Table of Contents

What does Investing really mean?

Investing has always been known to reach our financial goals. It is to improve our lifestyle and to improve our standard of living to the ones we actually deserve. Investing isn’t any new term that came out to be in fame in recent times. We always have known various concepts of investing and people have made fortunes out of their investments.

But, can everyone become an investor? Is investing easy we have come across many manuals by the name ‘investing for dummies. Is it possible to be a professional investor without any qualification degree? We have known individuals making millions and billions worth of fortune by investing. But, is it really possible for each and every one of us?

World-renowned scientist Sir. Isaac Newton was one of the smartest people to ever live. And, here’s how history tells us about ‘the smart people being dumb’. Wherein, it is evident that making money in the stock market requires a different sense of smartness. Something that’s more psychological than intellectual.

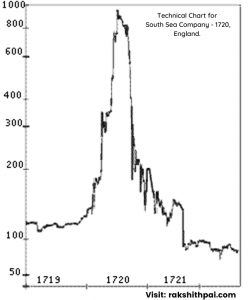

“Back in the spring of 1720, Sir Isaac Newton owned shares in the South Sea Company, the hottest stock in England. Sensing that the market was getting out of hand, the great physicist muttered that he ‘could calculate the motions of the heavenly bodies, but not the madness of the people.’

Newton dumped his South Sea shares, pocketing a 100% profit totaling £7,000. But just months later, swept up in the wild enthusiasm of the market, Newton jumped back in at a much higher price – and lost £20,000 (or more than 42 crore rupees in today’s money. For the rest of his life, he forbade anyone to speak the words ‘South Sea’ in his presence.”

Image source: Wikimedia Commons

When guys like Sir. Newton makes mistakes in investing. We are far from perfect. In fact, it’s fine for us to make mistakes. But, what matters is what it cost us. I believe that’s the biggest reason people don’t invest in the stock market.

So, how to avoid making mistakes? By the end of this article, you’ll get the answer.

People aren’t aware of the risk-return perspective and hence get burned out. Risk isn’t something to be feared of. In fact, it’s something to deal with, and the first thing to understand is that it is a part of investing. You cannot nullify the risk entirely. Risk is always present.

I believe. “Not investing is the biggest risk one ever takes”. You got to take some level of risk to succeed. It’s the uncalculated risk that’s harmful to your wealth. To eliminate unnecessary risk and take only calculated risk is called intelligent risk. The trick is to be aware of what you do. Learn, unlearn, relearn, and then earn.

You shouldn’t be worried about losing invested capital more than the purchasing power lost in your savings account. Inflation is like cancer eating our savings from the inside. Know how the system works and you’ll never see the banking & financial institution the same.

Anyways, we invest in various asset classes (such as equities, precious metals, real estate, etc) to reach the required financial freedom we desire for. It gives us a sense of security in this uncertain world. One that assists us to reach our financial goals. Especially when our savings don’t even remotely help us reach the milestone to achieve retirement.

Now, due to the COVID pandemic and the aftermath of the economic disaster (expected). The interest rates over savings deposits are around its all-time low at 2-2.5% and the inflation rate is hovering above 6%. Invest not to create wealth. It’s more like investing to preserve wealth.

I hope I’m persuading you well enough that investing is the only way. But, before you start your investing career, answer some questions, and know yourself in regards to what type of investor you really are.

What Kind of Investor Are You?

Investing is taking a calculated risk and a decent return that helps us reach financial freedom. And, in this process, an investor chooses to be a certain kind for it is in our very nature to lean towards one that satisfies our interest. Either by our risk appetite, time horizon, knowledge level, and interest to learn new concepts.

An investor brackets himself into either of the below-mentioned three (3) categories. The three major types of investors are;

1. Active Investor

As the word suggests, active investing demands an investor to be more active in his portfolio management. He/she must be a qualified financial analyst (or knowledgeable enough) to handle the market condition and invest accordingly. He/she is a professional investor, who must look into quantitative and qualitative aspects of the company, sector, economic conditions, and other aspects before investing.

If investing is really your passion. Then, this is where you are supposed to be. Active investing takes a good amount of your life into learning stuff. But, it’s all worth it.

2. Passive Investor

Passive investing is usually a subtle way of investing. Here the investor tends to spread out his/her portfolio into various mutual funds and index funds to avoid active participation whilst creating optimum wealth by letting professionals (Active-Investors) handle his/her portfolio for a marginal fee.

If investing is not your cup of tea. If you are not able to devote the required time to investing activities but are aware of the importance of investing on the way to wealth creation. Then, you are suggested to take professional help. Let the known individuals do what they do the best.

