Table of Contents

Introduction:

We all like the idea of earning a regular income while holding stock, which, in the meantime, also rises in value. We like the passive income generated from dividend stocks. A sense of security it provides

Yup, I’m talking about dividend investing.

Dividend investing, just like any other investment strategy, has its own approach. When choosing a company, there are some things we can’t give up on, and this is very important in the case of dividend investing.

15 Highest Dividend Paying Stocks in India 2023

What is Dividend Investing?

Purchasing dividend-paying stocks are one strategy for generating passive income from your portfolio over time. This money is in addition to anything you make as a result of your portfolio increases in value due to stock market gains or other investments.

Shareholders receive dividends when a company pays out a portion of its profits. Owning dividend-paying stocks entitles you to a portion of the company’s earnings. In addition to the appreciation in your portfolio’s value, you may also receive a steady source of income.

Let’s say you find a stock that offers a 3% dividend. If you own one share of the corporation, it is worth Rs. 1,000. In such a situation, the dividend payment to you would be Rs. 30 per share.

As the word suggests, investing for the sake of earning dividend income is called “dividend investing. But that’s not it. A dividend is just a passive income, a side source of income. It is a pickle in the dish and never the main course. What divided signifies is that the company paying steady dividends is;

1. Consistent & Growing Revenue

2. Profitable Business

3. Cash Rich business and

4. Most importantly, the business has enough money to spare such that they give it out to its shareholders as a gesture of gratitude for being with them throughout the period they hold onto the shares of the company.

Factors to Consider Before Investing in Dividend-Paying Stocks:

I’ve listed out three such factors that you must check for sure before investing in any company for the sake of a dividend;

Cash Position

Guys, listen to this and listen very carefully. There are a number of ways in which the management can deceive you by paying out a hefty dividend and trapping you into holding onto the shares at a loss.

Don’t ever invest in a company without knowing its cash position. Every company must and should have a healthy cash position. Just go through the company’s balance sheet to find out more.

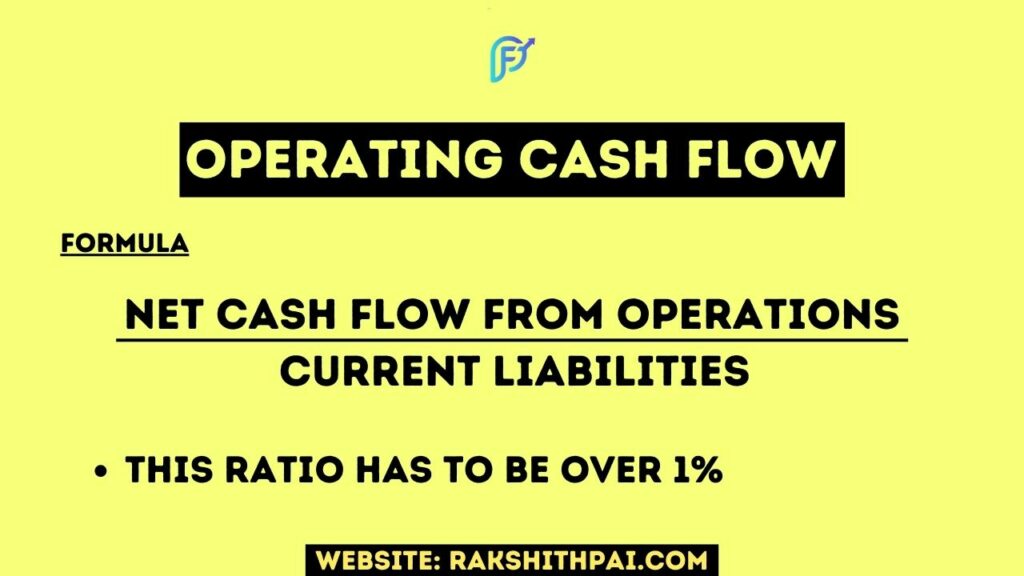

For instance, if you calculate the operating cash flow of a business, you’ll know the amount of money made by its core business activities. The operating cash flow ratio is nothing but net cash flow from operations divided by the company’s current liabilities. This ratio has to be over 1.

