Table of Contents

How to Invest in the Equity Market?

When I say the best way to invest in Indian Equity Market, I mean the approach!

I have been investing in Stock Market for the past 7 years. whenever im in doubt, I listen to some of India’s or even global-level market veterans. These are the people who have achieved heights, they have become successful by understanding the pulse of the market. And you know what I always make out from their speeches?

It’s a simple fact, which is, no one… I repeat… not a single individual can predict where the market heads. Even now, if you read some of well know fund manager’s reports on the market, and their analysis, it’s very evident that out of 10 such reports, 5 will say the market is in a bearish trend while the other 5 say we are in one of the biggest bull runs ahead.

Not to blame them, but it is what it is. No one can predict the market. We can make an informed guess and act accordingly. But, whatever happens, we do not know.

How to Approach the Market?

There are two approaches:

No.1: Simple SIP

As the word suggests, in SIP which is a Systematic Investment Plan, we invest in a set portfolio in a disciplined manner, we invest every weekly, monthly, or even quarterly intervals and keep investing in the same set of companies. Be it a bull market or a bear one, we do not stop our SIP.

If you wish to start your own SIP. Go to apps such as “Small case” or select any mutual fund and pick the “SIP option”. You can also make a list of stocks, i.e, a list of well-established Indian Blue chip companies, and keep investing in them. So, this way, create your own SIP option.

For more information regarding the Benefits of SIP, check this article, CLICK HERE!

If you wish to know where to invest, here’s a list of top-performing companies in India.

15 Best Blue Chip Companies in India – 2022

If you know how to invest and where to invest, then you wait and invest, right?

And in case you don’t know how to or where to invest, you invest and wait, this is what we call SIP. Invest in good companies and wait for a long time.

No.2: Smart SIP

In our earlier approach, we did SIP, but it was more mechanical.

For example, Simple SIP is when I invest in a mutual fund on the 5th of each month. So no matter what happens, I invest a set amount say Rs,15,000 each month on the 5th date in my preferred mutual fund.

Over a stretch of 10-15 years, It’ll automatically wave off all the unwanted noise in the market and stay invested for the long term. And, I will make money. Doubt it? Check the Indian Stock Market large companies and see their growth in the past 10 years. Check Companies such as HDFC twins, Reliance, TCS, Infosys, and other Indian Companies. You’ll get what I mean.

And, under our smart approach, similar to Simple SIP, But with one additional step.

Under Smart SIP, apart from our usual monthly investment on a set date, we also invest during market corrections or even crashes.

I like to quote Mr. Warren Buffett, who says “Be fearful when others are greedy, and greedy when others are fearful”.

He means when the market is tumbling out of fear and when everyone is selling, you buy. And when everyone is super optimistic and every tom dick & harry is making money in the market, you sell!

The stock market is subject to herding behavior. Here people due to fear or greed factor take decisions that are not financially viable. We have to control our emotional decisions and the best way to do it is to start SIP.

Train your mind such that you do not fall for such petty traps and invest when others aren’t ready to. Invest when everyone calls for a further market crash, because, that’s when we have reached the bottom.

So, suppose you have your monthly SIP set on the 5th of every month. And, you invested Rs. 15,000. But, on the 20th of the month market corrects 5% due to some reason. Why leave such an opportunity? Why leave a discount on the table? In such a case, you invest some more and bring down your average. That’s what I call Smart SIP

I do this all the time! Invest in regular intervals. And, invest in extreme situations where the market is in a panic.

Disciplined investing is important, what’s more, important is to make use of the opportunity. Think Long-term, approach the market with SIP and invest wisely.

Factors to Consider:

Discipline

One of the most appealing features of SIP is its ability to automate investing, which may help instill discipline. We don’t invest consistently because of our emotions (fear) or laziness.

But, with an automatic SIP, we need not worry about not investing. In fact, an automatic SIP will deduct money directly from your bank account and invest it in the securities you choose.

Market Timing

The danger of market volatility increases when investing a large quantity in equities and when trying to time the market. Due to SIP’s time-based distribution, exposure to market volatility is mitigated.

As said earlier, nobody can predict the market. So, we can overcome the risk of volatility by investing for the long term. And, with a systematic investment plan, we can avoid paying a high price for our investments. As a result, rather than investing at the peak of the market, we can invest throughout the ups and downs and thus invest at all market phases.

Equity or Debt

A combination of equity and debt investing is considered the safest form of investing, mainly because of the nature of these two assets, which are inversely correlated. Thus, when one asset rises, the other asset drops.

Whether you’re looking to put money into stocks or bonds, SIP is the way to go because it reduces your exposure to market fluctuations.

