Table of Contents

Business Introduction:

One 97 Communications Ltd (PayTm), founded in 2000, is India’s leading digital ecosystem for consumers and merchants. The company had 333 million+ customers and 21 million+ registered merchants as of March 31, 2021, to whom it provides payment, finance, commerce, and cloud services.

In 2009, the company launched India’s first digital mobile payment platform, “Paytm App,” to provide customers with cashless payment services. It has since grown to become the largest payment platform and most valuable payments brand in the country, with a total brand value of US $6.3 billion, according to the Kantar BrandZ India 2020 Report.

Customers can use the app to do cashless transactions in businesses, top-up mobile phones, make online money transfers, pay bills, access digital banking services, purchase tickets, play online games, purchase insurance, and invest. Merchants, on the other hand, can use the platform for advertising, online payment solutions, product offerings to customers, and loyalty programs.

About founders:

Paytm has moved beyond digital payments into emerging sectors such as loans, gambling, wealth management, financial services, and digital commerce, driven by founder and CEO Vijay Shekhar Sharma.

Top shareholders list as follows:

- Ant-fin (Netherlands) Holding B.V. – 27.9%

- SVF India Holdings (Cayman) Limited – 17.3%

- SAIF III Mauritius Company Limited – 11.4%

- Mr.Vijay Shekhar Sharma (Founder) – 9.1%

- Alibaba.Com Singapore E-Commerce Private Limited – 6.8%

IPO Details:

| Particulars | Information |

|---|---|

| IPO Issue opens on | November 8, 2021 |

| IPO Issue closes on | November 10, 2021 |

| Issue Type | Book Built Issue IPO |

| Face Value | Rs. 1 per equity share |

| IPO Price | Rs. 2,080 - 2,150 per equity share |

| Minimum Order Quantity | 1 lot = 6 Shares, Amounting Rs. 12,900 |

| Maximum Order Quantity | 15 lot = 90 Shares, Amounting Rs. 1,93,500 |

| Listing At | NSE and BSE |

| Issue Size | Amount aggregating up to Rs. 18,300 crore |

| Fresh Issue | Amount aggregating up to Rs. 8,300 crore |

| Offer for Sale | Amount aggregating up to Rs. 10,000 crore |

| Allotment date | November 15, 2021 |

| Initiation of Refunds | November 16, 2021 |

| Credit of share to Demat Account | November 17, 2021 |

| IPO Listing date | November 18, 2021 |

Object of the Issue:

- Strengthening and expanding the Paytm ecosystem through acquisition and retention of customers and merchants.

- Increasing access to technology and financial services for its customers and merchants.

- Forming strategic alliances and investing in new business ventures and acquisitions.

- Meeting the organization’s general standards.

