Table of Contents

Business Introduction:

SJS is a market leader in India’s decorative aesthetics industry. The company is a provider of ‘design-to-delivery’ aesthetics solutions for the automobile and consumer appliance industries.

The company’s product line includes decals and body graphics, 2D appliques and dials, 3D appliques and dials, 3D lux badges, domes, overlays, aluminum badges, in-mold labels, and decoration components, lens mask assembly, and chrome-plated printed and painted injection-molded plastic parts.

Exotech, the company’s subsidiary, meets the demand for chrome-plated, printed, and painted injection-molded plastic parts in the two-wheeler, passenger car, consumer durables/appliances, farm equipment, and sanitary ware industries.

The company operates manufacturing facilities in Bengaluru and Pune, with an annual production capacity of 208.61 million and 29.50 million products, respectively, as of March 31, 2021. The company and its subsidiary manufactured 91.94 million and 15.60 million goods, respectively, in the fiscal year 2021. The company operates on a global scale, having provided over 115 million parts to around 170 customers in 20 countries in the fiscal year 2021.

About founders:

- Evergraph holds 77.8%

- K.A. Joseph holds 20.7%

S J S Enterprises Limited IPO Details:

| Sl. No | Particulars | Information |

|---|---|---|

| 1 | IPO Issue opens on | November 1, 2021 |

| 2 | IPO Issue closes on | November 3, 2021 |

| 3 | Issue Type | Fixed Price Issue IPO |

| 4 | Face Value | Rs. 10 per equity share |

| 5 | IPO Price | Rs. 531 - 542 per equity share |

| 6 | Minimum Order Quantity | 1 lot = 27 Shares, Amounting Rs. 14,634 |

| 7 | Maximum Order Quantity | 13 lot = 351 Shares, Amounting Rs. 1,90,242 |

| 8 | Listing At | NSE and BSE |

| 9 | Issue Size | Amount aggregating up to Rs. 800 crore |

| 10 | Fresh Issue | - |

| 11 | Offer for Sale | Amount aggregating up to Rs. 800 crore |

| 12 | Allotment date | November 10, 2021 |

| 13 | Initiation of Refunds | November 11, 2021 |

| 14 | Credit of share to Demat Account | November 12, 2021 |

| 15 | IPO Listing date | November 15, 2021 |

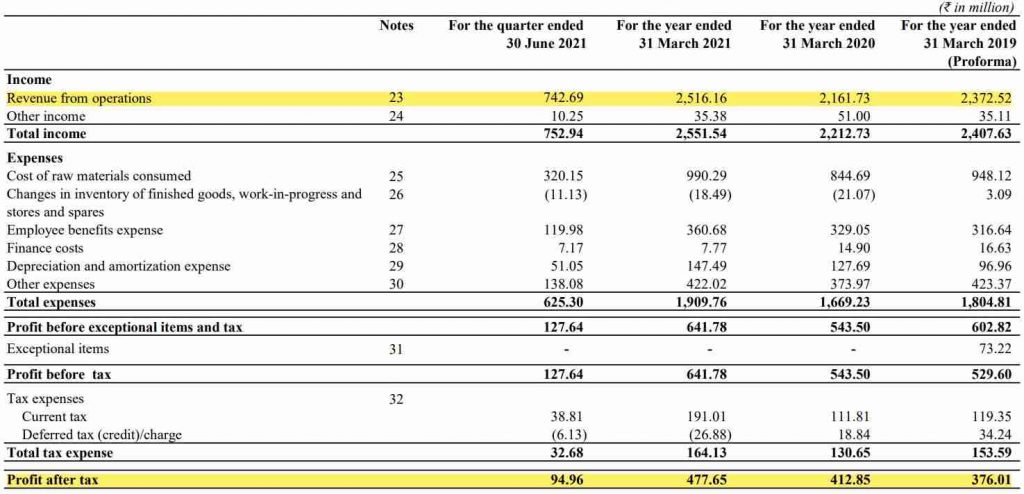

Financial Information:

| Particulars (In crores) | Jun-21 | FY21 | FY20 | FY19 |

|---|---|---|---|---|

| Total Assets | 416.23 | 383.54 | 332.25 | 304.04 |

| Revenue from operations | 75.29 | 251.6 | 216.1 | 237.2 |

| Net profit | 9.96 | 47.7 | 41.2 | 37.6 |

Company Opportunity & Strength:

- One of the top suppliers of ornamental aesthetics, offering a diverse selection of items.

