Table of Contents

What is FIRE Moment?

Independence in terms of money The goal of the Financial Independence, Retire Early (FIRE) movement is to retire before age 60 by saving and investing a certain portion of one’s income. If you’ve got enough money saved up to pay for everything you’ll need in retirement, including inflation, then you’ve made it to the FIRE finish line.

Gaining financial independence and retiring early are two main goals of the FIRE (Financial Independence, Retire Early) lifestyle movement. In the 2010s, millennials became more interested in this approach for two reasons:

1. The millennium just experienced the ill effects of the 2008 market crash.

2. The millennials, who were the faces of the minimalist lifestyle, talked about how important it was to retire early and use less.

Those who want to achieve financial independence and retire early (FIRE) intentionally increase their income and/or decrease their expenses while also making timely investments that increase their wealth and/or income. The goal is to amass sufficient assets so that one’s retirement lifestyle is supported by passive income.

How Does FIRE Work?

By putting away as much as 20, 30, 50, or even 70% of your income while still working full-time, the FIRE philosophy wants you to retire far sooner than the conventional retirement age of 60-65. When your savings account reaches 25 times your annual expenses, you may then retire from your day job or stop working altogether.

In order to fund your early retirement, FIRE principles suggest that you make modest withdrawals from your funds each year, often between 3% and 4%. Usually, under the FIRE principle, you are forced to live a simpler life both while you are still working and even after you have retired.

Rule of 25:

To retire comfortably, the “rule of 25” states that you must have saved 25 times your yearly costs. All you have to do is multiply your monthly costs by 12, and then you’ll have your yearly cost of living. Your FIRE number, or the sum you’ll need to retire early, is just your yearly expenditure multiplied by 25. With 25 long years, we are not only giving your retirement sufficient legroom but also letting it grow over time.

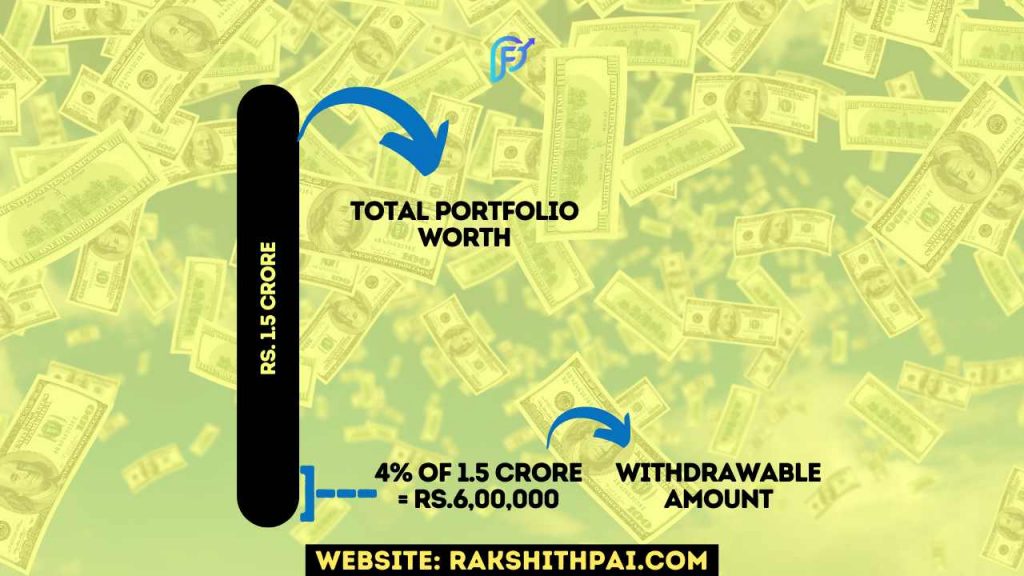

Let’s say your monthly costs average Rs.50,000; by multiplying it by 12, you obtain a yearly cost of Rs.6,00,000. When that figure is multiplied by 25, the resulting sum is the FIRE goal amount: Rs.1,50,00,000 (Rs. 1.5 crores).

I can understand that when faced with a FIRE goal the seems too high. Well, that’s the cost you pay for early retirement. Some people look for ways to make more money and then invest the extra money (explained below).

The 4% Rule:

According to the 4% rule, retirees won’t go broke if they spend only 4% of their savings in the first year and then, if required, adjust for inflation thereafter.

If you want to retire sooner than 30 years from now, the 4% rule might not be the best option.

As for the FIRE statistic, your retirement investment, as said earlier, will grow at a rate of at least 10% to 12% per annum. If you factor in inflation and other aspects that could increase your cost of living, and such increased cost deducts 6% to 8% per annum of your earnings, you’ll still have 4% (10-6) or 12-8). That 4% is your monthly required amount for consumption.

The 4% rule is commonly cited by FIRE advocates as a rough withdrawal guideline, with the resulting target amount being at least 25 times one’s projected yearly living expenses. When a person has saved up enough money, they don’t have to keep working for pay. This makes it possible for them to retire decades before the typical retirement age.

How to Achieve Financial Independence?

Income

Early retirement is contingent not only on how much money is being saved but also on how much money is being earned. Therefore, you should broaden your revenue streams as much as possible. You could, for example, experiment with different ways to earn money. For more information, read, “The 10 Best Ways to Make Passive Income in India”

Savings

Saving is a key factor in being financially independent. When you save more, you can retire sooner. It is recommended that if you wish to retire much sooner than others, you set aside 45–55% of your monthly salary now.

