Table of Contents

The US debt problem:

The United States of America has to date thrown in over 3 trillion dollars for COVID relief. Thus, increasing US National debt at such a rate never seen before. At the time of writing this article, the US National debt stood at a little shy of 26.5 trillion dollars. Thus, a debt per capita at over 80k in dollars per citizen.

We know, uncertain events such as this call for unprecedented action. The Covid-19 has stopped the economic cycle entirely all over the world. With over 130% in debt to GDP, the US is going to have tough times ahead. No, I’m not talking about its loan repayment. I’m talking of its repayment of interest over the loan.

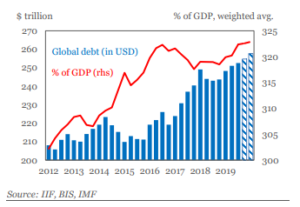

As shown, Global debt-to-GDP is at an all-time high reaching over 320%. Amounting to total debt of over 253 trillion dollars.

What’s the US Debt situation?

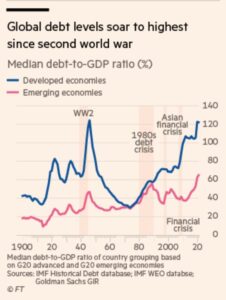

Unfortunately, it’s not just the US. The global debt-to-GDP ratio has peaked to its WW2 level. Moreover, western countries are especially fond of credit. They are their new norms. But, spending that which you don’t own leads to creating such an event wherein you’ll have to liquefy what you own for repayment.

Saving for a rainy day is highly underrated amongst the present generation. Financial planners suggest having savings at over 6 months of expenses. Saving is defined as a mode of lifestyle with limited consumption. Limiting our present consumption to provide for the funds in case of such uncertain events as COVID.

The importance of savings and wealth creation has become an endangered term. The paradigm shift tells us a lot about the change of global order, one among them is how a developed economy takes credit for granted wherein, the developing economy strives in saving and wealth creation only to replace the developed economy and follow the same path of debt pile up. It’s a loop, an unbreakable cycle where wealth transfers from one country to another. It’s time for an Asian country to hold the baton now.

As shown, the developed economies are more indebted than emerging economies.

Debt war between the Developed and the Developing nation:

As seen in the picture above, It’s those developed economies that are highly indebted. And, whom do they owe such staggering debt? Well, it’s funny to see that the developed economies owe these debts to the emerging economies (Not in entirely). I.e, China, and others.

China being the 2nd largest economy in the world is still named under ‘emerging economy’. The same China holds over 1 trillion dollars in treasury bonds or about 5% of US national debt. With over 3 trillion dollars in Forex reserves, China is in a much more comfortable position financially than any other western country.

This systemic failure to recognize China’s position shows up the institutionalized corruption among global organizations. Acting in favor of China over the years and communism as its governing & constituting body has led to such an enormous economically feasible environment for Chinese businesses that none could compete with them at the domestic or global level.

On one hand, China is gaining power and the other way the US is losing its superiority in the global market. China now accounts for over 12% of exports in global trade valuing at over 4.5 trillion dollars. This recession ‘The debt-based global recession – 2020’ can change the monetary system. The US is the largest debtor and China being the largest creditor. It’s a change of power from the US to China.

As quoted in the article “The Elites Are Already Prepared For The Coming Collapse Of The Dollar Bubble” by Tyler Durden – Zero Hedge. The US dollar-based Monetary system is at its brink of collapse and has made way for an alternative monetary system.

I believe the alternative is something such as Crypto-Gold.

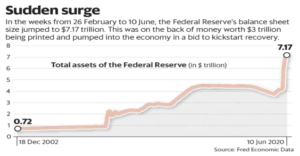

Feb balance sheet surge as shown in the above graph, Trump government had its intention to reduce the balance sheet by the end of the term only to double it due to Covid-19.

The Fed’s way of the solution!

The US president knew the debt pile-up and was on this thought to somehow reduce the fed balance sheet to its minimum level and then struck the COVID pandemic. As of June 2020, the fed balance sheet has risen over 7 trillion dollars (as shown above). There is no way the US can shrink this balance sheet without calling for a major recession. The time for the major recession is on its way and the same to have a dire effect on a global scale.

