Table of Contents

Introduction to Cash Flow:

“Cash flow” is used to describe the net inflow and outflow of currency for a business. Money coming in and money going out are referred to as inflows and outflows, respectively.

The capacity to produce positive cash flows, and more especially to optimize long-term free cash flow, is central to a company’s ability to create value for its shareholders (CFC). Free cash flow (FCF) is the cash flow remaining after a firm deducts the cost of capital expenditures from its regular operating cash flow (CapEx).

FCF formula = Net Cash Flow From Operations (-) Capital Expenditure

Capital Expenditure includes all “Property Plant & Equipment” expenses as well as the cost of depreciation over the years.

What is Discounted Cash Flow (DCF)?

Investments may be valued with the use of the discounted cash flow (DCF) analysis approach by discounting their anticipated future cash flows. Since DCF analysis may be used to determine the worth of a broad variety of investments, projects, and other endeavors, it is frequently employed in the investing world and by corporate finance managers.

After taking into account the passage of time and other factors. Discounted cash flow analysis can provide a reasonable estimate of the value of the investment’s return. It applies to all projects that will make money in the near future.

Comparing the DCF to the initial investment is common. The investment is profitable if the discounted cash flow (DCF) value exceeds the present value. Increases in DCF indicate better returns on investment.

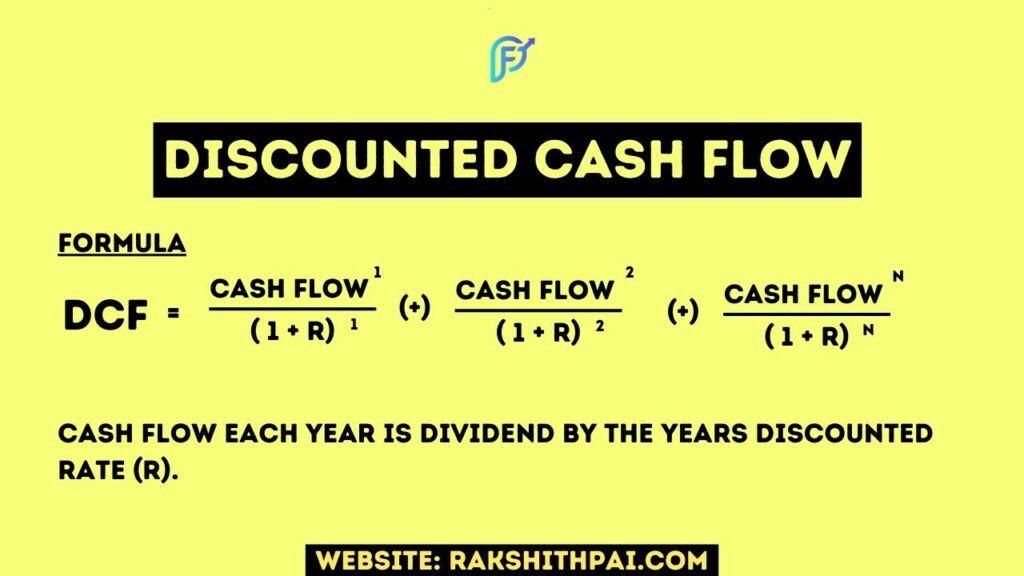

Discounted Cash Flow Formula:

How Does Discounted Cash Flow (DCF) Work?

The goal of discounted cash flow analysis (DCF) is to figure out how much money will be coming in the future after taking into account how time acts as a multiplier.

To put it simply, the time value of money is the concept that money now is worth more than money tomorrow because it may be invested, and the invested money has the chance of making more money with time.

Thus, a discounted cash flow analysis is applicable whenever one makes a current monetary outlay in anticipation of future financial gain. Simply put, by discounting future cash flows, known as DCF, the present value of an investment may be estimated. It can be used to get a rough idea of how much you need to invest to get the rate of return you want.

For instance, considering an interest rate of 6%, a rupee saved now will be worth 0.94 paise a year from now. The same holds true for delayed payments, wherein a rupee put off for a year is only worth 94 paise now since it can’t be put in a savings account at 6% and collected interest.

In a discounted cash flow analysis, the future cash flows are discounted to their present value. The present value of money is a tool for valuing future cash flows of an investment or project to see if they are more than the worth of the initial investment.

The opportunity should be explored if the discounted cash flow (DCF) value is greater than the present value of the investment. If the calculated value is less than the cost, this might not be a good opportunity, or more research and analysis are needed.

Understanding Time Value of Money (TVM):

How to Calculate DCF Analysis?

To begin a DCF analysis, one must first make projections for both the investment’s ultimate value and its future cash flows. Your investment horizon might correspond to the time frame used in the estimate. If more money needed to be invested at some point in the future, the cash flow might be negative.

Next, you must decide on a rate to discount the cash flows to arrive at a fair present value. The discount rate is often the cost of capital, which can vary greatly from one project or investment to the next. The weighted-average cost of capital (WACC) method is useful when a project uses both loan and equity financing.