For instance, it will take at least three years to build up enough money for one year’s living costs if you set aside 20–25% per month. On the other hand, if you save between 50 and 55 percent, you’ll need only one more year to cover your bills.

Investment

The entire premise of the F.I.R.E Principle stands on this.

Nobody can save their way to early retirement. Hence, diversified investments in right the portfolio are the way to achieve Financial Independence.

Consumption

Obviously, if you want to save money, you need to spend less and live a more modest lifestyle. Many strategies exist for doing so. One such method is to cut costs on unnecessary items through proper budgeting. It is to avoid all the additional expenses we would have and draft a proper spending plan. For more information on budgeting, CLICK HERE!

The 50/30/20 Rule of Budgeting. Its Features & Importance Explained:

Debt

Your debts have a devastating impact on your financial resources. Many people nowadays are struggling to make ends meet each month due to mounting debt. Then, a sizable portion of your income will be needed to cover all of your expenses. There will be nothing worth keeping. Consequently, settle all your bills and make an effort to avoid accruing any more.

For a better understanding of the topic, I suggest you read our article, “Is Buying A Home A Good Investment?“ in which a simple example of Mr.Ranju and Mr.Raju gives a clear picture of the topic.

5 Tips to Fire up your FIRE!

Professional Help

Since we are talking about your retirement, do not do it all on your own. You can get professional help in areas such as tax planning via your Chartered Accountant (CA) and wealth management and financial planning from your Certified Financial Planner (CFP).

Your CA and CFP know more about finance than you do. Acknowledge this fact and communicate with them about your financial needs and requirements.

Financial Goals

Goals, dreams, and aspirations drive us to take risks. A calculated risk leads us to better returns. You should have financial goals that motivate you to take calculated risks and venture into new ideas for making more money.

Budgeting

Do not take a single step without proper planning and budgeting. Budgeting is nothing more than striking a balance between your income and your spending. The problem will arise if your finances are out of balance and you wind up spending more than you earn.

If you’re constantly spending more than you’re making, you will end up accumulating debt over time. We have discussed the importance of Budgeting in detail, to Know more, CLICK HERE!

Retirement Benefit Accounts

Take full advantage of the retirement benefit accounts such as the Provident Fund, the National Pension Scheme, etc. They not only provide you with returns above the fixed deposit scheme but are also tax deductible. Investments under these schemes are deductible under section 80C.

Invest

Nowadays, investment has become a mainstream tool with a lot of institutions offering varied schemes. You can invest in a particular sector or industry, particular types of companies, a distinct segment, or even a different country altogether.

And, investment has also become easy. You just need to select a well-performing Mutual fund and invest via SIP. Invest in a diversified portfolio to balance your risk and returns.

Saving, Investing & Withdrawal in F.I.R.E:

Your FIRE journey consists of three major components:

It is to save as much as possible, invest your savings in a well-balanced portfolio, and then spend your investments according to the FIRE principle’s plan for spending your money.

To begin with, think about how much of your paycheck you can set aside as an emergency fund. All retirement savings can and should be counted as savings, including employee and employer contributions and any extra money saved in retirement accounts such as PF and NPS.

Second, calculate your current spending rate by a factor of 25. For instance, in order to retire early on an Rs. 6,00,000 annual income (Rs. 50,000 monthly income), one would need to save Rs. 1.5 crore over 25 years. If that amount is scaring you, do not.

This is where the magic of compounding comes into the picture. You do need to save the entire 1.5 crore amount to retire. Instead, all you need to do is invest on a timely basis over a certain period of time and leave room for your investments to grow. For example, a Rs. 12,000 monthly investment for the next 25 years at just a 10% ROI will yield you Rs. 1.60 crores in total investment value.

The last step is to estimate how long it will take you to reach your FIRE number if you continue to save the same amount every year. There is an assumption regarding financial rewards that must be made. for rapid gains and quick financial independence, retirement, and early retirement, you need to save more, invest aggressively, and repeat.

Conclusion:

Financial Independence and Retiring Early is the meaning behind the abbreviation FIRE. Several people have banded together under the FIRE movement to accomplish a common objective. The plan is to save enough money so that they may retire early, preferably in their 30s, 40s, or 50s, when that age is typically considered to be young for retirement.

As a general rule of thumb, people use the “4% rule” to deal with such situations. The principle is as straightforward as it sounds: Withdrawing more than 4% of your retirement account balance in a single year is not recommended. To put it another way, if you retire with Rs. 1 crore, you would spend Rs. 4 lahks (4% of Rs. 1 crore) in your first year on living expenses.

Most people believe that FIRE is just for those who earn a six-figure salary or more. If you’re in your thirties or forties and want to retire soon, you’ll find that to be true. However, the movement’s ideals may help you save for retirement and possibly retire early, no matter your age.

And keep in mind that “FIRE” stands for Financial Independence, Retiring Early, which, if attained, might allow you to forego retirement in favor of working at something you enjoy. So, as per FIRE, it’s not necessary that you retire or aim to retire. It is simply a means of obtaining your required corpus, which will enable you to earn and sustain a passive income sufficient to cover your minimal annual expenses.

For More Information, Check this Video:

Disclaimer: All the information on this website is published in good faith and for general information purposes only.