Table of Contents

Business Introduction:

Sapphire Foods India is the largest franchisee of the YUM brand on the Indian subcontinent by revenue as of FY’20. Additionally, it is Sri Lanka’s largest international quick-service restaurant chain in terms of revenue for the fiscal year 2021 and restaurant count as of March 31, 2021.

The firm owned and operated 204 KFC restaurants in India and the Maldives as of March 31, 2021, 231 Pizza Hut stores in India, Sri Lanka, and the Maldives, and two Taco Bell restaurants in Sri Lanka. The overall number of restaurants operated by the corporation in the subcontinent region increased from 376 in 2019 to 437 in 2021.

The company operates its own supply chain and collaborates with vendors on food ingredients, packaging, warehousing, and logistics. The company runs warehouses in five cities throughout India and has invested in digital solutions for their restaurants.

The company leverages the YUM brand’s global online and digital channel solutions to improve the consumer experience, increase operational efficiency, and maintain financial management. The company runs restaurants in high-traffic, high-visibility locations throughout India’s major metropolitan areas and cities and plans to expand into additional cities as part of its expansion strategy.

About founders:

The company is promoted by QSR Management Trust and Sapphire Foods Mauritius Limited.

Group CEO & Whole Time Director – Mr.Sanjay Purohit. He has over 30 years of work experience across consumer product categories including food and apparel retail, packaged food, and paints.

Company Shareholders:

| Name | Percentage of Equity Holdings |

|---|---|

| Sapphire Foods Mauritius | 45.52% |

| WWD Ruby | 18.38% |

| Edelweiss Crossover Opportunities Fund | 6.69% |

| Amethyst | 6.53% |

| QSR Management Trust | 5.83% |

| AAJV Investment Trust | 0.13% |

IPO Details:

| Particulars | Information |

|---|---|

| IPO Issue opens on | November 9, 2021 |

| IPO Issue closes on | November 11, 2021 |

| Issue Type | Book Built Issue IPO |

| Face Value | Rs. 10 per equity share |

| IPO Price | Rs. 1,120 - 1,180 per equity share |

| Minimum Order Quantity | 1 lot = 12 Shares, Amounting Rs. 14,160 |

| Maximum Order Quantity | 14 lot = 168 Shares, Amounting Rs. 1,98,240 |

| Listing At | NSE and BSE |

| Issue Size | Amount aggregating up to Rs. 2,073.25 crore |

| Fresh Issue | - |

| Offer for Sale | Amount aggregating up to Rs. 2,073.25 crore |

| Allotment date | November 16, 2021 |

| Initiation of Refunds | November 17, 2021 |

| Credit of share to Demat Account | November 18, 2021 |

| IPO Listing date | November 22, 2021 |

Object of the Issue:

- Enhancing the company’s brand recognition among current and prospective consumers.

- Establishment of an open market for the company’s shares.

- Conduct a sale offer for the selling shareholders.

Financial Information:

