Table of Contents

RBI’s survey results:

According to the RBI’s latest poll of household inflation predictions, median inflation forecasts for the three-month and one-year ahead periods have hardened by 50 basis points and 60 basis points, respectively. This did not dissuade the Monetary Policy Committee from maintaining an accommodative monetary policy stance, although with one dissenting vote.

It had little option, given its conclusion that ‘the embryonic and tentative recovery requires nurturing via fiscal, monetary, and sectoral policy levers.’ It did, however, enhance its inflation forecast and attempted to normalize liquidity by raising the amount of money absorbed through the 14-day variable rate reverse repo (VRRR) auction. Its justification for ignoring rising inflation is impeccable, it reflects the US Federal Reserve’s position that inflation pressures are transient.

Consumer mood in the one-year forward scenario increased slightly, but remains extremely low, according to the consumer confidence poll. Only 21.5 percent of respondents anticipated increasing discretionary spending in the next year; fewer than half expected their earnings to increase; and while 42 percent expected their employment prospects to improve in the next year, 41 percent predicted they would deteriorate.

Bear in mind that these forecasts are based on exceptionally pessimistic present evaluations of the state of the economy in terms of income and employment, so a rebound in sentiment is completely understandable.

Industrial Analysis:

The industrial outlook survey indicated that business emotions were extremely optimistic for the second quarter of FY22, despite the fact that Q1 was deemed to be a washout. Notably, despite improving optimism, slightly more than half of those surveyed predicted an increase in capacity utilization in the second quarter.

Bank Lending:

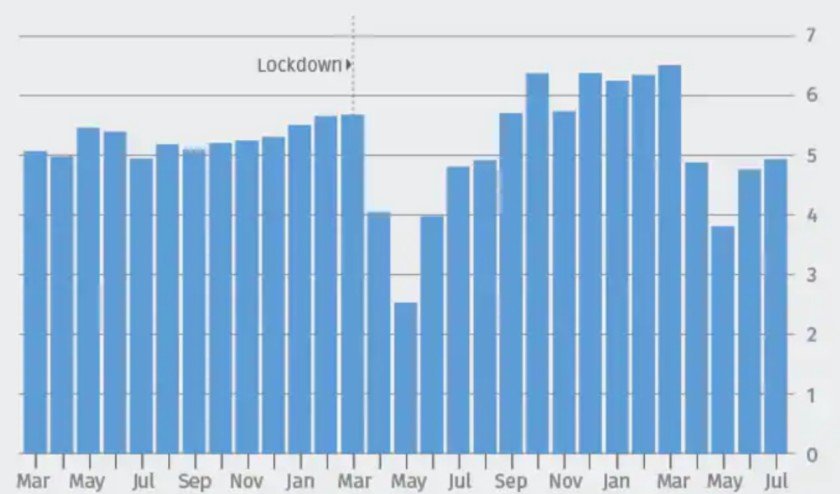

Bank lending survey results suggested that the majority of bankers were optimistic, with 64.3 percent anticipating a slight increase in Q1 2021-22. To be sure, scheduled commercial banks’ overall non-food credit growth was 6.5 percent year on year as of mid-July 2021, hardly a moderate increase’ given that we were in the midst of a lockdown a year ago. And, given that 71.4 percent of bankers previously forecasted a slight increase in bank lending in the January-March 2021 quarter, take their forecast with a grain of salt.

Service and Infrastructure:

The Services and Infrastructure surveys indicated that while service firms anticipate steady improvement, they also anticipate that selling prices will remain elevated through the fiscal year’s end. The situation is similar in the infrastructure survey, although attitudes have been dampened by the pandemic’s second wave.

Economic Recovery a near possibility?

Bank credit growth continues to increase on a monthly basis. The output of the eight main industries, air traffic figures, and e-way bills all increased. Nonetheless, weekly data suggests that the post-second wave rebound may not be entirely upward.

