Table of Contents

Introduction:

In this We-Blog series, we attempt to answer questions posed to us or found on various social media platforms, as well as provide sound financial advice.

Today’s question for discussion is “I am 30.” I want to invest 1L per month for the next 25 years and then retire. “What should be my plan of investment?”

Ok, a Rs. 1 lakh per month investment is really good. He or she gets to overcome the lost period, which is all the compounding he or she could have done in their 20s by just investing more in their 30s.

Basically, there are three ways to earn retirement.

- Basic SIP

- Lump Sum

- Combo SIP (Mix of Simple SIP & Timely Lump Sum Investing)

Either you start early and gradually increase your investment over time, or you start whenever you can but invest huge lump sums. Or you can do a mix of both wherein, apart from monthly SIPs, you also invest in lump sums when there’s money to invest and when the market is down and it’s beneficial to invest.

Total Investment Amount Required:

So, he or she is ready to invest Rs. 1 lakh per month, which amounts to Rs. 12 lakh per year. or a total of 3 crore rupees in investment over 25 years.

Where to invest?

When the sole purpose of investing is to cover retirement. We can rest assured that the investment must be made for the long term in assets that compound over time.

Given the fact that this individual is ready to invest Rs. 1 lakh per month, it says that he or she is living a good life now and even prefers not to compromise on it in the future. So, basically, this person wants good returns for their investment. And a retirement corpus of something like 15 to 20 crores.

In any case, there are assets that deliver good returns, but none better than equity. So, your primary investment must be in equity.

But fully investing in equity isn’t suggested. So what to do?

Best Investment Plans in India for Middle Class 2022

Your investments must be diversified among the following categories:

- Equity, direct or indirect: 75%

- Bullion and debt instruments: 10%

- Retirement Accounts: 15%

How to Invest?

Now that we know where to invest,

Let’s see how this 1 lakh per month or 12 lakh a year can be invested for better returns.

First and foremost, by investing 12 lakhs a year, you are for sure earning a lot more than that. which means you’ll fall under the 20% or even 30% tax bracket. right? In that case, it is important for you to take advantage of all the benefits offered under the tax codes. meaning to invest in such assets that provide tax benefits.

15 Best Ways to Save Income Tax in India:

I have made a detailed video on the topic where you can invest Rs. 2 lakh per year and save the entire amount from tax and earn 3.5 crores in 25. Watch this video to learn more.

You must invest Rs. 2 lakh in 3 different portions namely (1) NPS, amounting to 84,000 + (2) 36,000 in PF, and the balance (80000) in (3) that is ELSS. A detailed video with a full explanation is given in the other video;

Check This Video to Know more – “This is How You Invest Rs.2 Lakh Per Year & Earn Rs.20 Lakh in the Future!“

So I hope this covers your Rs. 2 lakh investment. The remaining Rs. 10 lakh must be put into stocks and other similar investments.

Out of this 10 lakh, invest at least 1 lakh in investments that have zero correlation to the others. meaning a non-correlated asset can give returns when the other doesn’t.

For example, we know equity investment returns tend to go down at times; we call them a “correction” or “crash” in the market. You need investments in assets that give returns even when the equity market is suffering.

This way, your net return on investment each year will stay positive. This you can do by investing in debt and bullion ( bullion is nothing but gold and silver); you can invest in these assets in a 60:40 ratio or even on a 50:50 basis. Most do it this way.

I suggest putting just 1 lakh in debt and bullion and the balance, 9 lakh, in equity. Just so you know, most of the investments in your NPS and PF accounts are invested in equity and debt instruments in a ratio of 80:20 or 75:25, depending on which account you have.

So, 2 lakhs in the NPS, PF, and ELSS combo as suggested, 1 lakh in gold and silver, and the balance of 9 lakhs in equity.

Returns on Investment:

Your investment can be classified into three categories.

And the returns expected after 25 years of investment are as follows:

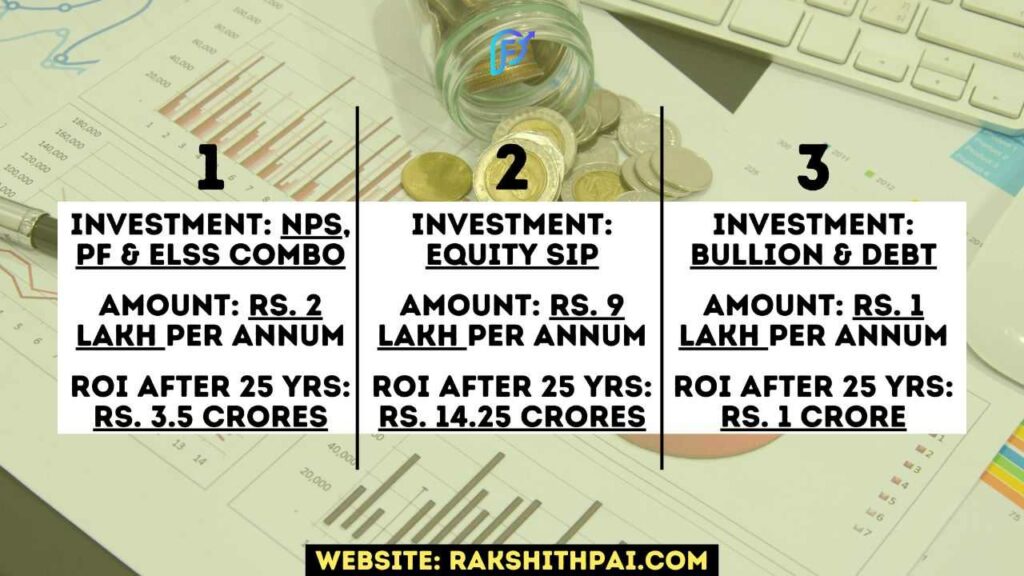

1. You must invest in the NPS, PF, and ELSS combo with an investment of Rs 2 lakh per annum, which can yield you somewhere around Rs 3.5 crore in returns after 25 years.

2. Equity SIP: You must invest at least 9 lakhs per annum in equity and equity-related instruments. Select the top mutual funds and invest Rs 75,000 per month via SIP in mutual funds. To know more about mutual fund investing, check out this article (link in the description). Anyway, with Rs. 9 lakh investment per annum for the next 25 years and expecting a 12% ROI, your estimated return upon maturity will be Rs. 14.25 crore.

3. Bullion and Debt Investing: Usually, debt instruments will yield returns over and above the fixed deposit rates and can reach a maximum of 9 to 9.5%, and your gold and silver investments can give an annual appreciation of around 10% if held for the long term. So, assuming a 9% CAGR on your Rs 1 lakh investment for the next 25 years, you can expect a maturity value of somewhere around Rs 95 lakh to Rs 1 crore.

Conclusion:

The reason why we diversify is that the investment you make, even with all due diligence and proper research, can still go wrong. So, it is crucial that we diversify our investments. Also, what if you need to withdraw part of your investments for some emergency expenses? That’s why we invest in short-term and long-term assets, right?

Considering the investments as explained above, with a total investment of Rs 3 crores in 25 years, we can expect a total maturity amount for the retirement of over 18 crore rupees.

For More Information, Check this Video:

Disclaimer: All the information on this website is published in good faith and for general information purposes only.