- supplied with a well-developed supply chain and delivery mechanism.

- capable of creativity, design, and development of products.

- a demonstrated track record of financial success

- Customer relationships that are well developed

- Increase the emphasis on premium items by leveraging market leadership.

- Enhance capabilities for product style, customization, design, and development.

- Construct, innovate, and create new products.

- intend to concentrate on increasing penetration in Asia’s two-wheeler automotive segment.

- Take measures toward integrating the operations of subsidiary companies.

- Expansion of the business via strategic inorganic growth prospects

- Expanding geographical reach and exports

Company Threats & Weakness:

- Any competition-related loss of significant clients and contracts would be a disaster.

- Fluctuations in the automotive and consumer appliance industries’ performance

Management Analysis:

Management includes Mr. Ramesh Chandra Jain (Chairman and Independent Director. He previously worked with Eicher for 25 years, retiring as group vice-chairman. Prior to joining Eicher, he worked at Hindustan Aeronautics Limited.

K.A. Joseph is the Managing Director of the Company.

Risk Factors:

- Inability to obtain raw materials at reasonable costs.

- High reliance on the automotive sector, which accounts for 70% of revenues.

- Inability to handle inventory accurately

- Counterparties may make payments late or fail to execute contractual obligations.

Industry Overview:

Automobile and consumer durables manufacturers work diligently to deliver value-for-money items to the market in order to maintain and expand their market shares. While product features and price are crucial, product aesthetics play a critical role in helping original equipment manufacturers (“OEMs”) build brand value. Consumers seek products that are not just economical but also visually appealing. For discretionary consumption products such as vehicles and consumer durables, aesthetic superiority is critical.

In consumer discretionary items, decorative aesthetic components include logos, stickers, decals, appliques, overlays, chrome-plated parts, IML/IMD, and IME. Several components, such as appliques, overlays, and optical polymers, are also used for their practical properties in addition to their aesthetic value-adding properties.

The aesthetics market as a whole is quite extensive, and aesthetic items are used in a wide variety of industries, as shown below. Only the aesthetics opportunity has been examined across the 2W, photovoltaic, and major consumer durables industries. Thus, total demand for aesthetics will exceed the opportunity assessed by CRISIL Research, owing to aesthetics applications that extend well beyond 2W, photovoltaic, and major consumer durables.

Conclusion:

Company designers conceptualize and co-develop innovative concepts for customers in its Bengaluru facility’s design studio, which is equipped with the latest technology. SJS has in-house design, development, and engineering capabilities, which will foster innovation and increase manufacturing process efficiency.

The company’s product portfolio is varied and aims to create a variety of aesthetic goods for two-wheelers, passenger vehicles, commercial vehicles, consumer durables and appliances, medical devices, farm equipment, and sanitary ware. SJS offers decals and body graphics, 2D appliques and dials, 3D appliques and dials, 3D lux badges, domes, overlays, aluminum badges, in-mold label or decoration, lens mask assembly, and chrome-plated, printed, and painted injection-molded plastic parts.

IPO Ratings:

| Sl. No | Particulars | Rating (Out of 10) |

|---|---|---|

| 1 | Business Prospects | 8 |

| 2 | Financial Information | 9 |

| 3 | Company Performance | 9 |

| 4 | SWOT | 8 |

| 5 | Overall | 8.5 |

How to apply for – IPO?

Steps to be followed to apply for “S J S Enterprises Limited” via Zerodha console:

Step 1: Visit the Zerodha website and log in to Console.

Step 2: Go to Portfolio and click the IPOs link.

Step 3: Go to the “S J S Enterprises Limited” row and click the ‘Bid’ button.

Step 4: Enter your UPI ID, Quantity (In lots), and Price.

Step 5: ‘Submit’ IPO application form.

Step 6: Visit the UPI App (net banking or BHIM) to approve the mandate.

Do not have a brokerage account? Apply for Upstox – India’s top brokerage service.

Disclaimer: All the information on this website is published in good faith and for general information purpose only.