Table of Contents

Brief explanation:

Vodafone is a company primarily based in Newbury, United Kingdom (UK). A British Multinational telecom company headquartered in London, England. The company entered the Indian market in the year 2007 as a subsidiary which acquired Hutchison Telecommunications International Ltd’s (HTIL) stake in Hutchison Essar Ltd (HEL) – Joint venture. A Cayman Island-based deal (Tax haven territory) led transactions gave Vodafone over 67% of control over the telecom company.

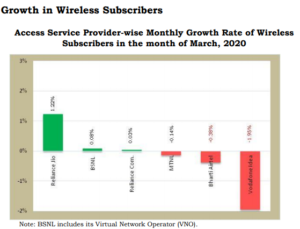

Basically, the telecom market is high cash consuming and cutthroat competitive industry. By 2016, Jio enters the Telecom market and started to garner the market share by providing interest and call service to the customers at ‘zero charges’. This made Tata Docomo, Vodafone, Airtel, Idea, and many other telecom operators to lose customer base to the newly entered competitor ‘Reliance Jio’.

In the year 2017, March month. Vodafone and Idea teamed up for a merger that led to the formation of the merged entity as the single largest telecom operator in India with a market share of 35%. This deal gave the Vodafone group 45.2% of the ownership and the Aditya Birla Group led ‘Idea company’ a 26% ownership and the remaining ownership amongst the shares held by the general public.

Indian Telecom sector market share (March 2020):

| Sl.No | Operators | Subscribers (In crore) | Market Share (Mar-20) |

|---|---|---|---|

| 1 | Reliance Jio | 38.63 | 33.47% |

| 2 | Airtel | 32.67 | 28.31% |

| 3 | Vodafone-Idea | 31.82 | 27.57% |

| 4 | BSNL | 11.94 | 10.35% |

| 5 | MTNL | 0.33 | 0.29% |

| 6 | Reliance Communication | 0.00 | 0.00% |

| Total | 115.41 | 99.99% | |

Sector dominators:

- Reliance Jio – owned by Mr.Mukesh Ambani (Reliance Industries), the largest telecom company with over 38% market share.

- Bharti Airtel – owned by Mr.Sunil Mittal (Bharti Enterprises), the second-largest telecom company with over 32% market share.

- Vodafone-Idea – owned by Mr.Aditya Birla (Aditya Birla Group) and Vodafone Plc (Vodafone Group), the third-largest telecom company with over 31% market share.

So, What exactly went wrong with the Vodafone-Idea merger?

Well, the present Vodafone Group CEO Mr.Nick Read blams the situation on the strict government regulations and unfavorable tax implications on the telecom companies. With the issues of increasing operating costs for the management. The company was already struggling to bear. And then enters a new telecom company named “Reliance Jio” into the sector. Jio literally gave away ‘data plans’ and with ‘zero charges – free call’ made other telecom operators follow the strategy or lose the customer base.

The very idea of a merger of two entity “Vodafone-Idea’ was to tackle this issue. But, the company failed to provide cost-efficient service to the customers, especially at the rate ‘Reliance Jio’ was providing. The operating cost was reaching new highs and the profits were slimming down till its non-existence. And, nothing could help the telecom operators from Jio’s aggressive pricing model.

Finally, the operators tried to adapt to the new norm. The data was cheaper, the call was freer. The charges were dropped to garner back the lost subscribers. At this stage, none were making profits and all the telecom operators were burning cash like there’s no tomorrow. Slowly, one by one. The telecom operates started losing its ground and gave up the fight. Now, we got two telecom operators I.e Reliance Jio and Bharti Airtel. Vodafone-Idea tried, they failed.

Will Vodafone-Idea shut down?

There are various reasons for the company to shut-down its business. Shut-down means, closure of its business. This liquidation results in unemployment, a loss for vendor businesses, the stakeholders (Management, Employees, vendors, shareholders, and other parties directly or indirectly related to business) to be hurt financially, and many more issues.

Reasons for Business closure;

- Poor Management.

- Insufficient Capital.

- Poor Credit Arrangments.

- Unforeseen Events.

‘Shut-down’ strategies;

- Divestment Strategy – It’s a form of liquidation strategy wherein the firm sells or liquidates a major part (failing business) to accrue sufficient capital for further business. This kind of liquidation strategy is an attempt by the management to not sell the entire firm but, to sell portions of it to acquire sizable cash for the same can be utilized for the operational activities of the rest available firm position. A better strategy, this way Vodafone-Idea can limit its exposure in non-beneficial locations and concentrate on those segment that provides with break-even revenue and better profit.

- Retrenchment Strategy – A much extreme and unattractive stance taken by the management would be to sell the entire assets and liquidate the firm completely. Such an attempt results in loss of employment, and closure of the business. In the Vodafone-Idea case, this would result in over Rs.18,000 crores in loan amounts to become NPA (Non-Performing Asset) in the case of banks.

What does “V!” mean?

I) In the year 1994, “MaxTouch” launched in Mumbai; positioned as a premium service.

II) In the year 2000, The same company re-brands into “Orange”; huge advertisement spendings, new outlook, and rebranding.

III) In the year 2005, “Orange” becomes “Hutch”; Remember the creative advertisement famously called “The Hutch boy and his pug dog”.

IV) In the year 2007, “Hutch” becomes “Vodafone”; Now, do you remember the rebranding of the telecom company with a new set of creative advertisements. Yes, I’m talking about “The ZOoZOo Effect”.

V) In the year 2018, “Vodafone” and “Idea” company merged into one entity. This merged entity helped the firm to garner the largest market share in the Indian telecom sector.

VI) In the year 2020, Here we are. A new rebranding by the “Vodafone-Idea” a unified brand launched under the name “V!”. A Coincidence?

A combination of five (5) different entities from 1994 till 2020, with multiple restructuring, rebranding, and here we are with a new firm under a new name. A sixth attempt by the management (old & new) to get hold of the telecom market, Probably the reason for the sign (VI).

Will Vodafone-Idea (V!) succeed?

As of now, the partnership between “Vodafone” and “Idea” to stay as it is. In fact, the brand no longer is in existence as two different names (the rebranded logo says it all). From the beginning, the company has not provided any beneficial value to the promoter be it the ‘UK based Vodafone’ or ‘the Aditya Birla Group’. The UK headquartered, ‘Vodafone Group Plc’ has already invested over $16 US billion. And have no intention to invest anymore.

The Adjusted Gross Revenue (AGR) dues, annually amounting over Rs. 7,500 crores. The same to be for the next 10 years. To meet such huge cash expenditure in the name of dues. The company has to have at least 2x – 3x multiples in revenue from the current level. Further, the company operational losses stood at Rs.55,175 crore. Put together, the company posted a net loss for the FY 2020 stood at Rs.73,876 crore. For reference, that’s the cumulative loss for the past 10 years put together, posted in 1 year.

This could be it!

A “do or die” situation for “Vodafone-Idea”. There is no other option but to succeed. But how? Well, only time can tell us more. Until then, we see that the company follows at least the below-mentioned aspects;

- Raise capital via Equity and debt.

- Allocate appropriately.

- Dilute from certain loss-making markets.

- Concentrate on well-established locations.

Disclaimer: All the information on this website is published in good faith and for general information purpose only.