You tell me if the company is unable to fund its current liabilities, such as short-term debt charges, how can you expect them to pay you a dividend?

Business Type

We are aware that each industry has its own demands for cash. Some are very high, some moderate, and some low. For example, capital-intensive businesses like textiles, transportation, and logistics. They burn cash like a steam engine does to coal.

And then there are businesses, such as IT, Finance & Insurance, etc., who require cash for their day-to-day operations but are always left with ample cash in the bank. So much so that they go out and invest their money. These are the sectors you must look out for.

A tip I would give is that if the company’s product or service is well known among the general public, it has a monopolistic market share and is selling its products and services at a beautiful double-digit margin. You can expect a fat dividend. Maybe not a fat one, but a consistent one.

Metrics

Before buying dividend-paying stocks, we must evaluate them, right? So, in order to evaluate, you must use the following metrics:

Dividend Yield

Dividend yield falls in tandem with a stock’s price, which may seem counterintuitive. This means, if the precise per shale falls, the dividend yield on it rises. The dividend yield of a company shows how much money can be made by investing in its stock.

It’s a common misconception among inexperienced investors that a higher stock price automatically means a greater dividend yield. For a better understanding of this counterintuitive connection, let’s look at the formula for dividend yield.

If you buy a stock worth Rs.100 and the company pays a dividend of Rs.10 per share, then your dividend yield is 10%. To Calculate, simply Divide the annual dividend earnings by its CMP

10 Best Dividend Yielding Mutual Funds:

Dividend Payout

If a company earns Rs. 100 crores in net income, and pays out 30 crores to its shareholders as a dividend. Then the dividend payout is 30%. We don’t want our company to pay for everything they earn. right? So, with this, we’ll know what amount is kept as reserves and what’s distributed.

Earnings Growth

If earnings are not growing, then your dividend will also stop growing, or in the worst case, it may stop altogether. Two ratios can help you here:

Price to Earnings Growth Rate

The PEG ratio is a way to figure out how much a stock is worth by comparing its price to its earnings per share and the growth prospects of the business it represents. You know the PE ratio, right? For PEG, you must divide the PE ratio by the earnings per share growth rate.

Dividend Payout Growth

The second one we have to check is “Dividend payout growth”. It is the percentage of stock dividends over a period. To calculate the dividend payout growth rate, divide the current dividend per share by the previous year’s dividend — 1 x 100

Should You invest only for dividends?

There are five main reasons why the dividend narrative is not a favorite with institutional and small investors. Let’s examine the issues that make dividend investing a risky option.

- Stocks with a high dividend yield often have a low potential for future growth, so the market is more likely to assign a higher P/E ratio to companies with a promising future. Therefore, the P/E ratio of firms with a dividend yield is rarely adjusted.

- Generally speaking, investors will shy away from a stock with a high dividend yield if they believe the firm offers few attractive investment options. This bad growth forecast puts a damper on the company’s value, which in turn affects how equity investors feel about the company.

- Both internationally and in India, high dividend-yielding companies are concentrated in low-growth industries like utilities and commodities trading. Commonly, the sole reason investors put money into these industries is to collect dividends on a consistent basis.

- Investors typically view dividends as a form of “partial liquidation” of a company. Usually, businesses may pick between two options. They can either increase dividend payouts or reinvest the money in the company to build up reserves. When a firm distributes dividends, it dilutes its ownership stake and hence its value.

- Generally speaking, dividends are subject to three different types of taxes. The first issue is that dividends are paid out of after-tax funds and are not exempt from taxation. Second, the dividend payout is reduced because of the dividend distribution tax (DDT) that is levied on the corporation when dividends are declared. Last but not least, the fact that profits over Rs 1 lakh are taxed at 10% makes it less appealing.

The takeaway from this is that high dividend equities are not favored by the market since they are typically slow-growing companies in oversaturated areas. That is not how you make money in stocks.