3. Active-Passive Investor

A combination of Active and Passive investing. Here, you’ll not only invest by yourselves but also take assistance from Mutual Fund, ETFs, and other passive investing asset vehicles for wealth creation. This mode of investing is taking real interest amongst the Millennials and the next generations.

A safe mode of investing wherein, we’ll get to learn throughout the way in the process. And, with relatively minimal risk for a segment of your portfolio is being handled by professionals via Mutual funds, various ETFs, etc.

So, before moving further, first decide what kind of investor you really are. Decide what amount of work you are ready to put in. Because investing by yourself takes a major chunk of your time. It demands an investor to be flexible in learning new concepts and be active enough to adapt to the constantly changing business environment.

Do you have what it takes to be an investor?

As mentioned above, Being a passive investor is to let professionals manage our funds. But, to become a professional investors ourselves. We need to possess certain skills and basic behavioral tactics that are essential.

Investing has always been termed risky for it requires an individual to be more mature than they usually portray. When we say mature, it is to be mature as in being more rational in decision making. One’s decision over emotions has no stand in the market. The stock market is a pure valuation game (In the long term) and an emotional holocaust (In the short term).

First, find out whether you really are an investor or not. This is most crucial for it defines whether you will succeed in the future as an investor. Now, to decide whether you are actually an investor. Here’s a checklist that’s a must to be a successful Investor.

Emotional discipline

To be a mature investor is all about controlling or not letting our emotions take control of our decisions. It is to avoid being emotional and to make rational decisions.

Example: During the 2008 crash, we had a market sell-off from its peak, and then the NIFTY dropped from 6000 points in 2008 to below 2500 points by 2009. And, a more recent example of the Feb-March 2020 crash was mainly based due to Covid-19 where people panicked and the market started dropping over 10% in a single day resulting in the stoppage of trading sessions.

But, now you see after 6-9 months, the market is as if nothing had ever happened.

Today (1st week of December 2020) the market is at its all-time high. Had we known this outcome, none would have sold back in March. Those with emotional discipline made money. In all this situation, the market corrects and worse crashes. But, those that stay invested in healthy companies become wealthy.

Be a ‘TMN’

A ‘Touch Me Not’ (TMN) plant doesn’t let itself touch, and when actually touched by a foreign body, it retrieves itself. Here, an investor should retrieve himself for those sectors that are not his/her cup of tea. He/she should avoid reaching out to every other business there is and rather stick to those business aspects that he/she is comfortable with.

Having a perspective is very important. We take or tend to take professional advice for every aspect of our life (Dental, Contractor, etc). But, when it comes to investing, “The Greed” kicks in, and instead of being conservative over the ill source of advice. We jump in and invest our entire savings. If an investor has a perspective. He/she will start questioning. Thus, the chances of not going all-in on an unknown company can be reduced.

Avoid tips and calls

Investors all over the world have fallen for this scam where individuals’ tips or stock calls are being taken seriously and ultimately the investor loses his money. This has been done over and over again for it is in basic human nature to fall for such recommendations especially when they offer or seem to offer benefit. Here an individual’s “greed” takes over.

Not being an emotionally disciplined investor is costly.

Example: If you are an investor or a trader, try telling that to your family and friends and be sure to face two situations.

- All your people will start asking you for stock tips and suggestions. Trust me! In most cases, they’ll blindly follow your suggestions for it doesn’t matter what kind of track record you have as an investor if at all you have any.

- In the second case, your friends and family will suggest you invest in such stocks that they themselves have no idea of but have heard from another individual.

In both cases, the investor who follows tips and calls from another individual is destined to fail. Even if you mirror out exactly Mr.RJ’s (Rakesh Jhunjhunwala) portfolio. You’ll still lose out. For it’s nearly impossible to make money by taking or following tips and suggestions. Mr.RJ’s investment allocation (Allocation of capital into one stock), his time period, his commitment and his strategy might be completely different than an individual who’s trying to mimic.

Thus, it’s nearly impossible to know what professional investors such as Mr.RJ do. And, when we know where they have invested. We do not know much of the other details mentioned above. Example: When Mr.RJ bought “Yes Bank”, people were intrigued and some of them even bought the shares. Without knowing much about the investment. Wherein, Mr.RJ’s allocation into “Yes Bank” is not even 1% of his entire portfolio.

Read, read, and read!

Yeah, reading is important. Our knowledge is limited to the place we live in, society, and the environment. They decide what we know and to what extent. To avoid and overcome this barrier, one needs to read books and articles. Especially those that give us tips and suggestions on how and how not to invest/trade. An author writing such books will explain those mistakes that he/she had made in the past. That’s a great way of learning.

