Table of Contents

Introduction:

Here, I’m gonna explain a topic that’s very relevant to the current situation. Something that has the capability to bring the market to its knees! Yup, I’m talking about “Taper-Tantrum”

Will we have Taper-Tantrum 2.0? and if we do, what’ll be the impact on the Indian Stock Market?

The Great recession & QE!

To overcome the 2008 “Great recession”, the central bank of the US, i.e., the Federal Reserve, also known as the Fed, executed a policy known as quantitative easing (QE), which involves large purchases of bonds and other securities. In theory, this increases liquidity in the system and helps maintain stability, and promotes economic growth. Stabilizing the financial sector and encouraging lending to allow consumers to spend and businesses to invest.

When the Fed began purchasing its own Treasury bonds, it did so for over 3 to 4 years. And, by 2013, the economy had, in some ways, started to pick up. It was then when the Fed announced the future tapering of its policy of quantitative easing. Meaning, the Fed will not provide easy money to keep the economy going, rather, they will start pulling out the money from the economy, thus raising the interest rates.

The Fed announced that it would be reducing the pace of its purchases of Treasury bonds, and reducing the amount of money it was feeding into the economy. The ensuing rise in bond yields in reaction to the announcement was referred to as a taper tantrum in the financial world.

What happened next?

Reducing the rate at which the Fed purchases assets represented a significant negative shock to market expectations since the Fed had grown to become one of the largest buyers in the world. As with any decline in demand, bond prices would fall in response to fewer Fed purchases. Bond investors immediately sold bonds in response to the threat of future declines in bond prices, reducing the price of bonds. Of course, declining bond prices always result in higher rates, and as a result, yields on US Treasuries have increased significantly.

And, market veterans predicted that since bonds fell, the stock market would also follow the same suit and we’d have a massive crash! At some point, we did have a correction. But, as always, the market recovered and, by the midst of 2013, we were back and booming.

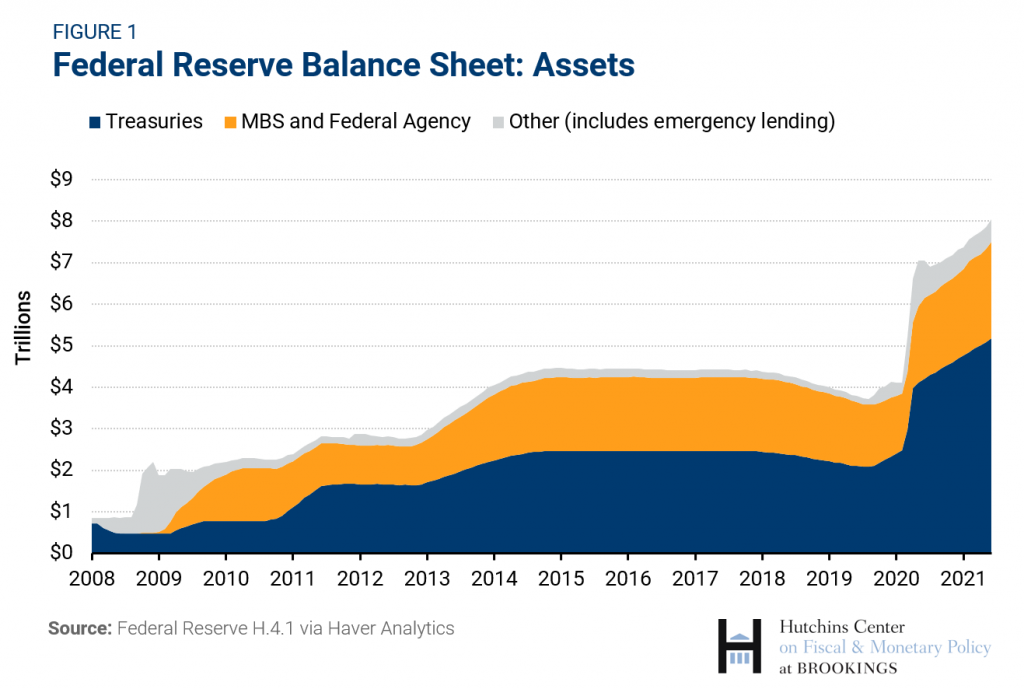

Since 2008, the fed’s balance sheet to date has ballooned up to become a huge worth of over 7 trillion in holding (treasury bonds contributing to over 5 trillion of the worth). And, at some point in time, they will and should consider de-sizing the created issue. (picture for reference)

The current situation:

The Federal Reserve has been preparing the markets for the onset of its first policy tightening move since the beginning of the pandemic, and investors have begun bracing for the change. That means the Fed will start reducing the amount of bonds it buys, which then means that the money supply will be reduced going forward. It is said that the 2021 “Taper-Tantrum” will begin by the end of the year.

Although this time, we might not see a much bigger crash as it is said in the news media. But, a correction is certain to happen. And, do not make your investment decisions based on these economic factors. It is wise to know their importance on our economy and wealth but, they shouldn’t guide your investment decisions.

It is advised to keep your systematic investment plan (SIP) going. I would like to say it this way;

East go dust! or West go bust! It’ll not stop my nation’s progress. So, Invest!

Watch YouTube video for more information:

Disclaimer: All the information on this website is published in good faith and for general information purpose only.