Table of Contents

Introduction:

Discounted cash flow (DCF) is a way of valuing an investment that is used to determine its value based on its predicted future cash flows. DCF analysis is used to determine the current value of an investment based on future cash flow estimates. If the value arrived at through the DCF model is higher than the current cost of the investment, then it is considered a good opportunity to invest.

How to calculate DCF?

Let’s take a hypothetical example.

There’s a company named “Mr. Pai Industries”. This company is valued at Rs. 100 crores with 10 crore outstanding equity shares. Hence, the per-share price is Rs. 10. The company also has 30 crores in debt & other liabilities.

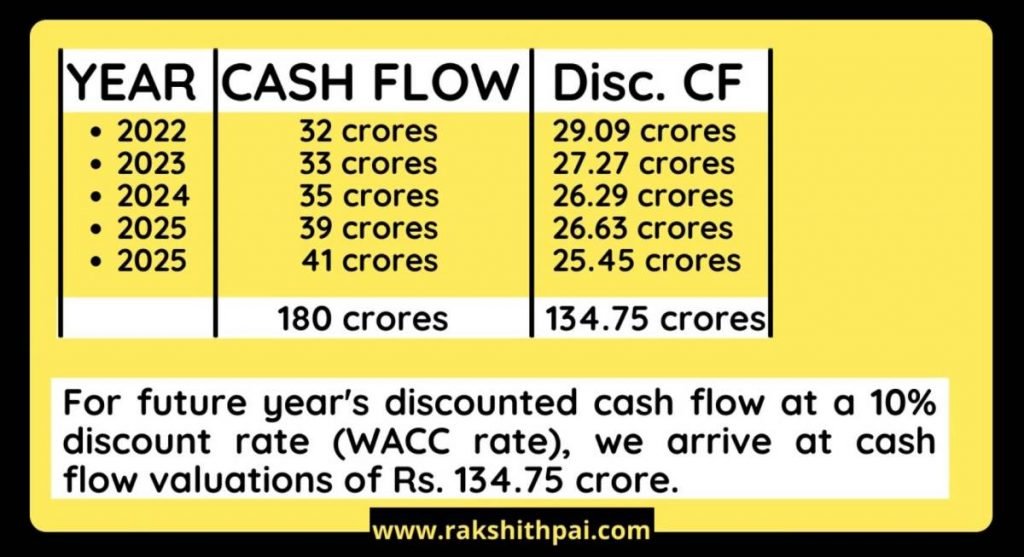

Suppose this is the cash flow of the company for the next 5 years. And, the company’s weighted average cost of capital (WACC) is at 10% p.a.

[WACC is a method for calculating a firm’s cost of capital that weights each category of capital proportionately. A WACC computation considers all sources of capital, including common stock, preferred stock, bonds, and any other long-term debt, to arrive at one rate, which is the overall cost of capital for the company.]

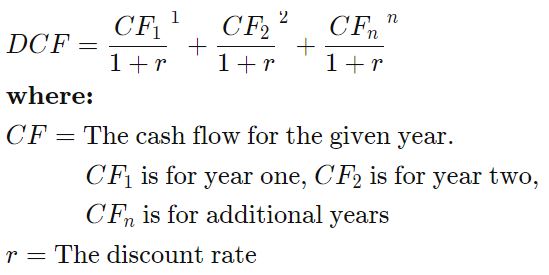

We then use the WACC figures as the discount rate for the future year’s estimated cash flow figures to make an estimate of what the company could be worth now. Where “CF” stands for “Cashflow” and “r” represents the “discount rate” or the “WACC rate”. We do this calculation for multiple periods to arrive at the present enterprise value.