SIP or a Lump sum?

A SIP is a plan for investing in which regular payments are made to a mutual fund or another type of investment vehicle. Users can set their own limits within the mutual fund’s overall structure. The minimum SIP investment is typically set by the mutual fund. Or, in the case of an ETF, the investment has no limit (in lowercase). To learn more about ETF investing, CLICK HERE!

However, with a lump sum investment, the investor puts all of his or her investing funds into the market at once, at the start of the investment term.

It’s important to evaluate one’s financial resources before settling on a certain investing strategy. An investor can participate in a SIP if he or she has a stable source of income and the ability to set aside some savings each month. In contrast, a single, huge investment is called a “lump sum investment,” and it is an option for those who have a lot of cash to invest.

When making an investment, it’s crucial to consider both the sum invested and its expected return. The longer and more steadily money is invested, the greater the return. In the case of SIP, your investment will yield higher returns for each passing additional year you hold onto your investments.

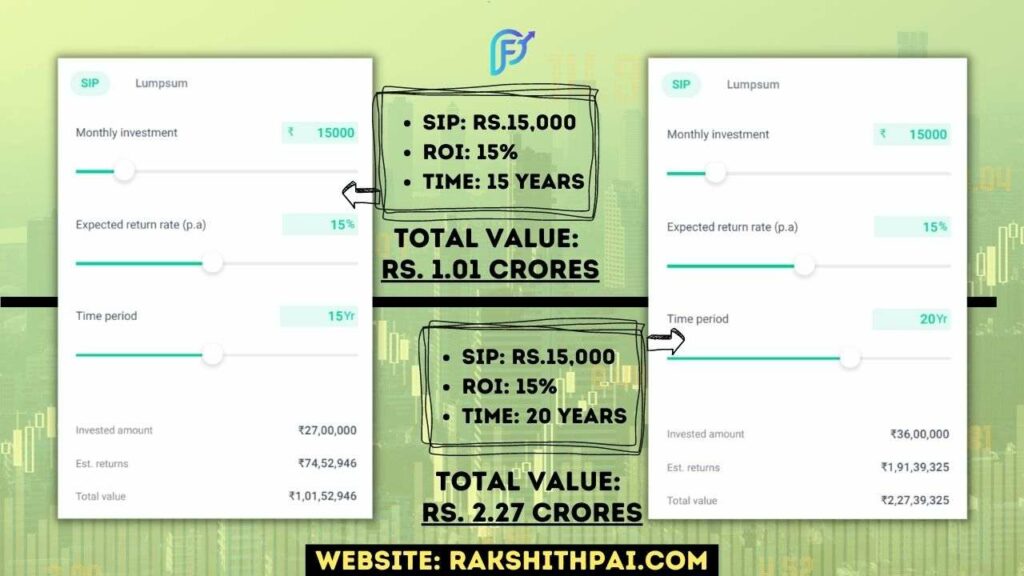

For example, a Rs. 15,000 per month investment for the next 15 years at a 15% return on investment will yield you Rs. 1 crore. Invest for an additional 5 years, and your total investment on your 20th year is Rs. 2.27 crore! So, an additional 1.27 crores just in 5 years.

Also, with SIP, you can increase your purchases during market downturns and decrease them during market upswings. As a consequence, you receive an annualized rate of return. wherein a lump sum investment can generate higher returns than a systematic investment plan (SIP) in the event of sustained market growth in the years ahead. However, SIP is a secure investment even in a tumultuous market.

A risk associated with investing in the stock market is that of market timing, and this risk is amplified when making a single, large transaction. SIPs help reduce this risk through disciplined investing and cost averaging that don’t depend on trying to guess when the market will go up or down.

Everything you need to know about Mutual Fund Investing:

Conclusion:

Rather than making a single large investment, mutual funds provide investors with the option of investing a certain amount in a mutual fund scheme on a periodic basis (monthly or quarterly, for example).

This is known as a systematic investment plan (SIP). The monthly payment is set at a fixed amount, which might be as little as INR 500. It’s hassle-free since you can simply ask your bank to automatically deduct the sum each month.

The systematic investment plan (SIP) is becoming increasingly popular among Indian mutual fund investors since it allows for disciplined investing without the need to anticipate or react to market fluctuations.

It is hard to overstate the value of mutual funds’ systematic investment plans for anyone looking to enter the investment industry for the long haul. Investing for the long term may provide significant benefits, but it’s crucial to get a head start if you want to reap the most rewards.

Investing is a long-term strategy, so you’ll get the best results if you start early and stick to a regular schedule.

For More Information, Check this Video:

Disclaimer: All the information on this website is published in good faith and for general information purposes only.