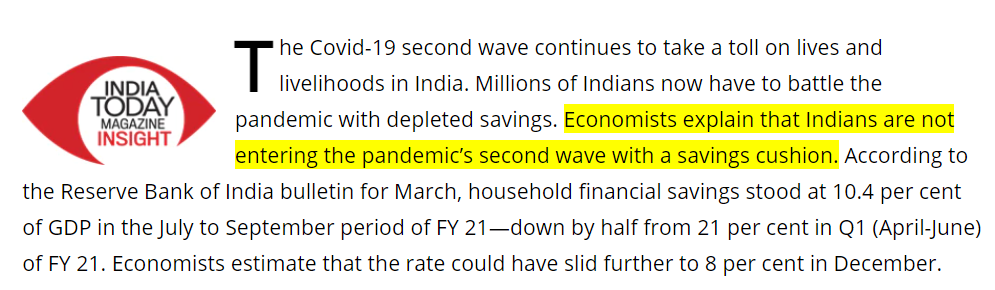

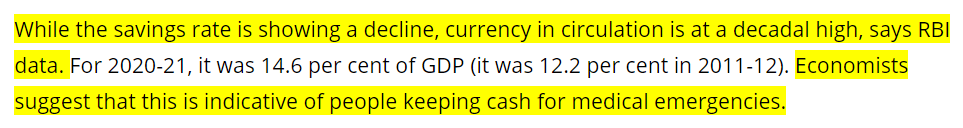

In this India today article, it says,

It took us a Pandemic to realize that we are doing something wrong!

A great part of the blame goes to the health crisis. But, the way the situation has arisen and with lesser savings in hand. People tend to suffer.

So, what’s the solution?

Think of this, Inflation hasn’t been kind to us. With an annual salary increment of say 6%-7%, you are not making any material progress in building your wealth unless you cut down your expenses and increase your savings.

Because, if not, with little or no savings and a 5-7% inflation rate, people tend to go broke by the time when they really need money.

Have listed down these points. So, just give consideration to them next time you think of saving:

How many of you do Budgeting?

It’s one skill each and every one of us should know.

And, it’s not that complicated either. All you got to do is list down your income and major expenses, see to what extent of expenses can you pay without putting in more money.

Meaning, Let’s say your savings is at Rs.10,000 and your monthly expenses are at Rs. 5,000. Now your job here is to cut down your expenses without materially affecting your living standard. And, see how long can you rely on just the savings.

Rainy day funds

Now, you might have heard this statement. It says “You should have sufficient sayings that could feed in for your 1 year or 6 months of expenses”. That’s all it really is. Have savings come investment such as “Public Provident Fund”, “National Pension Scheme” and you’ll pretty much cover this point.

Spending preference

Now, this is very important. Wherever you go, you are being persuaded in purchasing new products or services. The entire marketing industry starts feeding on you once you step out of your home.

These billboard ads, window advertisements, internet-based ads, they see that you open your wallet and start spending.

Now, your job is simple. Click on these colorful ads and buy whatever they are selling. Right?

WRONG!

Spendings can be segregated into 3 parts.

- Need-based spending

- Luxury

- Want based spending and

Need-based spending

This is nothing but your basic needs such as food, clothing, shelter, etc. You have to spend on this!

Want-based spending

See the watch you wear. It’s not a basic necessity for you. It was a purchase you made because you liked it. It is a want, something that you wanted. Right. So, this is want-based spending.

Luxury spending

This is just the next version of want. But, in this case, you expect more than usual. If you had an apple watch with you then that could be labeled as a luxury.

This is it! So, next time you make any purchases, all you need to do is. Put the said purchase in any of the brackets and you’ll see a pattern. Now, do this for a month and you’ll surely know where your expenses are going wrong!

Spending preference matters! Cause, your spending habits ultimately define the wealth that you could make Or not make!