A word from PMI:

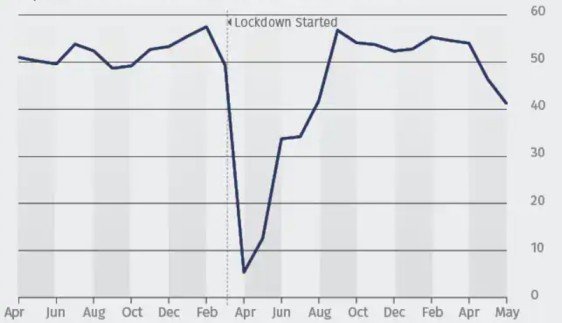

While the RBI’s Monetary Policy Committee (MPC) debates the merits of fostering growth and containing inflation, the July Composite Purchasing Managers’ Index (PMI) gives the most recent snapshot of economic activity. July’s Composite PMI was 49.2, up from 43.1 in June. This suggests that private sector activity contracted slightly in July compared to the previous month, but at a slow pace. In other words, the economy is improving, but slowly.

A PMI value greater than 50 indicates expansion from the preceding month, whereas a value less than 50 indicates contraction.

While manufacturing performed well throughout the month, the services sector contracted for the third consecutive month, harmed by pandemic-related limitations. July’s service PMI was 45.4, up from 41.2 in June. The most recent data indicated a slower contraction rate.

According to the PMI survey, ‘in addition to difficult domestic conditions, firms noted a significant deterioration in foreign demand for services. Foreign new business fell at a rapid pace that was hardly changed from June. Consumer services were the most adversely affected sector, with the quickest drops in new orders and output of the four categories that experienced contractions. Transport & Storage was the sole subsector to see an increase in company activity and sales. ‘

Government focus on Infrastructure:

Despite the pandemic, the government has maintained a strong focus on capital expenditure. This is a necessary component of ordering activity. Investec Capital Services’ research into order announcements by industrial enterprises and contract awarding bodies reveals healthy ordering activity in the June quarter relative to comparable times in previous years. Except for power, order activity on roads, trains, metros, and water & irrigation was fairly decent.

There are several potential drivers of capex. Additional investments may be triggered via the production-linked incentive scheme (PLI). “We believe that PLI-related ordering activity will increase in the next six to twelve months to meet the schemes’ FY23E-25E capital requirements,” analysts at Jefferies India wrote in a note.

Reviving the capex cycle could help not only the capital goods and infrastructure industries but also the economy as a whole. The issue, though, is sustaining government backing.

A significant number of existing infrastructure projects are reliant on government funding, which is in poor condition. Government income has been harmed by the outbreak. This may cause funding for the projects to be delayed. “Investors claim that financing may be a constraint. According to the estimations, $356 billion in orders has a good probability of being supported, “analysts at BofA Securities say. In the coming quarters, ordering activity will provide additional signals.

Production Linked Incentive program:

While the infrastructure push is not new, there are compelling reasons to support a multi-year capital expenditure cycle. The Make-in-India vision and the Production-Linked-Incentive (PLI) programs aimed at developing global companies in India are likely to attract investment. Nearly half of the expected PLI outlay of US $26 billion, which spans multiple sectors, is directed toward auto/auto components and electronics/mobiles. Together with reforms in real estate, labor, and power, these measures indicate increased self-sufficiency and decreased reliance on imports.

PLI is a well-timed investment vehicle. The epidemic has caused several economies to rethink their supply chains and adopt a China-Plus-One production and sourcing strategy. The government is exploring options to finance capex through increased fiscal deficits and asset monetization.

Whatever the case, a sustained multi-year capex cycle is predicated on two critical pillars:

- Timely government choices and

- The agility of PSUs and the private sector in adapting to new era business models.

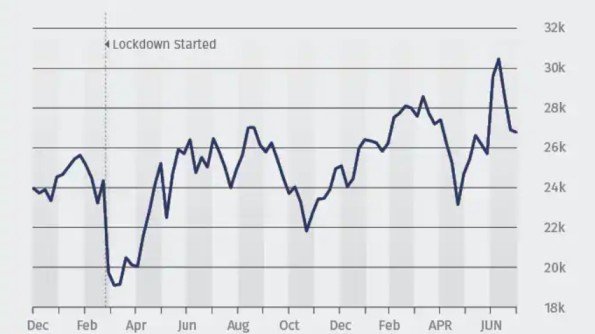

Stock Market boom so far!

The prolonged consolidation phase immediately following the pandemic’s second wave raised concerns about the market rally and its strength. Numerous market commentators discussed the market establishing a distribution pattern, indicating that a sharp correction is imminent.

Fundamental analysts have struggled to justify the rally, which lacked earning backing during a period of unparalleled global slowing.

There were symptoms of exhaustion during the last two months, as international investors continued to liquidate. China’s technology crackdown sent the market into a tailspin, as it was anticipated that capital would be withdrawn from emerging markets. Fortunately, FII selling was not as aggressive as anticipated in India.