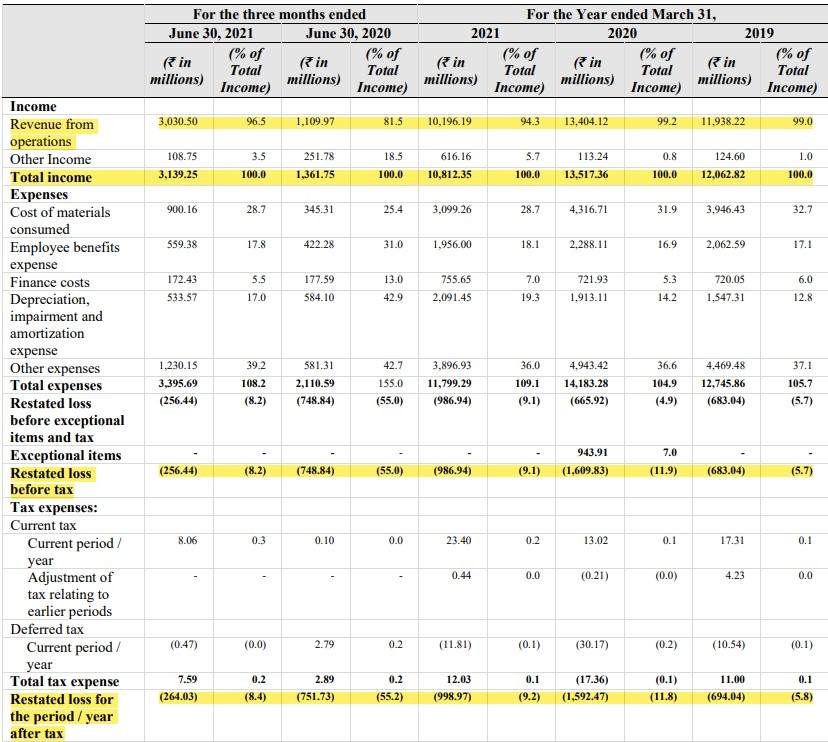

Revenue Statement:

Sapphire Foods cut their loss in FY21 to Rs 99.9 crore from Rs 159.25 crore the previous year. Due to the Covid-19 problem, revenue from operations decreased to Rs 1,019.62 crore in FY21 from Rs 1,340.41 crore in FY20.

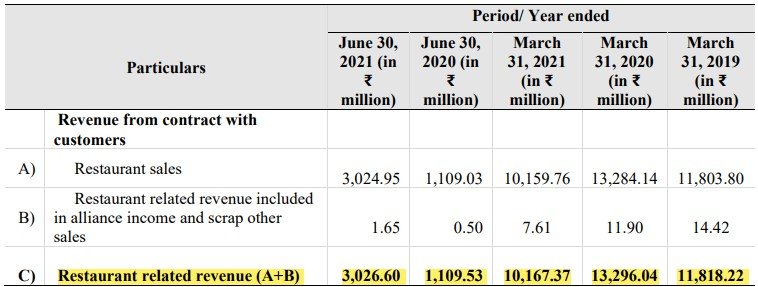

Restuarant sales report:

Yearly Financial progress report:

| Particulars (In crores) | Jun-21 | FY21 | FY20 | FY19 |

|---|---|---|---|---|

| Total Assets | 1,371.07 | 1,348.93 | 1,380.66 | 1567.47 |

| Revenue from operations | 313.92 | 1,081.23 | 1,351.73 | 1,206.28 |

| Net profit | -26.4 | -99.89 | -159.24 | -69.4 |

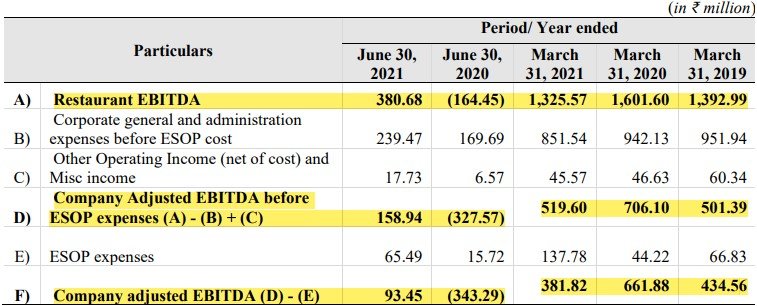

Restuarant EBITDA report:

Company Opportunity & Strength:

- The largest quick-service restaurant (QSR) chain in India, with a considerable market presence both online and offline.

- Significant investments have been made in operations, and a well-defined procedure has been established.

- Developed a scalable economic model for a new restaurant in preparation for growth.

- Having a healthy net worth and relying on capital borrowing sparingly.

- A strong management team with over two decades of food industry experience.

- Conversion from ad hoc food service to a branded one.

- Rapid expansion to seize growth opportunities.

- Using an omnichannel approach.

- Investigating acquisition prospects for a high-quality, scalable quick-service restaurant and food brand.

Company Threats & Weakness:

- Intense competition from domestic and international food chain titans, including Jubilant Food Works Ltd, Westlife Development Ltd, and Burger King India Ltd.

- Healthcare reforms and changes in local/national government regulations.

Management Analysis:

Sapphire Foods India Limited strives to be India’s top restaurant operator by providing superior food and service at an affordable price. The company runs various restaurants in high-traffic, high-visibility locations throughout India’s major urban areas and cities, and is constantly expanding its brand and food category.