Remember 2008, ‘The Great Recession. The one that negatively affected globally over 2 trillion dollars in economic growth, the stock market all over the world had its fair share of dark days and unemployment was at its peak for the decade. Those economists who predict a “V-shaped recovery” are making a joke out of the pandemic. It’s just the beginning for we are to see a major correction in asset prices and this pandemic-based recession could easily surpass the great recession.

The market crash was a long-awaited one (Over 12 yrs in making). Every crash gives way for a new set of companies to flourish. But, such a pandemic-based recession can topple down an entire country and its currency system that was ruling the world for over half a century. It’s time for the end of US dollar debt-based, value-ridden monetary systems to end and make way for an asset-based monetary system.

So, what’s the future then?

World-renowned investor Mr.Jim Rogers once said, “If you are living in the 21st century and wanna create wealth then you have to move to Asia”. World order changes and when it does, it creates this huge change of hands in power between countries. Although, a lot of economists and well-known investors weigh in on China when it comes to the next superpower. I highly doubt it!

Yes, I certainly believe the next future is in Asia. No, not communist Asia! The democratic capitalism that’s making way. China is a communist capitalist country that’s highly filled with corruption and concentrated wealth. There’s no denying the fact that China is one of the richest countries as of today. But, the major drawback is that China has its identity over a political party (CCP). If you are someone fond of political history then, you are certainly aware of the future a communist party holds. Yes, it’s not sustainable. Especially the way China behaves towards its neighbors.

I believe the future to lead with a new monetary system is amongst an Asian country. In my follow-up write, I’ll explain why not other Asian countries but India.

Disclaimer: All the information on this website is published in good faith and for general information purpose only.

I enjoy what you guys are up too.

This kind of clever work and coverage!

Keep up the great works guys I’ve included you guys to blogroll.

Thank you Shawn,

Happy that you liked our content.

Here’s another article you might be interested in.

Check out: https://rakshithpai.com/bitcoin-the-next-global-currency/

Thanks for writing this article.

Thank you Martin,

Glad you liked our article.

Wanna know more about what could take over once the dollar crash?

Here’s a link to our article on the topic.

Link: https://rakshithpai.com/is-gold-investment-still-worth-the-shine/

Thanks a lot for sharing this with all of us you actually know what you are talking about!

Bookmarked.

Thank you Camo,

Do share the article with all your contacts. And, let us know if you want us to write about any specific topic.

We’ll do the research for you 🙂

I’ve been browsing online for more than three hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my opinion, if all site owners and bloggers made good content as you did, the net will be a lot more useful than ever before.

Hi Lino Kennedy,

Thank you for your kind words. We are happy to see that you got what you wanted 🙂

Once, there is a dollar crash (If at all there is) Something should take over as the global reserve currency. Is it Bitcoin? Check out this article for more info. Link: https://rakshithpai.com/bitcoin-the-next-global-currency/

I always emailed this weblog post page to all my contacts, because if I like to read it then my friends will too.

Hi Ron,

That’s the spirit. Do share with as many people as possible. Thanks 😉

Check out our article on ‘Bitcoin’. Since that’s the hot topic for 2020

Link: https://rakshithpai.com/bitcoin-the-next-global-currency/

Well drafted.

Thanks for writing 🙂

Hi Jeanna,

Thanks for reading. Check out our article on ‘Bitcoin’. Hope you like it 🙂

Link: https://rakshithpai.com/bitcoin-the-next-global-currency/

I visit every day a few web pages and information sites to read articles. However, this website presents feature based posts.

Thank you. Keep posting 🙂

Hi Carma,

Thank you for checking out our content.

Show the same appreciation by subscribing to our YouTube channel 🙂

Link: https://www.youtube.com/channel/UC3vfc8G1sysZleCAKbytRFQ?sub_confirmation=1

Very well articulated. Kudos!

To grow in this business. you need to be regular in content. See that you provide content often.

Anyways, Thanks for writing 😉

Hi Crimean,

Thank you for checking out our content.

Point noted. Will be regular in our content. 🙂

If you like what you read. Do consider following us.

Social media links are provided at the header & footer.

