Table of Contents

Business Introduction:

Started in the year 2000, the company began with the manufacture of lower-end Cement paints, and gradually expanded its range to cover most segments of water-based paints like Exterior Emulsions, Interior Emulsions, Distempers, Primers, etc.

Today, Indigo paints is one amongst the largest and strongest companies in the Indian Paint Industry. Indigo paints have revamped its identity and put its multiple brands under one umbrella named “Indigo”.

The company has 3 manufacturing facilities situated in Jodhpur (Rajasthan), Kochi (Kerala), and Pudukkottai (Tamil Nadu). It is further looking to expand its manufacturing capacities at Pudukkottai to manufacture water-based paints.

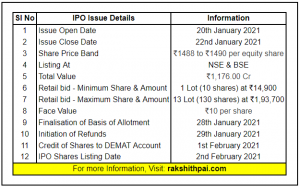

The country’s 5th largest decorative paint player, Indigo Paints has launched an Rs.1,186 crore IPO on 20th January 2021.

Financial Information:

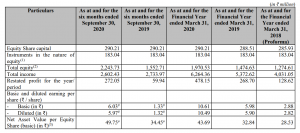

Indigo Paints Financials:

Source: Indigo Paints RHP issued for IPO (Page 19)

Due to their high concentration of differentiated decorative paints, Indigo’s gross margin profile is better than peers at 48.5% in FY20 vs 38-45% for its peers but the EBITDA margin profile is lower.

The company is valuing its equity at a P/E of 125x (Asian Paints and Berger Paints valuations at 100x & 150x respectively). This high valuation isn’t a shocker for the entire market is valued high and the premium is justifiable as compared to the companies peer players.

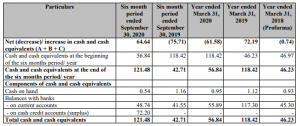

Financially, the company reported a net profit of Rs 27.21 crore at the end of September last year. Revenue from operation during the same period stood at Rs 259.42 crore. During the financial year 2020, Indigo Paints reported a revenue of Rs 624.79 crore and a net profit of Rs 47.82 crore.

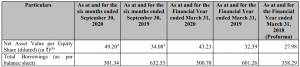

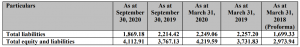

Equity & Liability status since 2018:

Source: Indigo Paints RHP issued for IPO (Page 59)

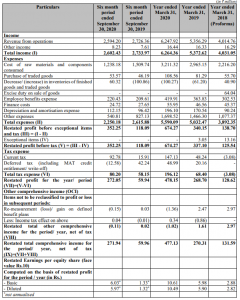

Profit and Loss Statement:

Source: Indigo Paints RHP issued for IPO (Page 60)

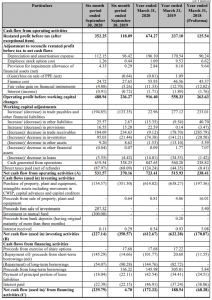

Cash Flow Statement:

Source: Indigo Paints RHP issued for IPO (Page 61 & 62)

Management Analysis:

Hemant Jalan, Anita Jalan, Parag Jalan, Kamala Prasad Jalan, Tara Devi Jalan, and Halogen Chemicals Private Limited are the promoters of the company. And, pre-issue of IPO, the promoter holdings is at over 60% of the company.

The same is to drop to 54% post issue of IPO. Promoter based Management has vast experience in the manufacturing sector and has run the company efficiently to this point.

Although some discrepancies noted in regards to legal issues that are standing due as of IPO date (details for the same is given in the below-mentioned table). Management has a well-proven and consistent growth track record with respect to managing the company well financially.

Use of IPO proceeds:

IPO proceeds shall be utilized for the following reasons;

- Funding capital expenditure for expansion of the existing manufacturing facility at Pudukkottai, Tamil Nadu by setting-up an additional unit adjacent to the existing facility amounting to Rs.150 crore.

- Purchase of tinting machines (paint dispensers) and gyroshakers (a machine to blend paints and others. A form of a mixer) amounting to Rs.50 crore.

- Repayment/prepayment of all or certain of our borrowings amounting to Rs.25 crore.

- General corporate purposes (To be finalized upon determination of the Offer Price and updated in the Prospectus prior to filing with the RoC. The amount utilized for general corporate purposes shall not exceed 25% of the Net Proceeds).

Risk Factors:

- It is to be noted that Mr.Hemat Jalan is the largest shareholder in the company holding up to 35.27% stakes in the company. But, Mr.Hemat is selling his stake by 16.7 lakh shares in the IPO. Mr.Jalan, who is also the MD of the paint company says that the Offer for Sale (OFS) is being done only to shore up the size of the IPO and that neither Sequoia nor the promoters are interested in selling their stake for a long time.

- The entire industry is highly competitive and involves aggressive marketing strategies. Any inefficiencies if noted could kill the company financially. And, with no natural moat, The company has to be a constant innovator to remain and get ahead in the market.

