Table of Contents

Intorduction:

Income tax is a direct tax that a government levies on the income of its citizens. In India, we segregate our income into 5 heads. That is Salary, House Property, Profit & Gains from Business or Profession, Capital Gains, and Other Income. And, in order to benefit those paying tax, and indirectly promote certain expenditures, the Indian government has given some exemptions and deductions from tax.

We have Exemption under Section 10

And All varied deductions under Section 80

Hello everyone, I’m Rakhith Pai and this video is specifically for Indian salaried individuals who wish to reduce their income tax burden. And, will also explain the various deduction options available for us and the difference between the old tax scheme to the new.

First, let’s understand the old tax scheme.

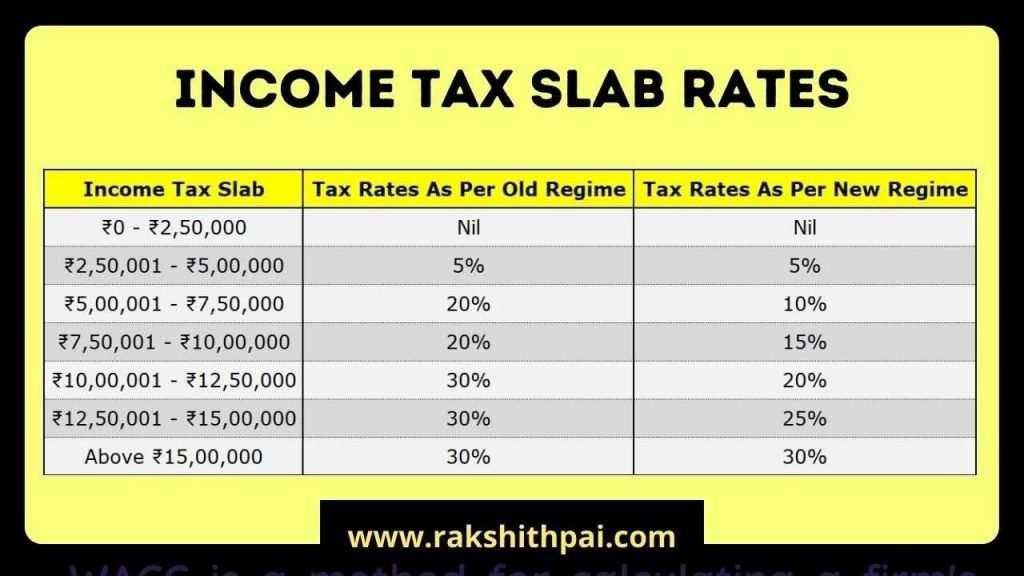

This chart shows the income and respective tax rates. Now compare the same with the new tax scheme.

So, the chart itself explains. The new scheme is for those individuals with higher income and the old scheme is for lower-income individuals.

Is it that simple? Well, there’s a catch here and that is Section 80 & Chapter VI A deductions.

Basically, with the Old scheme, you get deductions under Section 80 and Chapter VI A such as;

80 Deductions table:

| Sl. No | Section | Particulars | Limit |

|---|---|---|---|

| 1 | 80 C | Investment in Public Provident Fund | Rs. 1,50,000 |

| Employees share of PF contribution | |||

| National Saving Certificate | |||

| Life Insurance Premium payment | |||

| Childrens Tuition Fee | |||

| Principal Repayment of home loan | |||

| Investment in Sukanya Samridhi Account | |||

| Unit Linked Insurance Policies | |||

| Equity Linked Savings Scheme | |||

| Sum paid to purchase deferred annuity | |||

| Five year deposit scheme | |||

| Senior Citizens savings scheme | |||

| Subscription to notified securities/notified deposits scheme | |||

| Contribution to notified Pension Fund set up by Mutual Fund or UTI. | |||

| Subscription to Home Loan Account scheme of the National Housing Bank | |||

| Subscription to deposit scheme of a public sector or company engaged in providing housing finance | |||

| Contribution to notified annuity Plan of LIC | |||

| Subscription to equity shares/ debentures of an approved eligible issue | |||

| Subscription to notified bonds of NABARD | |||

| 2 | 80 CCC | For amount deposited in annuity plan of LIC or any other insurer for a pension from a fund referred to in Section 10(23AAB) | - |

| 3 | 80 CCD (1) | Employees contribution to NPS account (maximum up to Rs 1,50,000) | - |

| 4 | 80 CCD (2) | Employers contribution to NPS account | Maximum up to 10% of salary |

| 5 | 80 CCD(1B) | Additional contribution to National Pension Scheme | Rs. 50,000 |

| 6 | 80 D | Medical Insurance Self, spouse, children | Rs. 25,000 |

| Medical Insurance Parents more than 60 years old or (from FY 2015-16) uninsured parents more than 80 years old | Rs. 50,000 | ||

| 7 | 80 DD | Medical treatment for handicapped dependent or payment to specified scheme for maintenance of handicapped dependent | |