It’s the perfect time to make a few plans for the future and it is time to buy other assets that are not dollar-based.

That is what I learnt from this article.

Am I right?

Hi Danak,

You got it! You are absolutely right.

Thanks for reading our article. Spread the word 😉

Can I simply say what a comfort to discover someone who genuinely knows what they are discussing online.

You certainly understand how to bring an issue to light and make it important. More and more people must look at this and understand this side of the story. I was surprised you aren’t more popular because you most certainly have the gift.

Hi Birchell,

Thank you for your kind words. It means a lot and it truly motivates us to write more.

Do consider reaching out to us if you got any doubts in regards to anything we upload.

Link: https://twitter.com/Iam_MrPai

Pretty nice post. I just stumbled upon your weblog and wanted to mention that I have really enjoyed surfing around your weblog posts. After all, I’ll be subscribing to your feed and I am hoping you write again very soon!

Hi Dwain,

Thank you for checking out.

If you like our content. Be sure to check out our YouTube channel.

Link: https://www.youtube.com/channel/UC3vfc8G1sysZleCAKbytRFQ?sub_confirmation=1

I do trust all of the concepts you’ve offered in your post.

They are very convincing and can definitely work. Nonetheless, the posts are too quick for newbies. Could you please prolong them a bit from subsequent time? Thanks for the post.

Hi Latasha,

Thank you for reading the content.

By prolong, if you mean clear explanation. Worry not! for we are always available for any doubts and queries.

You can also reach out to us via any social media accounts (links provided in the header & footer of every page).

Twitter link: https://twitter.com/Iam_MrPai

Can you provide the next version of this article. We need to know more!

Do let us know what might happen hereon.

Thank you for writing such good content.

Hi Latanya,

Thank you for reading our content. To know more, please consider following us on Twitter.

Link: https://twitter.com/Iam_MrPai

Also, we are working on new content. We’ll update the same at our earliest convenience.

Keep reading. Share & support 🙂

Howdy! Someone in my Myspace group shared this site with us so I came to take a look. I’m definitely enjoying the information. I’m bookmarking and will be tweeting this to my followers! Terrific blog and fantastic design.

Hi Francis,

Thank you for checking out our content.

I appreciate your effort in sharing the content to reach a larger audience. Thanks a lot 🙂

Follow us on Twitter for more information. Link; https://twitter.com/Iam_MrPai

Spot on with this write-up, I honestly believe that this site needs a great deal more attention. I’ll probably be returning to see more, thanks for the information!

Hi Lorim,

Thank you for checking out our content.

Check out this article. It’s about bitcoin.

Hope you like it. Link: https://rakshithpai.com/bitcoin-the-next-global-currency/

Thank you for the good writeup.

Hi Danilo,

Thank you for checking out our content.

For more information, consider following us on social media.

Link in the Header & Footer of this website.

What’s up I am Kevin, it’s my first occasion to commenting anyplace, when I read this post I thought I could also make comment due to this sensible post.

Hi Kevin,

Thank you for reading our content 🙂

Do share if you find it useful.

Hello, I log on to your new stuff regularly. Your writing style is awesome, keep it up!

Hi Trina,

Thank you for checking out our content.

Consider sharing with your family and friends 🙂

Thanks, I’ve just been looking for information about this topic for ages and yours is the greatest I have come upon till now. However, what about the conclusion? Are you sure about the source?

Hi Stout,

Thank you for checking out our content.

Yes, I’m more certain now than ever. The US debt bubble is about to burst for it is the biggest we have ever seen!

Things will not go down well. I would suggest individuals holding US dollar and denominated assets to either convert to other currency or to Invest elsewhere.

Lot’s going on..

I’m sure dollar system will break and maybe we’ll have another currency to take over in 5-10 years or so.

Damn the US deserve this! They must feel the it!

Mr. Hensler,

It is true that the dollar domination is slowly reducing while the Yuan, Rupees and other Asian currencies are being used for cross boarder trade.

But the transition from Dollar to whatever the currency be, the entire transition takes atleast 2-3 decades.

Moreover, the US has its supremacy because of its dollar being used as the major currency for trade. So, US will do everything in its power to be in power.

We’ll see what happens man. Thank you for writing.