- A significant portion of the company’s sales are derived from the state of Kerala and any adverse developments in this market could adversely affect the business. Because In Fiscal 2020. Revenue generated from sales in the state of Kerala represented 34.56% of the entire revenue from operations.

- More than 1/3rd of the company’s revenue is derived from one state. Any issues from this state could mean lesser revenue and earnings. High concentration is due to the company’s recent acquisition of a Kerala-based Paint company.

- But, it’s not all bad. The Kerala Infrastructure Investment Fund Board (KIIFB), floated by the State government in 2009, is right now sitting on huge cash. And, if they decide it’s time to spend on infrastructure (for this is really the time to spend!). Then, Indigo could cash the real deal here.

- An inability to increase the number of tinting machines (paint dispensers) placed by the company with their dealers may adversely affect the business, prospects, results of operations, financial condition and cash flows. Hence, a good part of IPO fundings is being directed for such expenses.

- The company has a concentrated customer base. Any failure to expand into the new regions could adversely affect the sales, financial condition, result of operations, and cash flows.

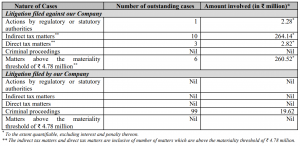

- There are outstanding litigation proceedings filed by and against the Company (list provided as below). Any adverse outcome in such proceedings may have an adverse impact on the reputation, business, financial condition, results of operations, and cash flows.

Summary of outstanding litigation and material developments;

Source: Indigo Paints RHP issued for IPO (Page 30)

- This business is working capital intensive. If the company experiences insufficient cash flows from its revenue operations or if it is unable to borrow to meet its working capital requirements, it may materially and adversely affect the business and results of operations.

- Covid had affected almost all the industry and the Indian Paint industry was not an exception. But, the company is coping out well and expects to grow more post successful IPO.

- Seasonality may adversely affect the business and results of operations. Especially, the decorative paints business is sensitive to the seasonality aspect. Paint industry is said to have low sales during the monsoon season during the months of June to August.

- Trade receivable is increasing year after year. Although the net trade receivables with respect to the companies total income are reducing. An increase in trade receivables has to be given special consideration.

- Certain Statutory obligations such as DIR-12 (Directors Designation) PAS-3 (Discrepancies in respect to equity shares prices as alloted) and others as filled by the company had factual inaccuracies. Further, the company has not been able to rectify the issues for the documentations (corporate records) are not traceable.

Industry Overview:

Indian Paint Industry is a competitive one. The players in the industry need to vary in market conditions and sectoral needs which are ever-changing and highly demanding. The market is filled with 2 other giants who ruled the industry.

Companies such as Asian Paints, Berger Paints are market leaders. Although the market is quite sensitive and seasonal. The companies have been able to cope with the seasonal demands post-monsoon season. And, hence could post better numbers by the end of the year.

Covid has left India injured. To overcome this injury, the union government has to spend more on infrastructure (expected in 2021 budget). If the same is met, Indian Paint companies are said to cash in on the newfound infrastructural demand.

Conclusion:

Indian market is large enough to lay a playing ground for over 3-4 Paint companies and all the other companies (Paint companies) are marketing aggressively to garner the most part of market share.

Since Indigo Paints is predominantly into ‘decorative paints’. The company can take just interest in the ‘decorative segment’ of the market. Thus, be a market leader whilst being in a predominant concentration on the “decorative segment”.

Indigo Paints has also done Financially sound business whilst having issues in the statutory compliance end. As the above chart says it all. The company’s management has put the investors in a doubtful mind in regards to companies ‘98 outstanding criminal proceedings amounting to Rs.1.95 crore, as notified in the RHP.

Other outstanding litigation proceedings filed by concerned individuals against the Company need to be thoroughly checked before investing. The negative outcome of the same can be detrimental to the company’s reputation and financial interest.

Investors are advised to read Red Herring Prospectus (RHP) thoroughly before making their investment decisions. All the above points are as read and understood by Rakshith Pai. And, any point missed out can be checked and verified in the RHP provided by the company.

How to apply for Indigo Paints – IPO?

Steps to be followed to apply for “Indigo Paints IPO” via Zerodha console:

Step 1: Visit the Zerodha website and login to Console.

Step 2: Go to Portfolio and click the IPOs link.

Step 3: Go to the ‘Indigo Paints’ row and click the ‘Bid’ button.

Step 4: Enter your UPI ID, Quantity (In lots), and Price.

Step 5: ‘Submit’ IPO application form.

Step 6: Visit the UPI App (net banking or BHIM) to approve the mandate.

Do not have a brokerage account? Apply for Zerodha – India’s top brokerage service.

Disclaimer: All the information on this website is published in good faith and for general information purpose only.

You are a very clever person!

Hi Mahantesh,

Thank you for checking out our content.

Thanks for your kind words. 😊