Dividend Reinvestment Plan: Everything You Need to Know

Top 10 Worth Investing Companies:

These are not just good dividend payers but are also consistent compounders. Yes, they are well-established, financially sound companies.

| Sl.No | Company Name | Dividend Yield (In %) | ROCE (5 Yrs) | ROE (5 Yrs) | P/E | EV / EBITDA | PB X PE | PEG | Debt / Eq | ROCE | ROE | ROIC | ROA | EPS | Market Cap |

| 1 | Heidelberg Cement | 4.84 | 23.02 | 18.84 | 17.97 | 9.04 | 47.98 | 0.66 | 0.13 | 20.82 | 16.46 | 14.35 | 8.88 | 10.38 | 4228.63 |

| 2 | ICICI Securities | 4.76 | 36.68 | 63.23 | 12.17 | 8.44 | 81.42 | 0.37 | 3.23 | 27.03 | 65 | 47.32 | 12.66 | 41.7 | 16340.28 |

| 3 | VST Industries | 4.43 | 50.08 | 35.5 | 14.57 | 10.16 | 66.29 | 0.9 | 0 | 42.44 | 31.74 | 420.55 | 20.78 | 218.19 | 4905.07 |

| 4 | HCL Technologies | 3.48 | 27.45 | 22.82 | 18.51 | 11.27 | 74.23 | 1.98 | 0.1 | 25.4 | 22.01 | 23.25 | 15.35 | 50.03 | 250484.86 |

| 5 | ITC Ltd | 3.44 | 32.67 | 23.15 | 25.26 | 17.02 | 167.22 | 3.04 | 0 | 33.64 | 24.76 | 45.49 | 20.48 | 13.27 | 412954.64 |

| 6 | Hawkins Cookers | 2.58 | 57.02 | 48.17 | 34.08 | 22.78 | 489.73 | 2.82 | 0.2 | 50.43 | 42.93 | 35.43 | 20.93 | 169.88 | 3060.28 |

| 7 | Infosys | 2.2 | 33.59 | 25.84 | 26.39 | 16.94 | 209.8 | 2.88 | 0.08 | 37.09 | 28.98 | 41.36 | 19.64 | 52.96 | 588527.81 |

| 8 | Marico | 1.72 | 42.3 | 36.12 | 56.09 | 38.28 | 1140.31 | 5.64 | 0.14 | 42.73 | 36.64 | 44.97 | 22.61 | 9.6 | 69611.94 |

| 9 | Britannia Industries | 1.49 | 42.82 | 38.01 | 63.55 | 40.32 | 2315.76 | 5.58 | 0.97 | 41.51 | 49.66 | 92.33 | 19.54 | 61.14 | 93083.53 |

| 10 | Supreme Industries | 1.13 | 33.07 | 26.42 | 26.56 | 17.3 | 186.19 | 1.51 | 0.01 | 34.62 | 27.43 | 29.67 | 20.73 | 79.68 | 26896.7 |

Do your research before owning the mentioned stocks. And, now let’s see what ET Money Genius is all about.

Conclusion:

Good dividend investors often choose either a high dividend yield or a high dividend growth rate plan. Both have important functions within a portfolio.

Companies with limited growth rates and high cash flow are prioritized using the high dividend yield strategy. This enables them to pay out substantial dividends, and it might give you a source of money right away.

You may use this dividend growth rate to your advantage by investing in firms that pay out small dividends but have strong prospects for future development. Over a five-or ten-year time horizon, you stand to gain a substantial sum of money by purchasing profitable companies at a discount.

There may be a variety of investors who favor one method over the other. A key thing to think about is whether you want short-term income stability or long-term growth and profit.

Decide what kind of risk you’re willing to take before committing to a certain strategy. Consider how long you are prepared to wait until you start seeing a dividend yield that satisfies your needs.

For More Information, Check this Video:

Disclaimer: All the information on this website is published in good faith and for general information purposes only.