With markets trading around record highs, this data is cause for concern. The primary distinction between institutional and retail flows is that the former is a collective and concentrated force whose flows have the ability to impact the market. Retail flow is dispersed and widely spread among a large number of stocks, primarily in the small and midcap space. Their ability to influence the market through their purchases and sales is restricted.

So, what next for Stock Market?

Fundamentally, the outstanding June quarter results, higher-than-expected July auto sales, and bullish view guidance from corporate executives all indicate that brighter days are ahead. While growth rates are starting from a low base, the majority of enterprises are confident of exceeding FY20 levels. GST tax collections indicate that fundamentals are strengthening. The thriving initial public offering market also reflects the market’s strength.

Finally, in the bull scenario, the rapid rate of immunization is helping to boost company and market confidence. Approximately 48.5 crore doses have been administered, with 11.40 percent of the adult population fully vaccinated. The prospect of a more expedited unlocking adds to the positive feeling.

While there are numerous reasons for the market to rise, there are a few that can cause it to fall.

Wall Street economists are forecasting the economy’s and corporate earnings’ peak, as the incremental benefits of the stimulus are diminishing. GDP growth in the United States was 6.5 percent in the second quarter, compared to an expected 8.5 percent. The Fed has been signaling that it intends to close the liquidity infusion, a warning that the market continues to disregard.

China, on the other hand, is confronted with its own set of issues. Apart from the Chinese government’s attack on its tech titans, analysts expect the economy to stall, which could have a global ripple effect. China, like the United States, is reporting an increase in the delta version of Covid-19, which could exacerbate its problems.

While markets are rising, the primary engine that propelled them upward liquidity is faltering. While one may party for as long as the music continues, it is critical to remain near the exit and exit as soon as the music stops.

Is the Indian Stock Market Overvalued?

We carry on this wrong notion that a high P/E market equates to an overvalued market. Which isn’t true! Although earnings in respect to the price we pay is highly required to make one’s opinion. But, that alone doesn’t define the market valuation.

While PE multiples are restricted in their ability to inform us how wealthy or poor stocks are priced, particularly for corporations that regularly compound earnings over lengthy periods of time, they are also ineffective at pricing cyclical enterprises in the developed world. This is because the PE would be inflated during the cycle’s peak and deflated during the cycle’s trough.

Instead, concentrate on the Price to the Earnings Growth rate. Which not only concentrates on the price to earnings but also the growth factor is included.

With easy money, any company’s stock could be overvalued. It is a common norm to see such a situation wherein the companies valuations seem overvalued at times such as a bull run. But, instead of valuing the companies earnings and market price per share, An investor must analyze what value the company could have in the future. And, is the product or service scalable and, if yes, then, does the company have a pricing advantage? Also, an investor must check the revenue growth figures from quarter to quarter and yearly, and then, if there is growth, what part of such growth is visible in the bottom line profit figures?

Conclusion:

In the previous month, benchmark indices stayed range-bound, reflecting tiredness among bulls. But, is there a bubble building? A variety of analysts remain upbeat and expect the markets to go further higher. They believe that stock values don’t matter anymore and what’s vital for markets is the incremental growth of corporate earnings and the monetary stance of the world’s main central banks, especially the U.S. Federal Reserve.

But here’s the catch. It’s not going to be a party that never ends. If there is one fear, it is inflation across all emerging marketplaces. Mexico has started hiking rates, Russia and Colombia are also considering boosting rates, and India is one of the few countries still talking about an accommodating monetary policy. If that story were to change and if inflation and oil prices continued to remain high, there could be an issue.

Now, our only hope is that the corporate earnings come out in record numbers to justify the company stock prising that’s rising! And, if the earnings aren’t up to mark, we can easily say that we are in a bubble.

If economic analysis and taking decisions based on current status & future viability is something that you are capable of doing. If that is done by you and you reserve your opinion to be right. Then, invest accordingly. And, if you are someone who doesn’t look deep into Economic analysis and is a clear optimist over the Indian Economy long into the future, then, do not bother about any of the economic metrics much.

Just invest timely as in SIP and be consistent with your investments. Hold quality stocks in your portfolio and just be with it. Or, take professional help in structuring your portfolio.

For more information, check our YouTube video:

Disclaimer: All the information on this website is published in good faith and for general information purpose only.