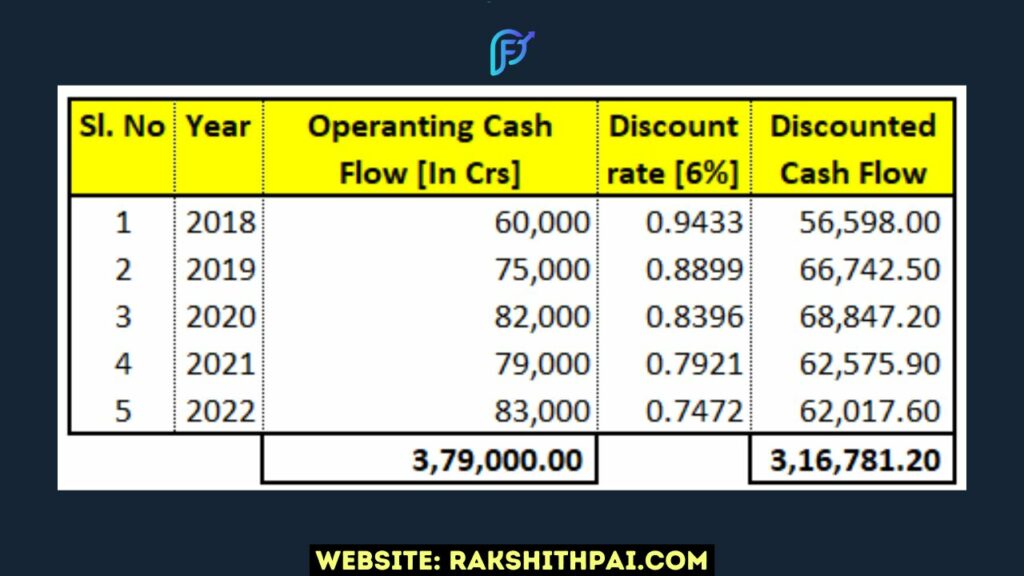

For a Better understanding, let’s check an example;

We know that the present cash flow and future cash flow are not the same. This fact is the reason why we have the “Discounted Cash Flow”.

For instance, let’s take a hypothetical example of “ITC Ltd.”

In the above case, ITC ltd total revenue over the 5 years period amounts to Rs.3,79,000 crores. At a 6% discounted rate, the revenue of ITC Ltd is at Rs.3,16,791.20 crores.

Suppose the company spent Rs. 3,00,000 crore to arrive at a total revenue of Rs.3,79,000 crore. Then the net positive cash flow in nominal terms is Rs.3,79,000 crores but the same in real terms considering the discounted rate is Rs.3,16,791.20 crores.

Where do we use the DCF model?

A company’s worth or per-share value can be calculated using the DCF formula. The following are some of the areas where the DCF Model is used:

- Evaluating an Investment

- Evaluate a particular project.

- Bond and equity valuation

- To Value Income-Generating Assets

- Recognize the value of a cost-cutting measure,

- Future Perspective on Cash Flow Statement

Advantages of Discounted Cash Flow:

- The discounted cash flow method (DCF) is a comprehensive valuation technique.

- Using assumptions about a company, such as cash flow forecasts and discount rates, DCF uses hard statistics and measurements.

- When these conditions hold, it’s possible to get a clear image of an asset’s worth based on the assumptions made.

- When used properly, DCF enables unbiased, market-agnostic appraisals.

- It is thought to be more objective than other valuation methods since it determines worth independently of volatile market sentiment.

- Companies may be mispriced by the market, but these short-term changes don’t affect the DCF.

- When evaluating an investment, DCF takes into account its possible future earnings.

- Using the time value of money and other factors, DCF calculates how long it will take for an investment to generate a certain rate of return.

Discounted Cash Flow model – DCF & its importance!

Disadvantages of Discounted Cash Flow:

- A large amount of information is needed for a discounted cash flow model.

- Accurate estimations are essential for DCF analysis.

- It takes a lot of time and effort to gather all the necessary financial data for a DCF model.

- When it comes to investing, the consequences of erroneous assumptions used in DCF models might be severe.

For instance, if a financier overestimates future cash flows, he or she may put money into a venture that won’t provide a return and therefore reduce earnings. Assuming cash flows will be too low, on the other hand, might lead to foregone opportunities.

Conclusion:

A discounted cash flow analysis needs the investor’s estimates of future cash flows and the asset’s final value.

An acceptable discount rate for the DCF model must be determined by the investor, and this rate will change based on the nature of the project or investment being evaluated. The risk tolerance of the firm or investor, as well as the state of the capital markets, are two variables that might impact the final discount rate.

Instead of discounted cash flow (DCF), you should use other models if the investor can’t give reliable projections of future cash flows or if the project is very complicated.

Disclaimer: All the information on this website is published in good faith and for general information purposes only.