Table of Contents

What is a Portfolio?

A portfolio is a collection of financial instruments such as stocks, ETF’s, Mutual Funds, and other assets that are strategically put together to beat the overall market average return and to have a rate of return (ROI) that’s comfortably over the average inflation rate.

A portfolio may include a wide range of assets that are or should be inversely correlated to one another in terms of past performance and future estimations. This way, an investor can make a profit tough a part segment of his/her investment is running on loss.

Hence, it is suggested to have a well-diversified portfolio. In terms of diversification, Inter-head diversification is as important as asset-based diversification.

Example: We have Equity being an asset class. Diversifying amongst various stocks (industry-based diversifying such as HDFC Life for Insurance, HUL for FMCG, Kotak-Mahindra for NBFC, etc.) is as important as asset-based diversification wherein, we invest in stocks, ETF’s, Mutual Funds, Gold & Silver, and Real Estate Investments.

Three (3) important metrics:

Before constructing a portfolio, answer these three important question;

1. What is your risk-return comfortability?

To what extent are you ready to take risks? And, are you sure that you are not investing heavily into risky assets, for when the music stops you’ll be holding a full bag of dump weighing on you! (To know more about various asset classes and their risk profile. Click Here!) Check the table.

2. What extent of Risk assets can you hold?

There is no dispute when we say “Equity is the best asset class to invest”. But, with better return comes higher risk. There’s one way the risk an individual investor can or should take can be estimated. I.e based on his/her age. The trick is to know one’s age and that’ll be the extent of non-equity investments one should hold. The rest to be invested in Equities.

Example: Suppose you are 25 years old. Now, 25% of your entire portfolio should be in assets such as Gold & Silver, Bonds, Money market Instruments, FD’s, RD’s and other non-equity based investments. Wherein, your rest 75% of the portfolio should be invested in Equities directly or indirectly (Indirectly being investing via Mutual funds, ETF’s, Index funds, etc). This way an individual over his/her 60’s should invest over 60% of their portfolio into non-equity based assets.

3. What is your maturity period?

Here, we answer the most important question. Why are you investing? Each of us has a goal that is to be achieved. And thus, we chose various assets to help us reach this goal. Thus, one should know what asset he/she is investing in and to what extent they are in it.

Example: To be a successful investor is to hold equities in well-established companies for a minimum of 15-20 years. if you are someone who does not wish to invest in any asset for 15-20 years and wants regular steady income. Then, bonds are your immediate option.

Investing and Retirement Planning Tips:

1. Financial Advisor:

We should always take professional help when it comes to such topics where we are not well informed. The same principle applies here. Invest only after consulting your professional financial advisor. Or, at least invest in such assets that are managed by professional investors. Assets such as Mutual Fund Investing, Index & ETF Investing for a continuous period (non-stop SIP) of 15-20 years qualifies.

2. Individual Retirement Accounts:

Make use of your retirement benefit accounts provided either by your employer or the government. Retirements accounts such as,

- Employees Provident Fund (EPF)

- Senior Citizens’ Saving Scheme (SCSS)

- Post Office Monthly Income Scheme (POMIS)

- Government of India Savings (Taxable) Bonds

- Fixed Deposits and such other savings.

3. Have knowledge of Inflation and Tax rates:

We all know or have a minimum idea about what our tax slab rates are (For more information, contact your Chartered accountant). But, how many of us know what the inflation rates are and how it affects our wealth over time? (To know more about the importance of Equity investing and how the same beats Inflation rates over time. Click here!)

Yes, Inflation, over time, eats away your dreams. They are the worst form of tax. A tax that’s not known to many. One that doesn’t do any partiality in regards to whom it affects. You are poor, rich, influential, or not. It doesn’t matter for inflation tax is known to affect each and every one of us. Start your retirement plan considering ‘inflation tax’ in mind!

Have a retirement plan!

Indian retirement age as per the government data (on average) is at 60 years. So, basically, an individual has to work until he/she is 60 years of age to take retirement (year changes based on the amendments and area of work). Now, Indians Life expectancy is at 69 years. Does it mean that we should toil our entire life just to have a mere 9 years of retirement?

Also, note that the life expectancy is increasing thanks to modern medicine and the health care system. But, with increased life expectancy comes additional years to service your retirement funds!

Example: Suppose Mr.X has worked for the past 35 years and has built sufficient corpus to meet his retirement expenses. This 60-year-old individual has 12 lakh in savings and earns a 7% return each year (not considering tax implications and other aspects). This 84,000 Rs (12 lakh * 7%) is sufficient to meet Mr.X’s entire year expenses based on the current standard of living.

Over time, Thanks to inflation, our cost of living increases thus a compulsory diminution in the standard of living. Here, Mr.X’s current income is sufficient to meet his standard of living. But, as inflation increases (for it surely will). His income of Rs.84,000 will not be sufficient. Hence, instead of working till 60 and taking retirement till the end of his time. He has to work till 65, 70, and over to maintain his current living standard to meet his basic needs.

All your retirement planning goes in vain if you are not considering the increased cost of living due to inflation. The increased cost of housing, increasing medical cost, and increasing cost of consumption (such as grains, veggies, fruits, etc) has to be kept in mind while planning for retirement.

