Table of Contents

Introduction to Education Inflation!

To most Indians, education is the second-highest expense, only after rent. And if you have your own house, then the education of your child is one of the biggest expenses you as a parent bear. I guess that’s one of the reasons many are choosing to have a nuclear family, wherein having one child per family is already the norm.

It is said that parents will spend over 1 crore rupees on their kids’ education from the beginning of kindergarten until the child reaches 20 years of age; remember, that’s on one child. That’s how expensive education has become.

And, inflation in education is among the highest, reaching up to 10% per annum. Considering all these expenses, it is crucial that you invest a part of your income just to meet your kids’ education expenses. In this video, I will explain in detail what you can do.

The expense of school is growing every day, and as parents, you may be anxious about offering your children the best education. However, by preparing early, you may ensure that your children do not have to give up on their aspirations due to a dearth of cash.

It is also crucial to keep in mind that you don’t endanger your personal financial security to support ambitious educational goals for the children. You may explore college loans or your child’s self-funding beyond a particular level.

One extremely challenging component of guaranteeing your child’s education is picking the most appropriate child investment programs. Here is an approach that may be used to pick among several plans.

Inflation and its impact on the Economy & Stock Market:

The goal of investing:

Our goal here is to set up a fund that could meet the education expense requirement. As said already, the cost of education is rising. By setting up a fund, we can help our kids avoid taking out student loans or at least fund a good portion of them via our investment.

It is every parent’s dream to give their child the education they require. Parents go to any extent just to see their kids get a good education from a reputed institution.

The issue here is that not only the cost of education is rising but the loan cost is also high. For example, most education loans are floating rates, meaning your loan interest rates are based on the running interest rates. Still, the interest cost will be over 8–12% at times. You can avoid a good part of such a burden by investing now.

How to Invest?

When we talk about education, the cost of higher education is the biggest burden for most middle-class families. Based on current rates, the cost of higher education is somewhere around 10 lakhs and could reach up to 1 crore rupees depending on the course you choose.

If all the costs are put on the child, then a big part of their earnings will go to pay off the loan amount. Instead, you as a parent can set up a fund that helps your child’s educational expenses.

For example, you just need to invest 100 rupees a day or 3000 rupees a month. Do this investment for the next 20 years until your kid reaches 20 years of age. Well, Rs. 3,000 a month seems too low. So, just add a 10% annual increment to your investment.

For instance, in this case, invest Rs. 3,000 per month for the first year. And then invest 3,300 rupees per month on your second-year investment; for the third year, it is 3630 rupees per month; this way, your total investment for 20 years is rupees 20,62,000

Diversified asset allocation leads to wealth creation.

Attack Inflation Heads on!

Inflation rate considerations are crucial when deciding on the best investment plans for kids. The annual increases in tuition and fees are largely attributable to inflation. Expenditures on higher education typically rise quicker than general price inflation.

As a result, you should start putting money aside for your kids’ college soon after they’re born. There are financial considerations beyond just tuition to think about if your child plans to study abroad. With a steady investing plan, you may be able to surpass these barriers.

Return on Investment:

To reach our goal, we need at least 50 lakh by the time our kids reach 20 years of age. So, we are seeking those options where we invest just Rs. 3,000 per month with an incremental SIP of 10% per year for the next 20 years. Our total investment is Rs. 20,62,000.

And after 20 years, at a 12% ROI, we’ll have 56 lakhs in corpus ready for one child’s higher education expenses.

Where should I invest?

Investing in a tax-saving fund is suggested. Considering the amount of investment you are ready to make, which is just 100 rupees a day, it seems that you do not have any other investments or retirement funds. So, this could be a tax-saving fund for you.

For example, since our investment is a long-term one, we can invest in ELSS, which also offers tax deductions for investments up to Rs. 1.5 lakh under Section 80C.

What I’m saying is that by investing in ELSS for the next 20 years, you can also claim a tax deduction on the entire investment you make. at least until the 16th year of investment.

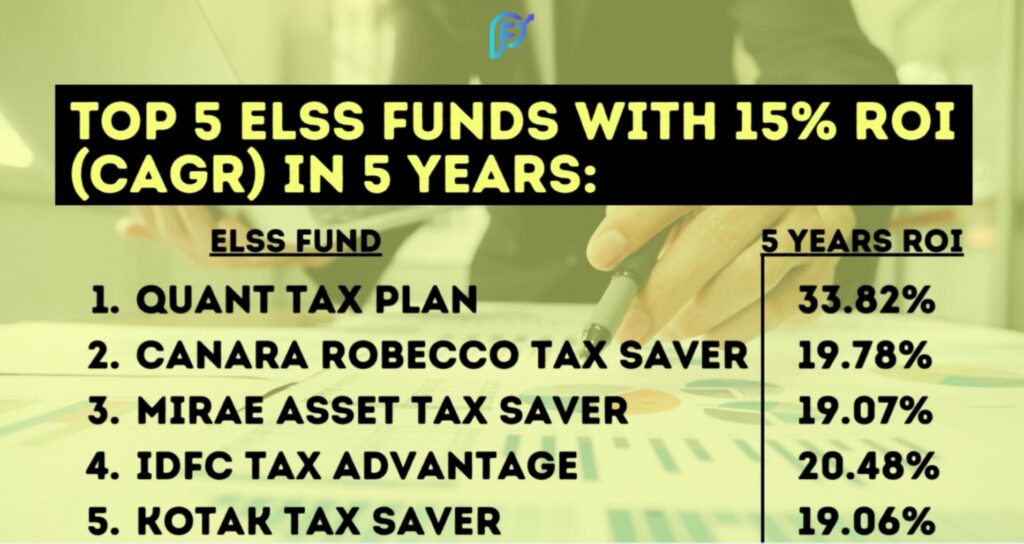

These are the top 5 ELSS tax-saving funds that have provided over 15% return on investment for the past 5 years. Before investing in ELSS, please read the article and get yourself informed about the fund, CLICK HERE!

Remember, with 12% ROI, we could earn 56 lakh, and since these ELSS are giving 15% ROI, we can set up a corpus of up to Rs 77.5 lakh for kids’ education.

Conclusion:

First, you need to establish concrete objectives, such as the kind and cost of schooling for the child. In addition to letting you know how much money you can put away each month after paying your bills, this will also give you an idea of how much you can save each month.

It’s important to remember, though, that loans can also be used to study finance. In light of this, investing in a child’s education does not necessitate sacrificing other priorities like healthcare or retirement.

As the target date for the financial goal draws near, it is prudent to reduce exposure to equities in order to lessen the impact of unfavorable market fluctuations.

For More Information, Check this Video:

Disclaimer: All the information on this website is published in good faith and for general information purposes only.