| Disability is 40% or more but less than 80% | Rs. 75,000 | ||

| Disability is 80% or more | Rs. 1,25,000 | ||

| 8 | 80 DDB | Medical Expenditure on Self or Dependent Relative for diseases specified in Rule 11DD | |

| For less than 60 years old | Lower of Rs 40,000 or the amount actually paid | ||

| For more than 60 years old | Lower of Rs 1,00,000 or the amount actually paid | ||

| 9 | 80 E | Interest on education loan | Interest paid for a period of 8 years |

| 10 | 80 EE | Interest on home loan for first time home owners | Rs. 50,000 |

| 11 | 80 GG | For rent paid when HRA is not received from employer | Least of |

| Rent paid minus 10% of total income | |||

| Rs. 5000/ per month | |||

| 25% of total income | |||

| 12 | 80 GGB | Contribution by companies to political parties | Amount contributed (not allowed if paid in cash) |

| 13 | 80 GGC | Contribution by individuals to political parties | Amount contributed (not allowed if paid in cash) |

| 14 | 80 RRB | Deductions on Income by way of Royalty of a Patent | Lower of Rs 3,00,000 or income received |

| 15 | 80 TTA(1) | Interest Income from Savings account | Maximum up to Rs. 10,000 |

| 16 | 80 TTB | Exemption of interest from banks, post office, etc. Applicable only to senior citizens | Maximum up to Rs. 50,000 |

| 17 | 80 U | Self-suffering from disability | |

| An individual suffering from a physical disability (including blindness) or mental retardation. | Rs. 75,000 | ||

| An individual suffering from severe disability | Rs. 1,25,000 | ||

And, with Chapter VI-A, we get a Standard deduction of Rs. 50,000 for all the Salaried individuals u/s 16 IA

Basically, You’ll not get all these benefits if you choose New tax scheme.

Why not New tax scheme? Section 115BAC

If you choose the new tax scheme, you must forego a number of tax deductions and exemptions that were previously available under the old scheme. Salaried individuals will be unable to take advantage of significant tax benefits such as the standard deduction, the House Rent Allowance (HRA), the Leave Travel Allowance (LTA), and even some of the allowances that are more of a prerequisite.

Numerous deductions, like those accessible under Section 80 C (which includes EPF, LIP, school fees, PPF, NSC, ELSS, and house loan repayment), 80D (for health insurance premiums), 80 CCD (1), and 80 CCD (1B) (for NPS), will also be unavailable to both salaried and self-employed taxpayers.

Additionally, you waive your claim for self-occupied house loan interest, as well as your right to set-off or carry forward loss on rented property. And, the most important case is that under the new tax plan, you would be unable to Setoff any brought forward losses against current income.

Similarly, retired senior citizens cannot deduct standard deductions from pensions received in connection with prior employment. Senior citizens will also be unable to deduct interest from post offices and banks up to Rs. 50,000 which was previously available under the old scheme under section 80TTB.

So, which is better? Old or New scheme?

Usually, most of India’s tax benefits are of all the deductions available under the old scheme, especially the HRA, or the home interest expenses, the 80 C deductions, and such. If you are not taking benefit of those mentioned earlier. Then, please consult your Chartered Accountant because you really need to plan your tax filings.

With that said, I would choose Old scheme given the fact that you are taking complete benefits of all if not most of the deduction benefits.

Salaried individuals will lose various benefits such as standard deduction, HRA, and LTA, and numerous expenses or investment items such as employee provident fund contributions, life insurance premiums, school fees, and home loan principal repayment, it makes sense for the majority of salaried individuals to remain under the old scheme. Even for self-employed taxpayers with an outstanding home loan, switching to the new scheme makes very little sense.

To my knowledge, the new tax system is beneficial primarily to individuals who are moderately high-income individuals and are unable to take advantage of all Section 80 C benefits, as well as those who do not have health insurance or a running home loan. The new system may be acceptable for just a small number of self-employed individuals or HUFs that are not eligible for the Section 87A refund.

What if you want to switch the old scheme to new and back?

Salary employees have the option of choosing between the two schemes each year. Even though your employer has chosen a certain tax scheme for you, you may still choose the other scheme when submitting your ITR if the alternate scheme appears to be more advantageous to you when computing your tax liability at the time of filing the ITR.

Please keep in mind that self-employed individuals do not have the option of returning to their previous tax system after the new one is chosen unless they cease to earn business income. Thus, an individual with a business income must exercise extreme caution while migrating to a new scheme, as it is a one-way journey for them. You won’t be able to go back to the old scheme.

Whether the new plan or the old one is better for you depends on the composition of your income and the deductions available, and each individual must make a judgment based on his or her circumstances.

My suggestion for you is to take benefit of everything offered to you by the Governments via various deductions. And, don’t wait until the last moment to file your taxes. Consult your Chartered Accountant for more information.

YouTube Video explaining the topic:

Disclaimer: All the information on this website is published in good faith and for general information purpose only.