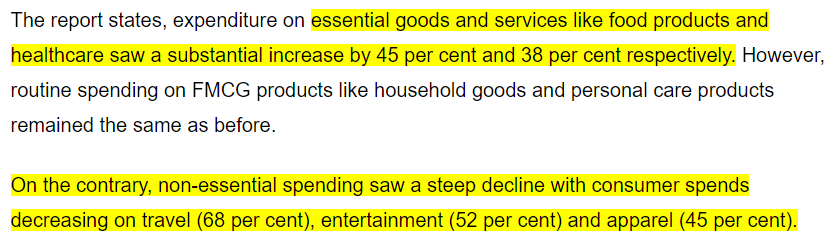

In this article by “Financial Express”

Now you see the pattern right? We do the right thing when the situation demands us. But, my question is why wait until the last movement. Why not make it a habit and work on our savings and Investment?

Well, I have done some research and listed down some key points for you people. Just concentrate on these points and you’ll pretty much start managing your savings well and maybe save some money for investments too.

So, let’s check them out.

- Avoid credit cards at all costs. They charge high interest!

- Cut down (or completely stop) on the consumption of sin products Ie. Alcohol, Cigarettes, and other tobacco items.

- No loan unless absolutely necessary! We don’t want unnecessary EMI burdens.

- While purchasing, make efforts to cut down the bill by subscribing to various coupons and discounts. Or, just make purchases on such occasions that provide discounts.

- Take help of government-offered schemes to reduce tax. Schemes such as PPF, NPS, NSC. (And, If you want more information about how middle-class Indians can save on taxes. Check this article CLICK HERE!

Before concluding the topic, Here’s How to Become Rich, Slowly:

5 Ways to Save and Build Wealth:

Educate Yourself

One definition of financial literacy is the possession and use of knowledge and competence in a range of financial areas, such as money management, budgeting, and investment. It also requires an understanding of financial concepts like compound interest, budgeting, and the time value of money.

Gaining financial literacy may aid people in avoiding the pitfalls of bad financial decision-making and paving the way to greater economic independence and security. Learning how to make a budget, keep track of expenses, eliminate debt, and save for retirement are all essential stages in achieving financial literacy.

As part of this type of education, people learn the ins and outs of money, how to plan for and reach their financial goals, how to spot and avoid unethical or discriminatory financial activities, and how to deal with the inevitable financial problems that life brings.

Plan Your Finances

Financial planning is an ongoing process that can help you meet your immediate needs, save for the future, and enjoy life now without worrying about money.

Creating a comprehensive financial strategy can help you make the most of your resources, make sure you reach your long-term goals and be ready for the inevitable setbacks that will happen.

In order to get a clear picture of your current financial situation, your long-term financial goals, and the steps you’ll take to get there, you should create a financial plan. Cash flow, savings, debt, investments, insurance, and everything else in your financial life all need to be factored into a comprehensive financial plan.

Budget Properly

Financial planning is incomplete without a reasonable budget. A budget is a plan for managing monetary resources over a specific time frame. You can get a handle on your current financial situation by breaking down your income and expenses into separate categories. When you do that, it’s much less difficult to figure out how to get to where you want to be financially.

For more information on Budgeting, Check out this article – “The 50/30/20 Rule of Budgeting. Its Features & Importance Explained“

Avoid Debt!

Debt is a financial obligation that must be repaid by a specified date. Debt comes in many forms, including mortgages, school loans, auto loans, and credit card bills.

You will probably have debt at some point in your life. But what kind of debt is considered excessive? Well, to answer this question: Your total yearly debt payments (vehicle payments, credit card bills, and bank loans) should not exceed 20% of your gross income. (Rent or mortgage payments alone can account for 30 percent of your income, so keep that in mind when applying this 20 percent rule).

Emergency Fund

An “emergency fund” is a savings cushion for use in unexpected emergencies. An emergency fund is a savings account designed to cover large or small, unanticipated costs, such as those associated with a medical emergency or major home repair.

Typically, the assets in a rainy-day fund take the form of cash or other easily converted assets. This makes it less likely that you’ll have to borrow money through risky methods like credit cards or payday loans, or that you’ll have to risk your financial future by taking money out of your retirement savings.

Watch the YouTube video for more information:

Disclaimer: All the information on this website is published in good faith and for general information purpose only.