The company is equipped with top-class management who are well experienced in the industry.

Risk Factors:

- The company has lost money in each of the last three fiscal years and may continue to lose money in the future.

- It is possible that it will incur extra debt in the future.

- National and international food and restaurant regulations/practices are always changing and evolving.

- The danger of exposure to chicken-related diseases such as bird flu can have a negative influence on the supply and consumption of chicken, resulting in losses.

Industry Overview:

In the fiscal year 2020, India’s domestic consumption proportion of GDP, as measured by private final consumption spending, was roughly 60%. In comparison, China’s domestic consumption contributed 36.8 percent of GDP in 2019. While the high proportion of private consumption to GDP insulates India from global economic volatility, it also implies that continuous economic growth directly translates into sustained consumer demand for domestically produced products and services. Between 2014 and 2019, India’s domestic consumption grew at a CAGR of 11.1 percent, compared to 4.3 percent and 8.2 percent in the United States and China, respectively.

Food services are a significant sector of the Indian economy, accounting for around the US $56.5 billion (approximately 4.24 trillion) in the fiscal year 2020, with approximately US $22.8 billion (approximately 1.7 trillion) from the organized market (chain and organized standalone outlets). Consumer trends in India are projected to continue to drive expansion in the food services sector.

A household spends over 38% of its out-of-home dining budget at quick-service restaurants (“QSRs”), followed by casual dining restaurants (“CDRs”) (31%), and cafés (3%). (14 percent). The significant percentage of QSRs in overall spending is attributed to their ease of access, competitive pricing, combinations, and promotions, which make them a favorite among young people and young office workers.

According to 2014 data given by the government of India, 72 percent of males and 71% of females aged 15 years and above were expected to be non-vegetarian.

As a result, the company’s market is enormous and rising.

Conclusion:

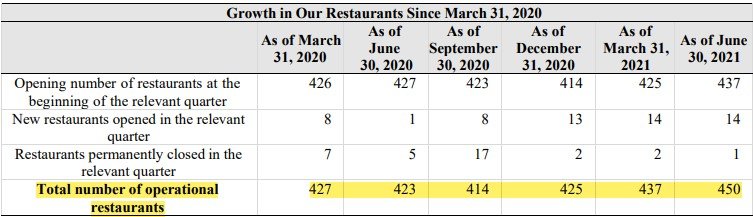

Sapphire Foods has ascended to the pinnacle of the food franchising industry. Sapphire Foods operates in Asia, with operations in India, Sri Lanka, and the Maldives. The total number of stores has increased from 376 in March 2020 to 450 in June 2021.

In the Indian subcontinent, Sapphire Foods is YUM’s largest franchise operator. The company began its relationship with Yum in 2015 and currently has the non-exclusive license to operate restaurants in the Territories under three of YUM’s top brands, notably KFC, Pizza Hut, and Taco Bell.

They owned and operated 209 KFC restaurants in India and the Maldives as of June 30, 2021, 239 Pizza Hut locations in India, Sri Lanka, and the Maldives, and two Taco Bell locations in Sri Lanka. As of June 30, 2021, the total number of restaurants is 450.

In comparison to Devyani International, Sapphire Foods India has a higher revenue per store. The corporation continues to improve its EBITDA margin. Taking into account all of the positive characteristics, we believe this valuation is appropriate.

IPO Ratings:

| Particulars | Rating (Out of 10) |

|---|---|

| Business Prospects | 9 |

| Financial Information | 8 |

| SWOT | 8 |

| IPO Valuation | 8 |

| Overall | 8.25 |

How to apply for – IPO?

Steps to be followed to apply for “Sapphire Foods India Limited” via Zerodha console:

Step 1: Visit the Zerodha website and log in to Console.

Step 2: Go to Portfolio and click the IPOs link.

Step 3: Go to the “Sapphire Foods India Limited” row and click the ‘Bid’ button.

Step 4: Enter your UPI ID, Quantity (In lots), and Price.

Step 5: ‘Submit’ IPO application form.

Step 6: Visit the UPI App (net banking or BHIM) to approve the mandate.

Do not have a brokerage account? Apply for Upstox – India’s top brokerage service.

Disclaimer: All the information on this website is published in good faith and for general information purpose only.