Have a Strategy

As I would like to say, Read and then write them down and then think over it. People usually do one or two of the steps but they don’t think or analyze what they have just read. ‘Thinking is highly underestimated. And, the blame goes to the society we have created. We are not encouraged to think. Look at our schooling system (hopeful that the new education policy brings the required changes).

The best gift you as a parent, partner, friend, colleague and such other personnel can give to another individual is to ask them and insist upon ‘Free thinking. Having an open-minded argument is crucial for a sane society to sustain. Encourage people to have an opinion and if there is such disagreement. Remember, this quote from Mr.Ray Dalio.

When someone asks me how I build my investing/trading strategy. This is what I got. “Read – Write – Think” and then, talk to people about how they arrived at the decision of investing in one particular company. Learn different perspectives.

Invest for Growth

Yes, you read it right. We should invest for capital appreciation and that alone. Now, How does capital appreciate? To answer this you should know what equity stands for.

Equity is nothing but a piece of business. It’s a part of the business owner of a company we invest in. If a company does good, makes a proper return over its investment by optimum sales, increasing profit margin, reducing cost, and other aspects. The capital appreciates. If not, the capital depreciates. It’s as simple as that.

Invest for growth is specifically noted in ‘Equities’ because, year over year, equities have the capability to grow. Unlike Bonds, where we get interest from our investment but the capital does not grow a bit. Bonds are mainly to earn interest, while stocks are to earn wealth. Cause, stocks stand for growth.

To be a successful long-term investor, it’s crucial to be invested for growth. As an investor, your first goal is to safeguard your capital. And then, to make ROI (return on investment) comfortably over the inflation rate. This is achievable only through equities.

Example: Suppose your ROI (post-tax and other expenses) is 11%. If inflation is at 4% (at average) then, your real ROI stands at 7% (11%-4%). And, Stocks is the only asset that can make it happen.

In fact, over the years there has been no other asset class that has performed as well as equities. Long-term equity investment literally beats every other asset class out there. Since its inception in November 1996, the NIFTY Next 50 index has delivered an annualized return of 17.2% as compared to 12.2% of NIFTY 50. Over the same period, SENSEX has delivered a CAGR of 8.9% per annum.

How to approach Investing in the Stock Market?

Cookie jar

The term ‘cookie jar’ is a reference used for ‘savings’. You cannot become wealthy without changing your spending habits. Sayings as a habit are highly underrated. People appreciate those individuals who spend well and live lavish life. Remember Mr.Vijay Mallya? (The King of Good Times). Please note that a country’s economy is built by those individuals who work hard, save well, and invest wisely.

Know yourself

The above checklist pretty much explains this aspect in detail. We just need you to know what type of investor you really are. To know oneself is to know one’s strengths and weaknesses. That’s how we become mature beings.

Goal

Note down your goal. The main reason why you are investing. The reason you are taking extra effort to overcome your current financial situation. This way, you’ll be specific with your target. This motivates you to reach your goal sooner & safer.

Why ‘safe?’ Cause, Investing puts an impact on your health & wealth. You need to bear the risk of losing your capital from time to time. So, being sane throughout the process is very important.

Participate in Long-Term

It’s understandable if you are at an opinion of short-term investing or trading. But, there is no substitute for long-term investing. Especially in the stock market (equities). We need not talk much about ‘the power of compounding’ for Mr.Warren Buffett has shown it to us practically.

The simple fact is that over time, stocks have outperformed all other kinds of investments. Which makes an excellent case for investing in stocks. Growth is the reason stocks have proved to be such solid investments over time.

Don’t try to time

No one individual or institution is certain of where the market is heading. We cannot predict the future and that’s the truth. Instead of waiting for the opportunity, start investing as soon as possible. As soon as you can, it doesn’t matter what amount of savings you got. Just start!

You can’t learn to swim by staring at the water. You need to get into the water. The method you choose to get in determines the end result. Take step by step to learn, for our end goal is to earn.

Diversify

Diversification is key! In fact, ‘Asset allocation is more important than any other steps you ever take as an investor. Diversification has two parts;

1. Diversify amongst different asset classes. Asset classes such as a mix of stocks, bonds, real estate, billions (gold & silver), and cash equivalents in your portfolio.

2. Diversify amongst different sectors. Diversifying within an asset class such as equity wherein you can select various non-correlating sectors (Sectors that don’t have an impact over each other at times of trouble) to balance your portfolio such that it includes a variety of stocks, a mix between large caps, small caps, and amongst several industries and with domestic and international presence diversification.

With understanding the above-mentioned steps, I now hope that you are mentally ready to be an investor. Let me correct myself, you are ready to be a “Long-Term” Investor.