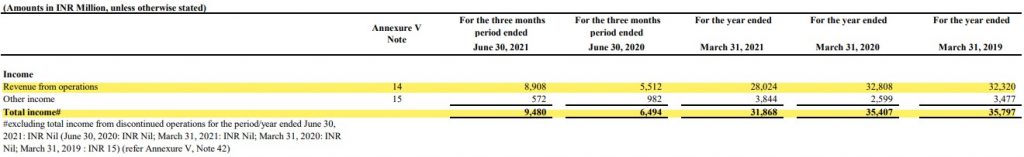

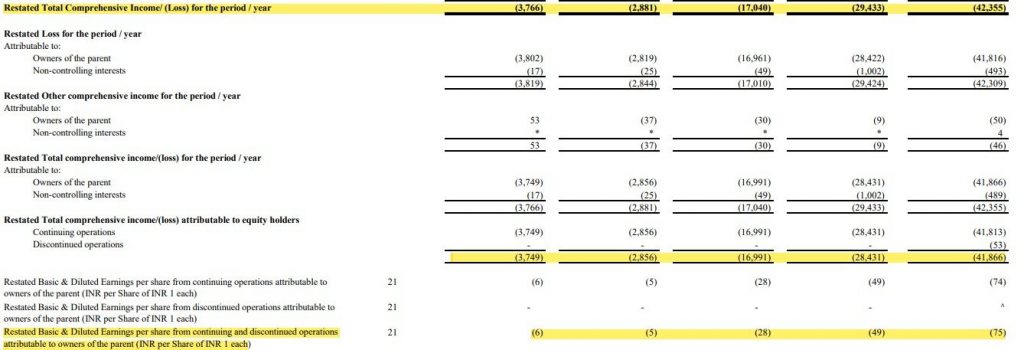

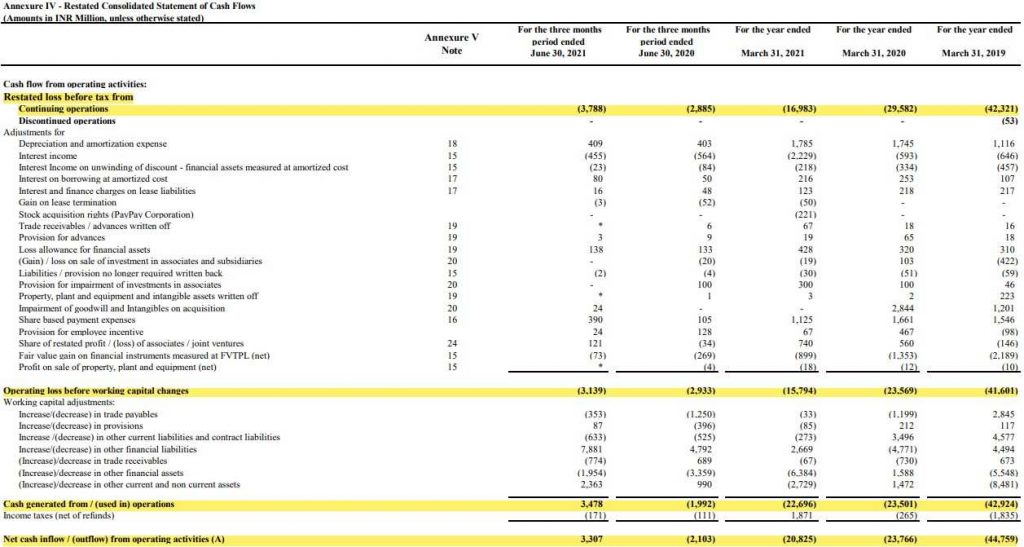

Financial Information:

In the first quarter of FY22, the company’s revenue from payments and financial services was at 689.4 crores, accounting for 77% of total revenue. In the quarter ended June 2021, the company lost 2.9 crores.

The corporation reported a Gross Merchandise Value of $53 billion (4 lakh crore) in the fiscal year 2021. Paytm’s operating revenue climbed by 62% in the first quarter of the fiscal year 2021-22.

The balance sheet has exploded in size during the last decade. However, the principal cause of the company’s losses is its ongoing efforts to acquire new clients and merchants. Having said that Paytm has been attempting to cut its losses.

| Particulars (In crores) | Jun-21 | FY21 | FY20 | FY19 |

|---|---|---|---|---|

| Total Assets | 9,459.00 | 9,151.30 | 10,301.10 | 8766.8 |

| Revenue from operations | 948 | 3,186.80 | 3,540.70 | 3,579.70 |

| Net profit | -381.9 | -1701 | -2942.4 | -4230.9 |

Company Opportunity & Strength:

- One of the largest and most trustworthy payment systems in India,

- Equipped with a strong technological bias.

- Each transaction sheds light on how Indians spend and conserve money.

- Management team with extensive experience.

- The financial services ecosystem as a whole

- Strong Brand Identity – “PayTm Karo!”

- Wide variety of customers and merchants base.

- The network effect results in decreased acquisition costs and increased revenue generation.

- Demand for fintech players such as Paytm is increasing.

- The rapid digitization of finance is expected to work in the company’s favor.

- India’s consumer payment market is mostly untapped.

- Internationalize your business.

Company Threats & Weakness:

- Competition from domestic and international technology businesses such as Google Pay, PhonePe, and MobiKwik.

- Concerns regarding the security of internet payments and financial activities are growing.

- Changes in the rules and compliance requirements governing digital payments and online financial services

Management Analysis:

Mr. Vijay Shekhar Sharma is the Founder of “PayTm” and is the Managing Director & Chief Executive Officer. He’s been with the company since its establishment and has been a strong pillar of support.