The best way to handle this situation is to start investing early. Be consistent and diversify!

How to have a Diversified Portfolio?

All this is fine. We know we need to plan accordingly and invest wisely to meet our retirement goals. But, how and where to invest? How to strategically allocate our portfolio?

To answer these questions. I would recommend you to read this article. Know what are all the asset classes available for Indian Investors. For more information, click here!

Portfolio Strategy One-2-Seven (1-2-7)

The portfolio shall be bifurcated into three parts.

1. First 10% – To provide safety savings.

The first 10% of your portfolio should be invested in Gold & Silver. Here, we should prefer Gold and Silver metal as in actual metals over any other pieces of equipment. This 10% in Gold & Silver not only provides you an opportunity to invest in such an asset that is intrinsically termed inflation hedge. But, it will also provide a vehicle to park your savings.

This 10% of your investment is to have a diversified portfolio that is partly inversely correlated to Equity investment. For more information about Gold Investing, click here!

The trick is to buy Gold & Silver in smaller quantities as and when there is a drop in price. By doing this over and again and not selling at immediate intervals. An investor can build a sufficient safe investment corpus to meet his/her future expenses.

2. Next 20% – To Trade with the trend.

The next 20% of your portfolio should be invested in Mutual Funds and Index funds (preferably a well know ETF’s). In order to beat the market average in terms of return on investment. We need to invest alongside the market. This is achievable when we invest in such ETF that shadows the Nifty 50, Sensex, and other indices to the extent possible.

Here, the trick is to stay invested. Mutual Funds, Index funds, and/or ETF investing is meant to be invested, to stay invested for a prolonged period of time. The minimum period span is 15 years and more.

So, the best way to approach this 20% of investment is to do SIP, (Systematic Investment Plan) every month no matter where the market is heading. Keep investing, keep accumulating. Here, discipline matters more than any other quality you possess as an investor.

3. Last 70% – To Invest for Growth and return.

The final 70% of your portfolio should be in Equities. I believe India will be a 10 trillion economy by 2030, this great fleet is achievable, and when it does. Market (SENSEX) could reach 5,00,000 points.

Extremely bullish on India and our growth story and hence, I usually suggest each and every individual to invest in the Indian Stock Market. Obviously, Investing in the Stock market comes at a risk. Hence, this 70% is further segregated and the following points are to be strictly followed.

i) Your Investment in Equities should not exceed 70% of the entire portfolio.

ii) Out of 70%, one half (35%) (Part A) of the portfolio should be concentrated on those well-established companies that rule their respective market segment. This way, retail investors are safeguarding their capital by investing in those already successful companies that are stable and have a proper market base as a moat.

iii) The first half portion (35%) (Part A) of the portfolio as said above should be invested in not more than 7 individual stocks. This way, each stock will get not more than 5% of the concentration in the entire portfolio.

iv) And, the rest half (half of 70%) I.e 35% (Part B) of the portfolio in another set of 7 stocks. Here, the investor is taking chances with his/her investment strategy. He/she can and should invest in those companies he/she feels worthy of investment. Again, since the limit is 7 stocks and the portfolio allocation is 35%. Each stock would get a maximum of 5% allocation.

v) The reason for the 5% strict limit is to encourage investors to diversify whilst keeping in mind for over-diversification. With this strategy, an investor will hold to the maximum of 14 individual stocks (70% of the portfolio at 5% each) in his/her portfolio. One which can be comfortably tracked by any investor (retail – Individual) with ease.

vi) While the 10% in Bullion (Gold & Silver) and 20% in Index, ETF and Mutual Funds Investing provide for safety in investing. The Part A of 70% (35% of the portfolio) provides for growth based investing (moderately risky, growth fund) and Part B of 70% (next 35% of the portfolio) provides for value hunting (high risk, high return).

vii) A balance is a must in every portfolio. This kind of hedge an investor takes can assist his/her portfolio to not only provide good returns in a positive market (bull run). The same could handle well in a negative market (bear drop) for all the diversification and asset allocation.

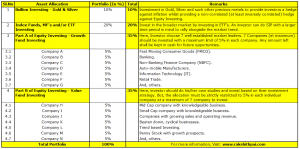

The below table explains the above wordings:

Conclusion:

As much as it is important to invest, it is more important to diversify our portfolio accordingly. A well-diversified portfolio can withstand any and all kinds of uncertain happenings that usually take place in our insane market.

Diversification is a method to stay sane, to invest sane in this market. Especially at times such as this where P/E ratio, Earnings and Earnings estimate, Cash flow, EV-EBITDA, and such other financial metrics have no value. Amateur investors have gone immature.

Instead of buying value. Today, investors (in reality, they are speculators) are buying volume. They just say, “Stocks always go up!” But, it’s the case only for those well-established companies that can sustain and only in the case of long-run.

Remember, it is very important for one to invest in Equities. But, not as important as he/she buys any and all equities at an unjustifiable price. As Mr.Buffett says it – “Buy low, sell high!”

Disclaimer: All the information on this website is published in good faith and for general information purpose only.

Some truly nice and useful information on this website, likewise I conceive the layout has got wonderful features.

Hi Clinton,

Thank you for noticing 😁

We changed our website layout for it needed an upgrade.

Happy to see you liked it.