Now that you have decided to invest. You have two options. Whether to go in by yourself or take professional help. If you choose the latter option then we got pretty good fund managers to assist you. Just save well (cut down your unnecessary expenditures) and then invest as in the Systematic Investment Plan (SIP). Over the years, down the line. You’ll have enough corpus funds for your retirement.

If you are planning to invest by yourself. Then, congratulations! You have taken one of the biggest decisions in your life and we’ll help you on the way to becoming a professional investor. (Stick with us for more information).

How much money do you need to start an investment?

Cash Deposits are like bonds. They pay interest, but they don’t really grow. When you put money in a savings account or a money market instrument, you aren’t buying anything. You are simply loaning your savings to banks and financial institutions for them to loan. You’ll get interested over your investment and this is the safest form of investing but, your capital doesn’t grow.

We live in such economic conditions with over 4-6% in inflations looming around. An interest income of 3-4% is simply disastrous to your wealth. Especially, in the long term. Your purchasing power is going to diminish over time and thus leading to underperformance.

At 3% inflation per annum, Inflation eats up more than a quarter of your savings purchasing power within 10 years. And in 24 years, your money purchasing power is at its half worth. Now, with covid, inflation is over 5% (on average). This will eat up your savings worth by half worth in just 14 years.

So, be aware of how inflation impacts your net worth. Invest wisely. Now, that’s aside. How much money do you actually need to start investing? Well, there’s no such limit. You can start with any amount of sayings. Just see that you got enough savings in the ‘Emergency Fund’.

Emergency Fund is something that you have as a mode of savings that’s available for disposal at times of need. The corpus of such funds should be sufficient enough to meet your 6 months expenses or such immediate emergence (whichever is early).

How can I start investing with little money?

You might have heard or read stories about Mr.RJ starting his investment career at Rs.5,000 (a little under Rs.64,000 in today’s money, inflation-adjusted). He is now worth over 19,000 crore rupees. Let that sink in.

No, I’m not saying we all can do the same. All I’m implying here is that it is possible to make it big. You just need to have consistency, patience, and the right investment. Even, Mr.RJ had invested a lot of money after his initial investment (Btw, Mr.RJ was one of the best traders we have ever seen). So, investing is a process. Throughout the way, We learn we unlearn, and finally, we earn.

So basically, it doesn’t matter what capital you begin with. Start investing, see how it turns out to be. Who knows, you might turn out to be the next big bull of the Indian Stock Market.

How to Invest in the Indian Stock Market?

Now that you have reached the end of this article. Let me tell you how to open a Demat account and start investing for it is easier now than ever before. Just a couple of procedures and you are all set to begin your journey as an investor.

Start Investing right now by opening your Demat account from India’s largest brokerage service provider. You just need to follow the below-mentioned procedure to open your Demat account.

- Choose a brokerage service provider – Nowadays, banks and other financial institutions provide services. But, opening an account from Zerodha, Upstox is much preferable for their service charges are much more reasonable.

- Basic documents – Documents such as PAN are mandatory. Have a Bank account, Personal Mail Id, Personal phone number, and other requirements ready with you before applying for a Demat account.

- KYC procedure – Fulfill all the KYC requirements. It is relatively easier to apply for a Demat account than a Bank account. And, if you get stuck at any particular step. Worry not for the brokerage service providers to value their customers and will assist you throughout the process.

- Process verification – Once you provide the required details. The process verification wherein, your application will be approved by the service provider. This might take anywhere from 3 days to a week.

- Final check – The brokerage service providers will not want to bother you. Hence, they’ll take care of the entire process post-sending the required documents. The final check is done by the service providers for a smooth transition of your application.

- Demat Id & password – Once approved, a mail will be sent to your registered mail Id (the one you provide to the brokerage house). You’ll receive your account id and a temporary password. Change the password (Having a strong password is suggested) and you are all set.

We have already chosen the best brokerage service provider for you. It is India’s top brokerage service provider. Click on the link provided below and open your Demat account. Start your investment journey now!

We wish you great success!

For More Information, Check this Video:

Disclaimer: All the information on this website is published in good faith and for general information purposes only.

Hi Rakshith,

Thank you soo much for writing in detail about investing. I was planning to start investing from 2021.

With this article. I can plan well and invest wise.

Keep posting such informative articles.

Thank you 💖

Hi Nikita,

Thank you for reading 🙂

Yes, investing is important. Start your investment journey as soon as possible. Any doubt, do consider contacting us. You can also write to us, Mail id: aug.mrpai@outlook.com

You can also reach us out via social media, link provided in the header & footer of this website.

Hi Pai,

How frequently you update your site?

Please write more often man…

Hi Sai,

Sure buddy. We’ll try our best.

Thanks for writing.