PayTm is also backed by world corporate giants like Mr. Warren Buffetts “Berkshire Hathaway”, Mr. Jack Mas “ANT Financials & Alibaba Limited” and others.

The company has a rich pool of knowledgeable personnel as Directors and other Key Managerial Personals.

Risk Factors:

- Widening losses and a track record for multiple years of loss.

- Economic downturn as a result of the pandemic and other unexpectedly unpredictable big market events.

- Fees paid to financial institutions and card networks for payment processing are being raised.

- There are several lawsuits pending against the corporation, its subsidiaries, and its directors.

- Inability to form strategic alliances or attract new customers and merchants

- Technological stagnation or inability to advance current technology.

- Dependence on third parties in some economic sectors.

- Reliance on mobile operating systems and app stores such as “Google Play Store”.

- Any infringement of privacy or data security, cyber-attacks, or internal infractions could affect the company’s goodwill drastically.

Industry Overview:

Technology plays a critical role in expanding merchants’ and consumers’ reach and accessibility. The mobile and cloud technological revolutions, together with rising incomes and consumption rates in India, have reached a digital tipping point.

India added almost 500 million additional smartphone users during the last decade. With increased affordability, lower smartphone costs (the typical smartphone costs less than the US $150), and a broader selection of value-added devices, smartphone users are predicted to reach 800-850 million in FY 2026, accounting for more than 55% of the total population and 80% of internet users.

In FY 2021, approximately 650-700 million Indians had internet access; this number is expected to increase to over 950-1,000 million by FY 2026, representing more than 70% of the total population. This increase is primarily due to increased smartphone penetration, lower data costs, new technology innovations, and the government’s digitization push. According to TRAI, data consumption per subscriber will increase to 141 GB in 2020 from 3 GB in 2014, but data costs will decrease from INR 269 per GB to INR 10.9 per GB in 2020.

And, PayTm is at the right spot at the right time to monetize this great digitization opportunity!

Conclusion:

Paytm reported sales of 2,802 crores and a loss of 1,701 crores in FY21. The revenue increase does not appear to be particularly impressive. The company reduced its losses mostly by reducing marketing and advertising expenses. Paytm is an ideal example of a well-diversified business that lacks clear leadership in practically every industry.

The IPO would consist of the issuance of new equity shares valued at Rs 8,300 crore and an Offer for Sale (OFS) by existing shareholders valued at Rs 10,000 crore. The Rs 18,300 crore offer will be the country’s largest since Coal India’s 2010 IPO, which raised Rs 15,200 crore.

At the upper band, the post-issue sales to market cap ratio are approximately 49x, making the issuance costly. Apart from valuations, I feel the ‘path to profitability for the company is more difficult for a few years ahead.

Paytm is India’s largest digital ecosystem for consumers and businesses. It is India’s largest payments platform, with a GMV of around Rs. 4 lakh crore in FY21. As of June 30, 2021, it serves 33.7 crore consumers and over 2.2 crore merchants through payment services, commerce and cloud services, and financial services.

Extremely competitive marketplaces with rapidly expanding technology, inability to attract merchants, and volumes can have a detrimental effect on business, and reliance on payment services for the majority of income is a significant risk and concern.

IPO Ratings:

| Particulars | Rating (Out of 10) |

|---|---|

| Business Prospects | 8 |

| Financial Information | 8 |

| SWOT | 8 |

| IPO Valuation | 7 |

| Overall | 7.75 |

How to apply for – IPO?

Steps to be followed to apply for “One 97 Communications Limited” via Zerodha console:

Step 1: Visit the Zerodha website and log in to Console.

Step 2: Go to Portfolio and click the IPOs link.

Step 3: Go to the “One 97 Communications Limited” row and click the ‘Bid’ button.

Step 4: Enter your UPI ID, Quantity (In lots), and Price.

Step 5: ‘Submit’ IPO application form.

Step 6: Visit the UPI App (net banking or BHIM) to approve the mandate.

Do not have a brokerage account? Apply for Upstox – India’s top brokerage service.

Disclaimer: All the information on this website is published in good faith and for general information purpose only.