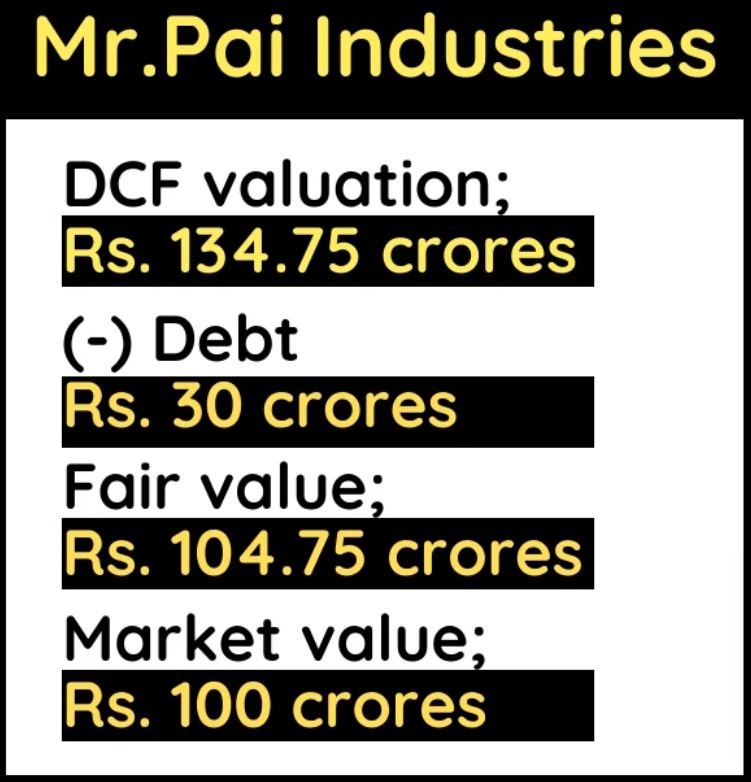

Then, based on the arrived figures (Rs.134.75 crores), we just need to subtract the net debt of the company, which is Rs.30 crores, to get the fair value of the company which is Rs.104.75 crores (Rs.134.75 – 30). Now, we just compare the arrived fair value figures (Rs.104.75 crores) with the current market price of the company (Rs.100 crores) to judge whether the company is overvalued or undervalued and invest accordingly.

In this case, “Mr. Pai Industries” is a company valued at Rs. 134.75 crore and when debt is deducted, we arrive at the company’s fair value at Rs. 104.75 crore. And, Based on the market value of the company at Rs. 100 crores, we can see that the company is undervalued.

Why DCF analysis is Important?

DCF analysis is used to determine the amount of money an investor would receive from an investment, adjusted for the time value of money. The time value of money hypothesizes that a dollar today is worth more than a dollar tomorrow due to its investment potential. As such, a DCF analysis is suitable in every case in which a person makes a payment in the present with the hope of receiving additional funds in the future.

For instance, if the yearly interest rate is 5%, Rs.100 in a savings account will be worth Rs.105 after a year. Similarly, if you delay an Rs.100 payment for a year, its present value will be Rs.95 or less, as you cannot deposit it in a savings account to collect interest.

Using a discount rate, DCF analysis determines the present value of predicted future cash flows. Investors can use the present value of money idea to analyze whether the future cash flows from an investment or project are equal to or greater than the initial investment’s value. If the DCF value is more than the investment’s present cost, the opportunity should be explored.

To perform a DCF analysis, an investor must make assumptions about future cash flows and the ultimate value of the investment, equipment, or other assets. Additionally, the investor must select an appropriate discount rate for the DCF model, which will vary depending on the project or investment, as well as the firm or investor’s risk profile and capital market conditions. If the investor does not have access to future cash flows or the project is extremely complex, DCF is of little utility and other models should be used.

Shortcomings of the DCF model!

The primary shortcoming of DCF is that it necessitates numerous assumptions. For one thing, an investor must accurately forecast future cash flows from an investment or project. Future cash flows would be contingent on a range of things, including market demand, economic conditions, technology, competition, and unforeseen dangers or opportunities.

Overestimating future cash flows can result in selecting an investment that does not pay off in the long run, reducing profits. Calculating cash flows incorrectly, which makes the investment appear expensive, can result in wasted opportunities. Selecting a discount rate for the model is another assumption that must be made accurately in order for the model to be worthwhile.

For more information, check our YouTube video:

Disclaimer: All the information on this website is published in good faith and for general information purpose only.